What is the correlation between two assets? The correlation is critical because it is the driver for any diversification decision. The better question is, “What is the correlation now, and what can it be in the future?”. Correlations are often time varying and regime specific. In bad times, correlations rise, so the diversification expected is not present when you need it. This phenomenon requires more thinking about tail risks and how to best address them.

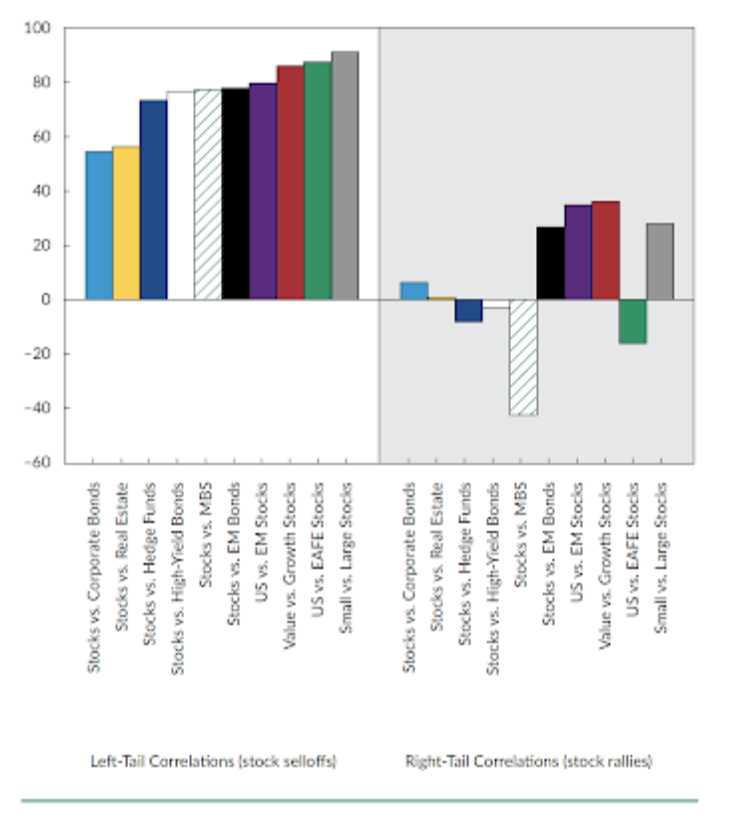

It is not clear that investors fully appreciate the magnitude of the tail problem. Of course, investors have felt the impact in their portfolio returns but visualization clarifies the point. We are using the figures from the Financial Analyst Journal, “When Diversification Fails” by Sébastien Page, CFA, and Robert A. Panariello, CFA which compares the equity left and right tail extremes for traditional assets, hedge fund assets, and investment factors.

What is truly surprising is the for traditional assets is the magnitude of the differences between the left and right tail. In the case of hedge funds, there is limited diversification safety in the left-hand tail. For many strategies the correlation is as high as what would be expected for a traditional asset. Alternatively, there is much better diversification benefit from investing in factors. A balanced portfolio of factors that can be generated from alternative risk premia is likely to provide a more stable diversified portfolio.