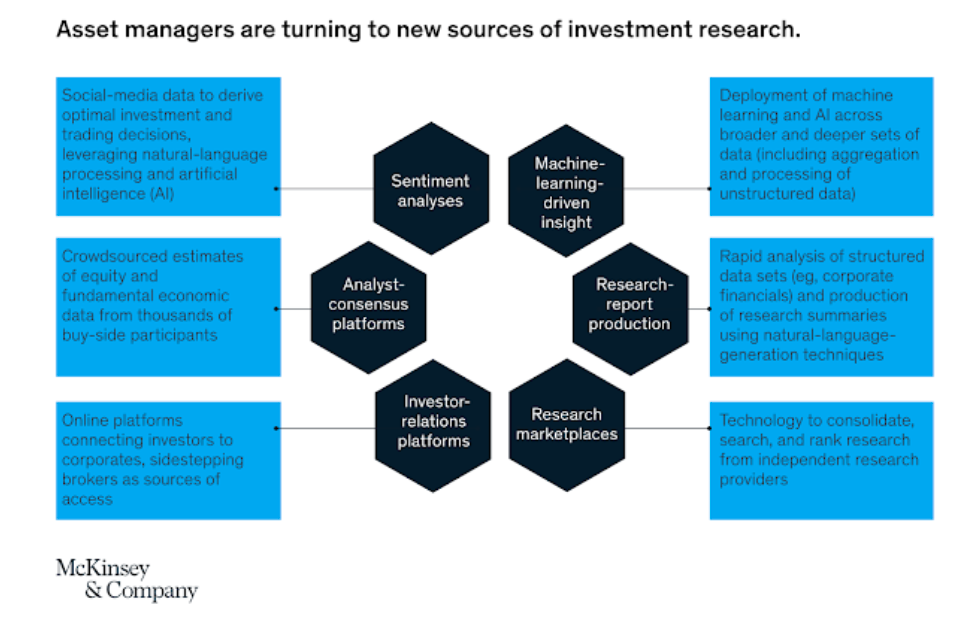

A new research piece from McKinsey and Co focuses on the investment management industry, “Advanced Analytics in Asset Management: Beyond the Buzz”. This work is not cutting edge. It is straight forward advice that more analytics are being used in the distribution, back office, and the investment process, and investors are going to have to step-up their analytic game.

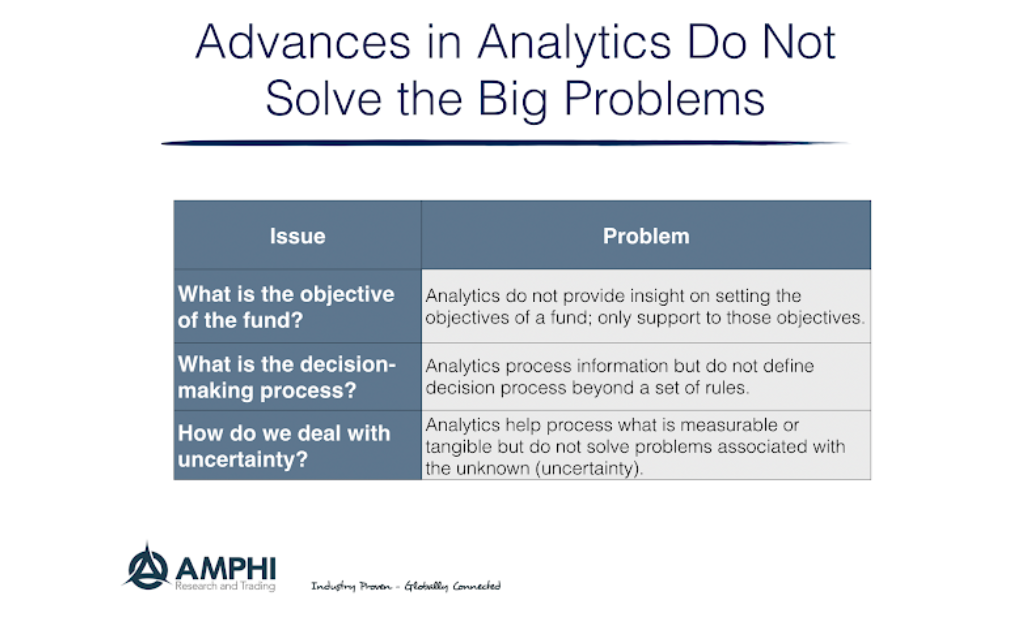

There is no question that given the large amounts of data and the high rewards, the greater use of analytical tools is obvious. The quant revolution has started before the Financial Crisis and may be more advanced than other industries. The problem is not the use of these tools but the clarity of the investment goals. Most will just say that the analytics are supposed to help increase returns, but that does not address the true problem. How do you make better investment decisions in an uncertain world?

There are three areas that an analytic revolution will not solve directly:

- Setting the objectives for fund;

- Improving the actions from a decision process;

- Solving problems of unknowns (uncertainty) from non-measurable events.

Increased use of analytical tools is an arms race with other firms, yet many of the techniques discussed in this report such as machine learning are readily available. The skill separator may be the ability to implement new information not creating it. The decision process especially when dealing with uncertainty is more critical than the tools.