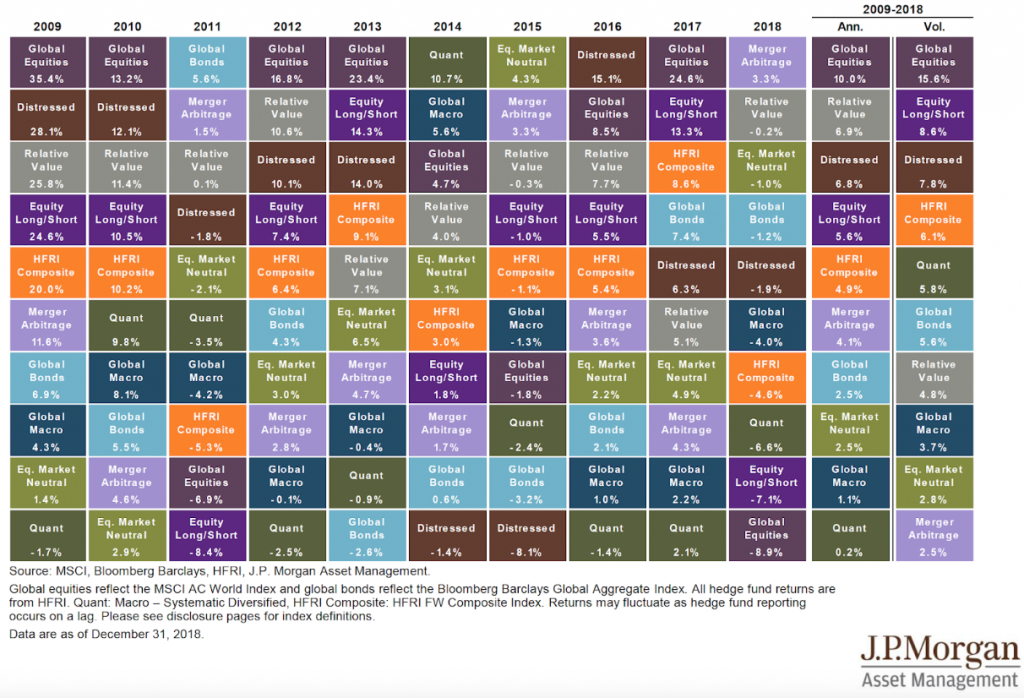

All hedge funds are not created equal as the return box chart shows for the post Financial Crisis period. There is a significant amount of dispersion across hedge fund styles. Over the period 2009-2018, the difference between the best and worst hedge fund category is almost 7 percent after we account for global equities and bonds.

A general observation is that hedge funds returns are bracketed between global equities and global bonds. In fact hedge funds could be thought of as the halfway investment. Returns will be halfway between stocks and bonds. Volatility for hedge funds will be between stocks and bonds and correlation will be higher than bonds but lower than other equity-type investments. There is consistent strong performance with relative value and general underperformance with quant strategies. with On a risk-adjusted basis, the best strategies are relative value and merger arbitrage. There is no guarantee for positive performance and every three to four years the average performance will be negative. Hedge fund returns are time-varying and seem to be linked to macro environment.

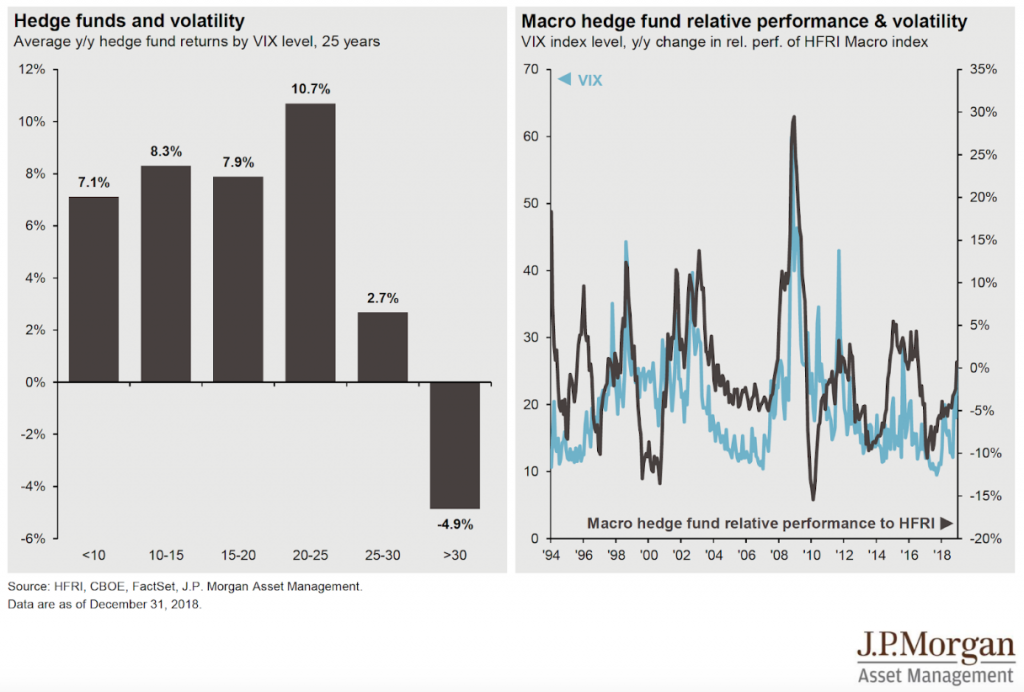

Hedge funds have a “Goldilocks” relationship with volatility. High volatility is not good for returns, but low volatility seems to limit the return opportunities. The average VIX over this period was below 20 percent so slightly higher volatility is good, but once volatility get above 25% there is a decline in performance. As volatility rises above a threshold, the chance for making investment mistakes increases. However, one way to protect against volatility is to look at investing in global macro strategies that will generate an excess return relative other hedge funds when the VIX index spikes.