Don’t worry about inflation – the Fed isn’t. Or, the Fed believes there is no value is trying to get ahead of any inflation increase given the relatively tight range for inflation. The market penalized any fixed income investor that acted on inflation fears. Any Fed objective function has a higher weight on growth.

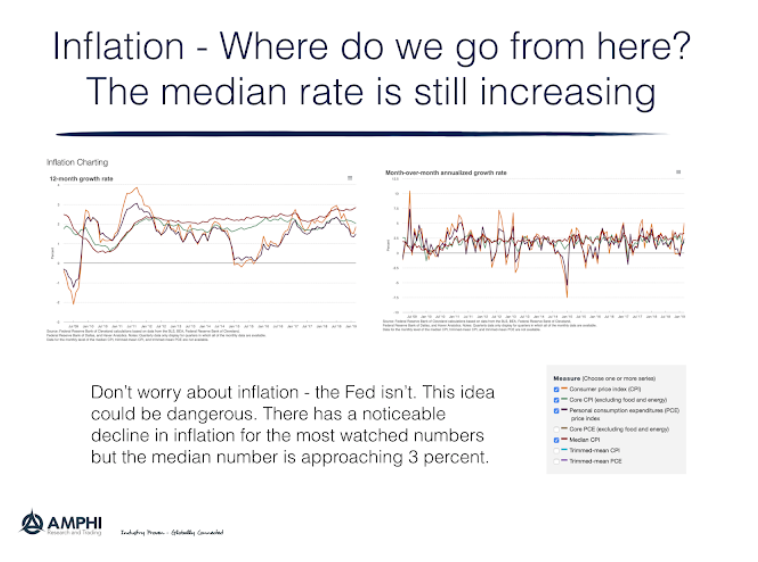

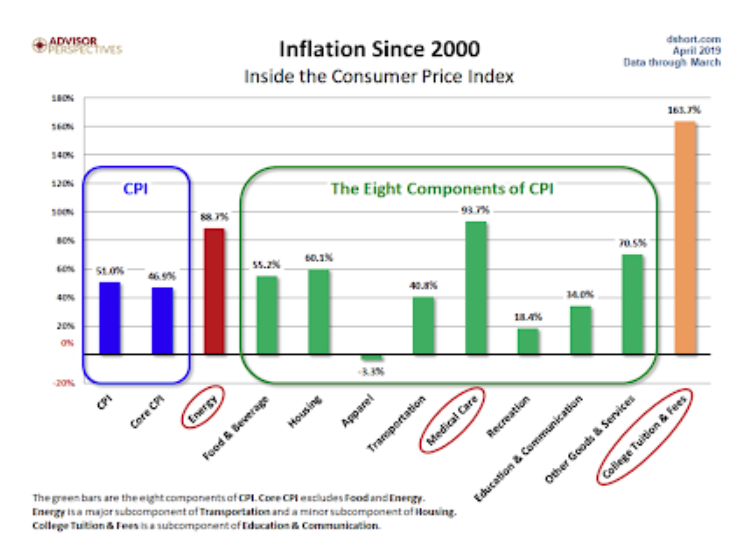

The Cleveland Fed has been producing the median inflation rate for years. It provides a different perspective on inflation. It is moving higher, yet that is not a focus by the market. The fact that the compounded effect of inflation in the 21st century has been substantial for those who do not have indexed wages seems to be missed by our central bankers. While there is talk of inequality by the Fed, the cost of low rates and inflation hurt the poor more than the rich.

The current bias is that Fed will under-react to any inflation increase. The PCE showing an extended period above 2% lasting for months and CPI close to 3% seems to be necessary conditions. All verbal signals say that the cost of inflation is low relative to any slowdown in growth or decline in financial assets. This may seem obvious for many investors, but an implication is that any Fed behavior different from this current consensus will be disruptive. Any surprise in 2019 will be associated with tightening.