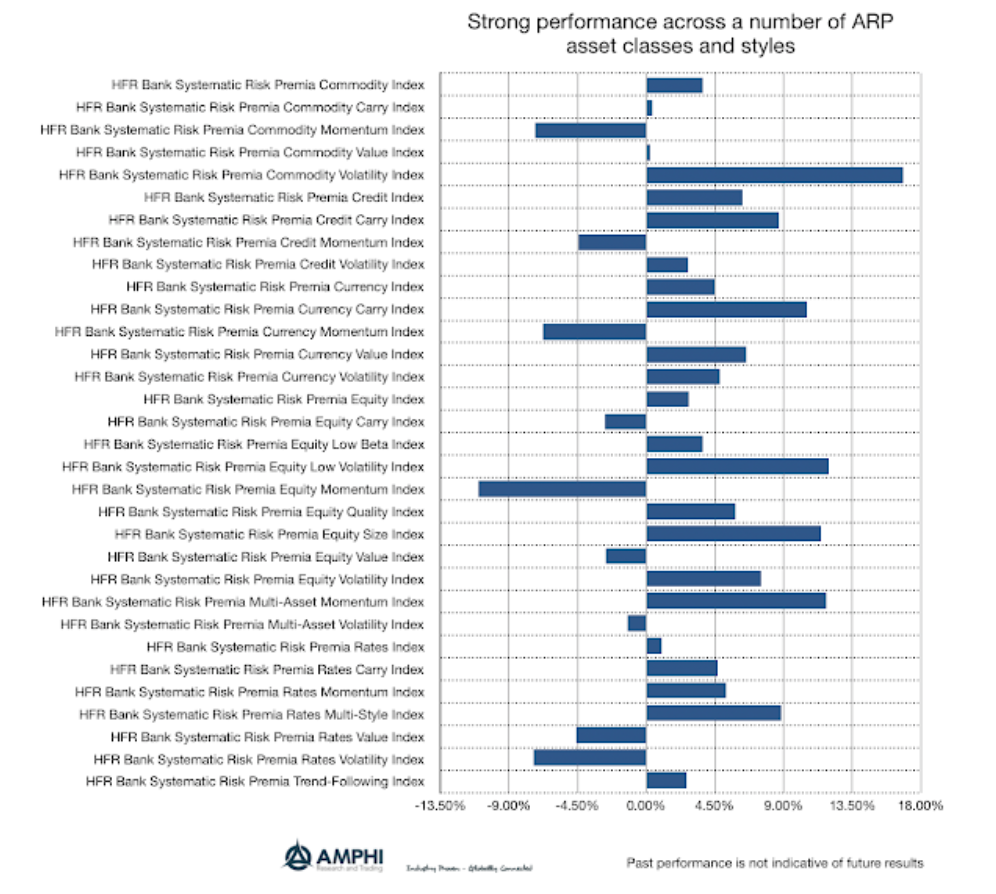

Selected alternative risk premia showed strong performance during the first quarter. There is a significant tracking error with the HFR risk premium indices versus individual bank risk premia swaps, but they can provide suggestive rankings. This strong performance should not be surprising given the significant reversal of equity beta and the strong moves in global bond markets. A couple of major themes emerged for the first quarter centered around positive equity beta risk and falling volatility.

Volatility strategies perform well when volatility is normalized after a spike. Given the link between ARP performance and volatility, the declines since December were good for these indices. Concentrated risks in credit also did well as spreads declined significantly with the reversal in equity market risk. Carry strategies often correlated with equity market risk and volatility also performed well. Momentum long/short neutral strategies were hurt from rising short returns and rotation across sectors. Long-only momentum (smart beta strategies) performed better in the first quarter. A stable environment for the second quarter should allow risk premia strategies to generate further returns.