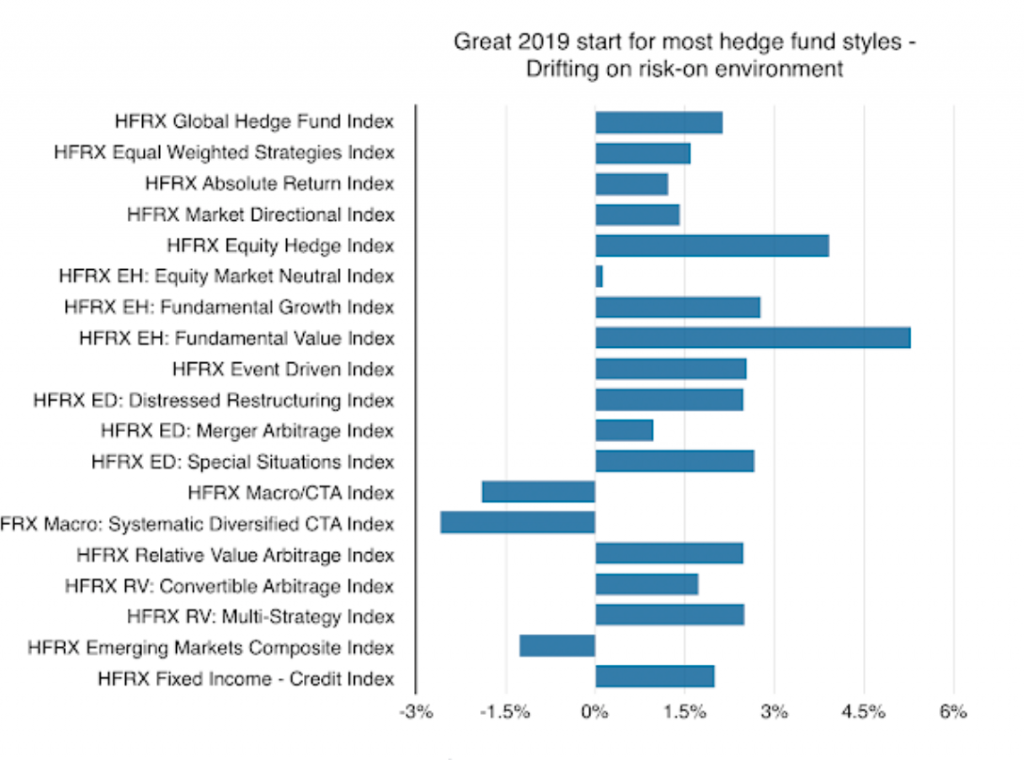

Hedge fund styles as measured by the HFR indices showed strong positive January performance in tandem with the gains in the stock market. When in a risk-on environment many hedge fund styles are winners.

These returns are lower than the SPX market return of 8% given the lower market beta of most hedge fund styles. This is expected, but the risk-on environment has been good for stock pickers because long position usually beat short positions. The environment was especially good for fundamental value managers that often buy riskier firms that do well when the liquidity environment turns positive.

The only exception was with macro managers that got wrong-footed after the Chairman Powell’s “pause” comments. There is a clear disconnect between short-term equity trends and current macro growth thinking which is pessimistic.

The biggest current challenge for all investors is the disconnect between negative macro growth expectations and positive trend momentum. This should be resolved soon and likely in favor of the growth and earnings fundamentals. The euphoria of January will subside. Nevertheless, this environment is good for hedge fund managers to show their core skills.