The origin of the word credit, credere, is Latin for believe or trust. So there is a simple question for any credit investor, do you believe that current outstanding credits can be trusted to payback all interest and principal over the next few years? It is a simple question and many who trusted payments a year ago do not have the same trust today.

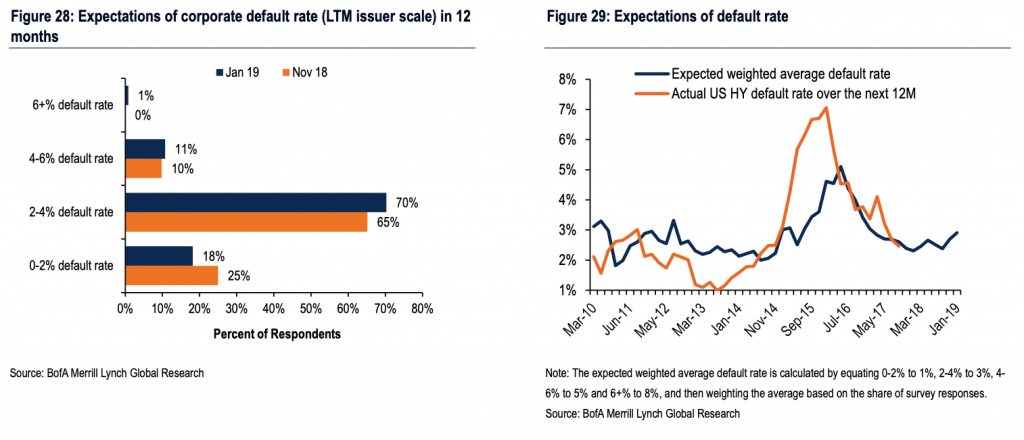

Default rates expectations are higher from BAML survey. Although not as high as 2016 levels, the default expectations are trending higher.

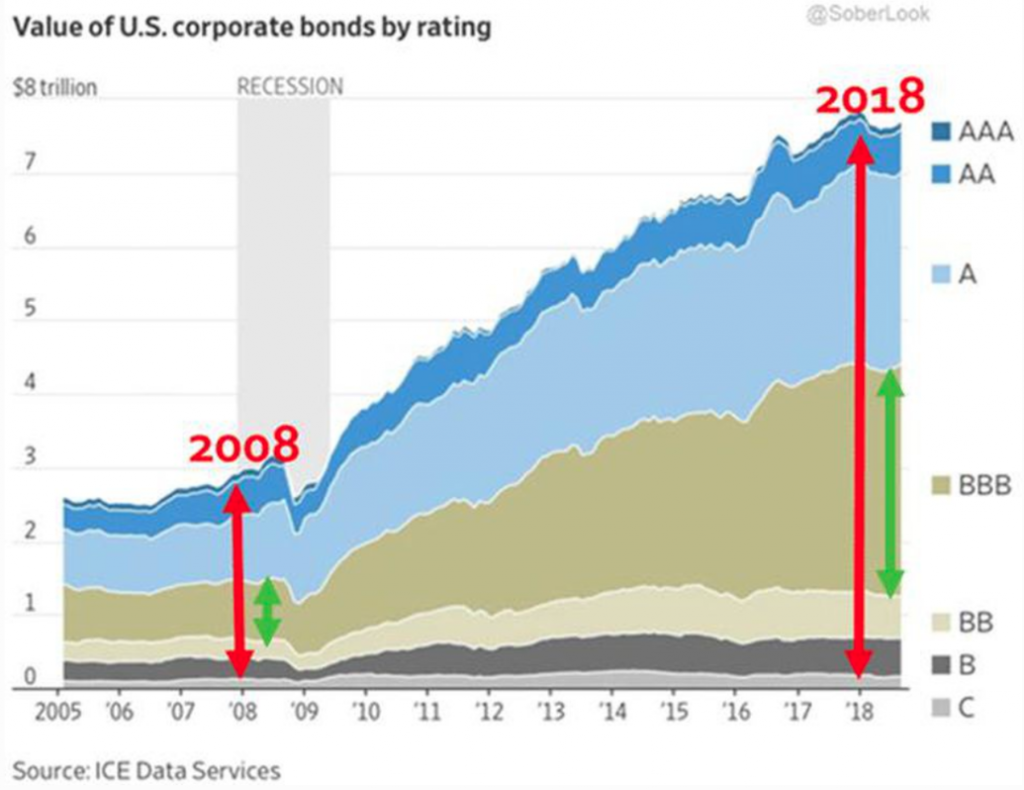

This is important because the size of risky debt is higher than ten years ago, and the growth has been especially high for BBB-rated firms.

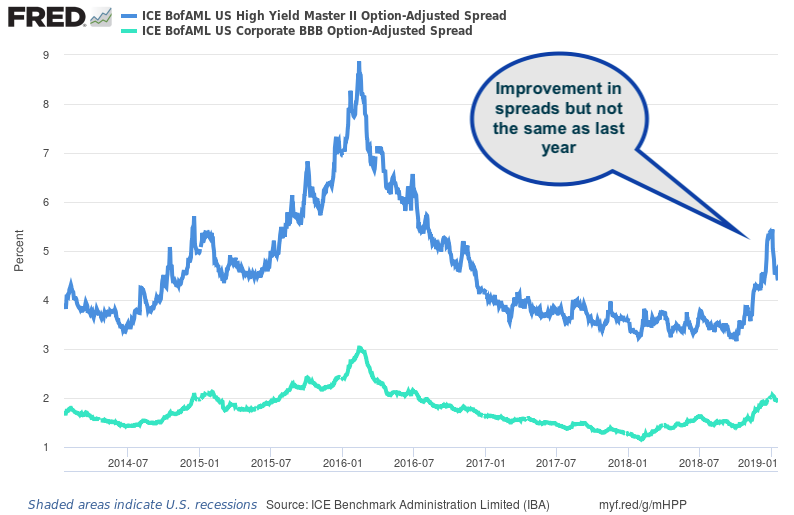

Spreads have widened both for high yield and investment grade although there has been reversal with the gains in equities this month. Certainly, volatility for spreads is at the highest levels in years.

Our view is very simple. Credit spreads are a risk premia attached to a Treasury bond. There is growing downside with being long this risk premia; consequently, it makes sense to diversify into other risk premia that have less downside.