Reviewing the first quarter financial performance, the dominant macro theme was the change in Fed policy actions. The same could be said about the EU—no rate increase and no solid trend for normalization. The new macro focus is on the choice of Fed governors.

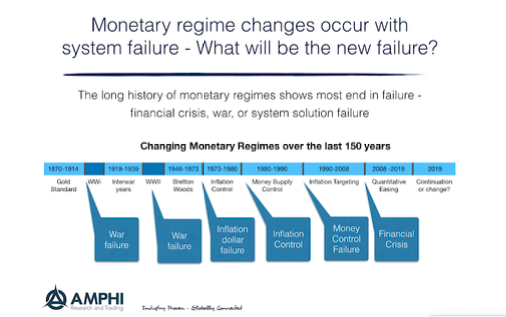

More important than any policy comments or change in Fed governors are the long-run changes in monetary regimes. These regimes are extended periods of dominant policy choices. The regime themes drive the behavior of financial assets. Quantitative easing has been the dominant theme for the last decade, and attempts to reverse this theme have hit a wall.

These themes drive central bank choices only to be discarded when they prove unable to address current problems or the world is punctuated by geopolitical upheaval. Wars cause monetary regime changes. Financial crises require changes as old policies are found to be inadequate. Central bankers only change their dominant policy when change is forced upon them. Failure and disruption are necessary for change. Without a liquidity crisis, don’t expect a new regime. We muddle forward.