Tell me it’s real / This feeling that we feel / Tell me that it’s real

K-Ci & JoJo

It’s all about the “pause” from the “data dependent” Fed at the beginning of the month. It was reinforced with Chairman Powell comments at the end of the month. The data looked at by the Fed is based on macro fundamentals, but the perception is that the Fed is now financial asset data dependent.

The fundamentals show there is a slowdown from the aggressive numbers in the first half of 2018 although GDPNow from the Atlanta Fed is predicting a 2.7% GDP growth rate which is more than respectable versus past expectations over this recovery. The decent growth rate was reinforced with the employment number this morning. However, January returns are in the books. Now we have to look forward.

January did not offset the December debacle and SPY is still below a 200-day moving average. There is still a negative bias in many markets, so the question for investors is whether the returns for January are for real. Is this the beginning of a new rally or is this just a reversal of the December extremes with the direction of stocks still in a lower trend?

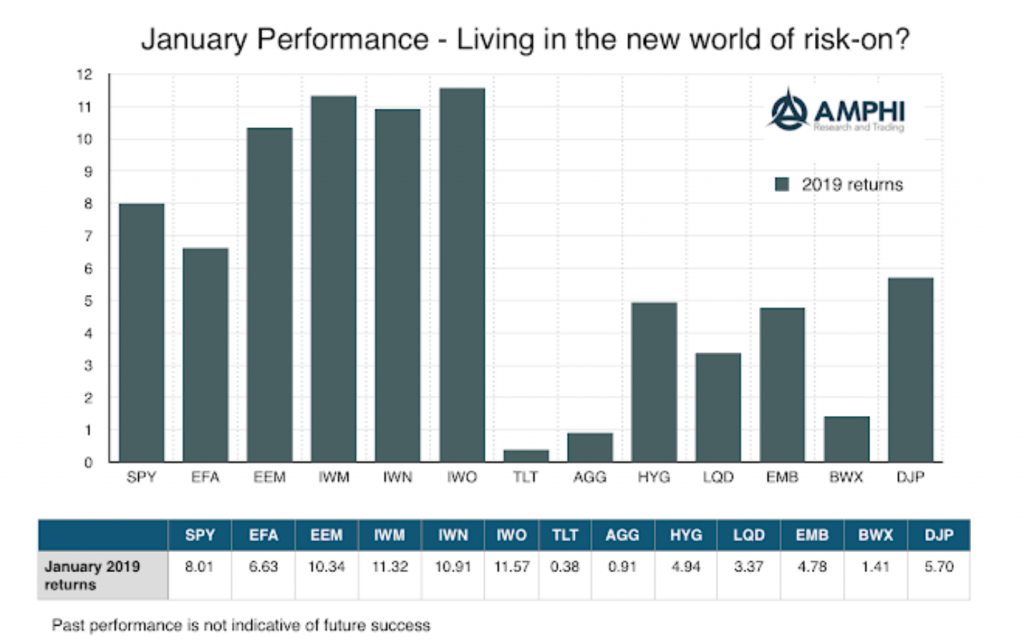

Certainly, a risk-on mentality exists with EM, small cap, growth, value and credit all moving higher; however, for continuation there needs to be two strong fundamentals – momentum in growth and liquidity. Growth is not showing momentum expansion. Liquidity, in terms of Fed words, is present, but the money supply numbers tell a different story. Real M1 year-over-year accelerated in December, but the rate is 40% lower than January 2018. New risk-taking should be carefully considered at this point.