“Do the central bankers know something I don’t know? Is the global economy worse than I think?”

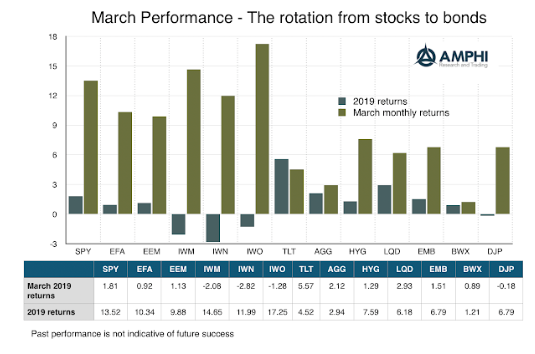

March was about asset class rotation from equity to bond demand with fixed income significantly out performing equities in March. Markets have moved from the January monetary euphoria to something more cautious and questioning. If the Fed potentially put all rate rises on hold for 2019 and the ECB is delaying a course on normalization, do they know something I don’t know?

Certainly, there has been softness in a wide range of economic data which is inconsistent with strong risk-on behavior. Nevertheless, the almost complete reversal of forward guidance could be something that is a greater warning sign. Central banks are showing nervousness about the economy and this has spilled over to bond markets. The second quarter could be a time of strong equity reversals as markets normalize to a slower growth economy.

Our key policy statistic worth watching is real money growth. It has slowed significantly and now hovers around zero growth in the US. It is one thing to stop raising rates, but it is another to have money growth at extremely low levels relative to the post Financial Crisis period. Tighter money from last year is working its way through the credit economy and is a macro shock. Money growth may have ben excessive before the Fed started raising rates, but weaning an economy of financial excesses is a difficult process and will have real effects.