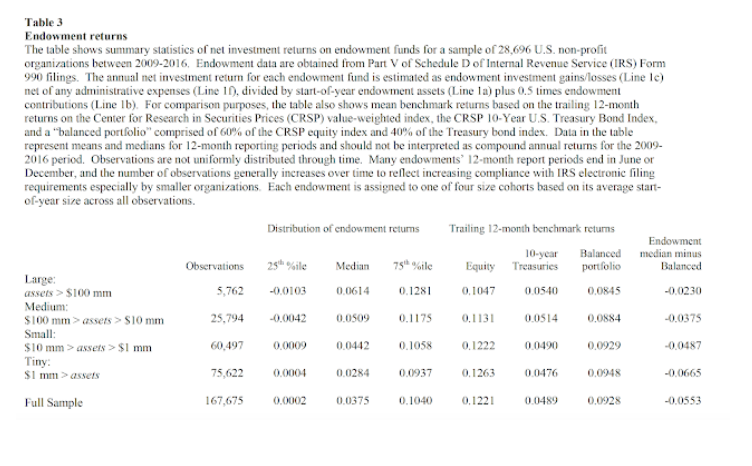

Endowments are supposed to be the smart money, yet if you review the recent exhaustive paper on return performance, you will get a different impression. Large endowments do better than small endowments, but when you compare with a simple 60/40 stock bond balanced fund, there is not a lot of alpha generated. See “Investment Returns and Distribution Policies of Non-Profit Endowment Funds” from ECGI.

I was shocked by the results, given that endowments can be patient money with broad mandates. They have often been at the forefront of hedge funds, alternative investing, and private equity. This could be a result of how the authors partitioned the data. A $100 mm large fund cut-off is relatively low.

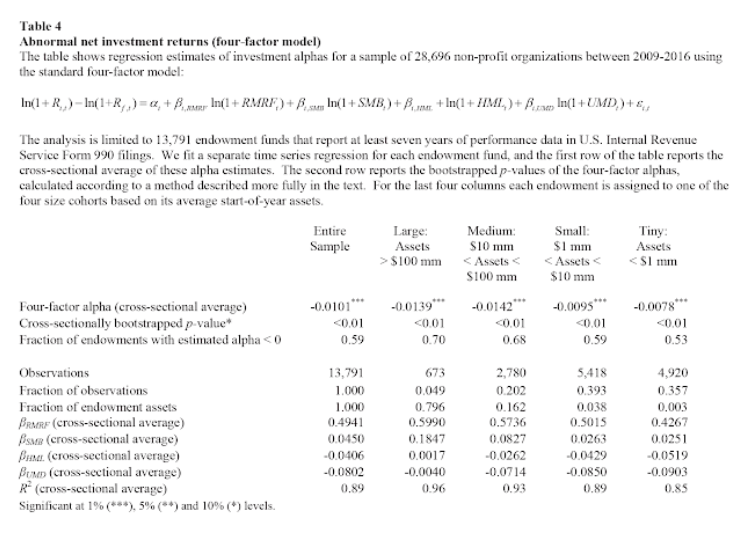

An analysis of the endowments using a four-factor model shows that all alphas are negative, but the smaller endowments are slightly less negative. The fraction of endowments with negative alpha is just under 60 percent. The odds of creating positive alpha are less than a coin flip.

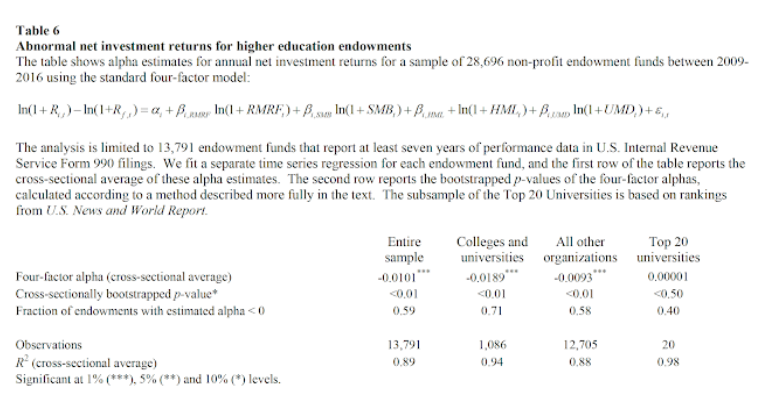

However, a deeper dive into alpha using a four-factor model suggests the top 20 universities at best generate no alpha. This is better than the other partitions, but this does not mean that the large endowments should be patting themselves on the back.

The takeaway from this study should not be surprising. Markets are competitive, and it is hard to produce added returns versus a benchmark or a simple factor analysis. There may be successful firms, but consistently adding value is not easy. Moreover, endowments do not seem to have any particular investment skill.

The current approaches to investment management by endowments are ineffective in generating an excess return. The processes in place for strategic and tactical asset allocation are not working. Endowments need to improve their investment behavior and do have a choice. They can move to a strategy of low-cost passive investing or change the current active return-generating model.

Passive investing means a structured approach to holding strategic asset class allocation or risk factors. A low-cost passive approach finds low-cost benchmark replicators and forms a well-diversified portfolio that is rebalanced through a set of rules. Be diversified at a low cost.

Changing the current return model may include moving away from a classic approach of adjusting asset class allocations, looking for successful active managers, and moving to a factor risk approach that allocates to a diversified pool of risk premia. The risk premia diversification will be adjusted based on business cycle risks. As a result, there is a change in focus from security and asset class selection to factor management.

The approach will be chosen based on whether an investment committee believes it has an information edge in the market. A candid review will likely conclude that a low-cost passive approach may be a safe and effective investment approach. Yet, a factor-based approach can be coupled with low fees to create a viable alternative.