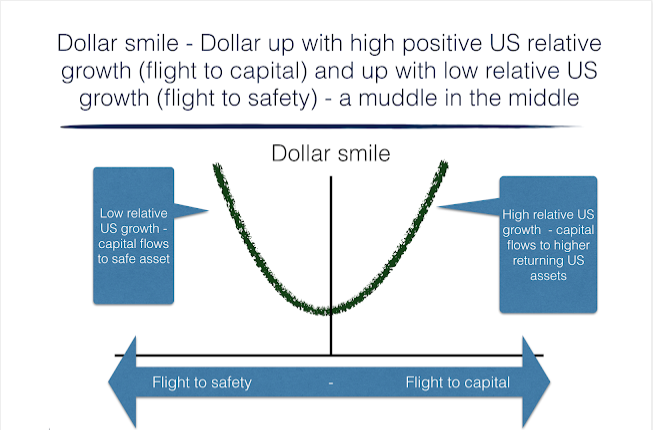

A good simple approach for framing the longer-term movements in the dollar is through using the narrative of a dollar smile. We have written about this years ago, but think it is relevant today. The dollar smile, first popularized by Stephen Jen, says that currency behavior is driven by two competing regimes.

Regime 1 is determined by macro factors such as growth, inflation, and liquidity. The dollar will move higher when better relative economic performance of the US economy causes dollar inflows to capture higher capital returns. This was the main driver up until the last quarter.

Regime 2 is determined not by macro factor but by the dollar being a reserve currency that is driven by the flight to quality. The dollar will see increased demand in a crisis as investors look for protection. This will happen when US relative growth is slow or negative.

The space in the middle is when the dollar muddle about. There is more focus on local currency risk and not broad trends. The dollar will spend a fair amount of time in the middle region. The flight to safety periods will be abrupt and strong as money flows into the US for protection. The high growth region will have to compete against a general risk-on environment so US returns and growth have to be higher on a risk-adjusted basis.

Right now, we now we are moving from flight to capital or high growth to the middle region. Investors need to focus on local country risks under a dollar range environment.