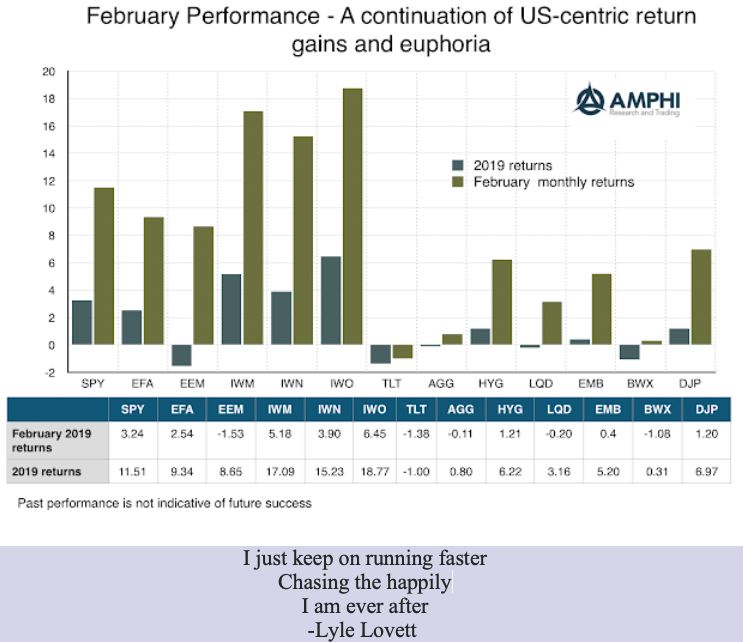

The trend is with risky US assets which is not what we saw in the fourth quarter of last year. The reasoning for risk-on is sound; equity volatility has been reversed and financial stress has fallen. These effects have dominated the US market and have had a stronger impact on riskier assets.

Nevertheless, there are bad things happening in the world. It can be political or economic, but don’t worry about the US because everything is right here. If you read the news headlines, you would not believe it, but if you follow markets you are in an alternative universe. In the financial alternative universe, small cap, growth, and value indices are all do well and offsetting much of their declines in 2018. Stocks are good and bonds are acting like diversifiers. Earnings have shown strong year-over-year gains and the future, which is suggesting lower expectations, does not matter.

Economic data of a mixed growth story is not being fully discounted. The data for March is not compelling. University of Michigan consumer expectations are below levels from 2018. ISM purchasing manager’s PMI numbers are good, above 50, but showing downward momentum. Investors are “chasing the happily they are ever after”. It is an easier story to believe.