Investors are always looking for ways to enhance cash returns – higher yield with liquidity and limited principal risk. The timing for using different enhanced cash techniques changes with market conditions. Widening the choice set through investing in alternative risk premia may be a way to meet enhanced cash goals without significantly increasing risk.

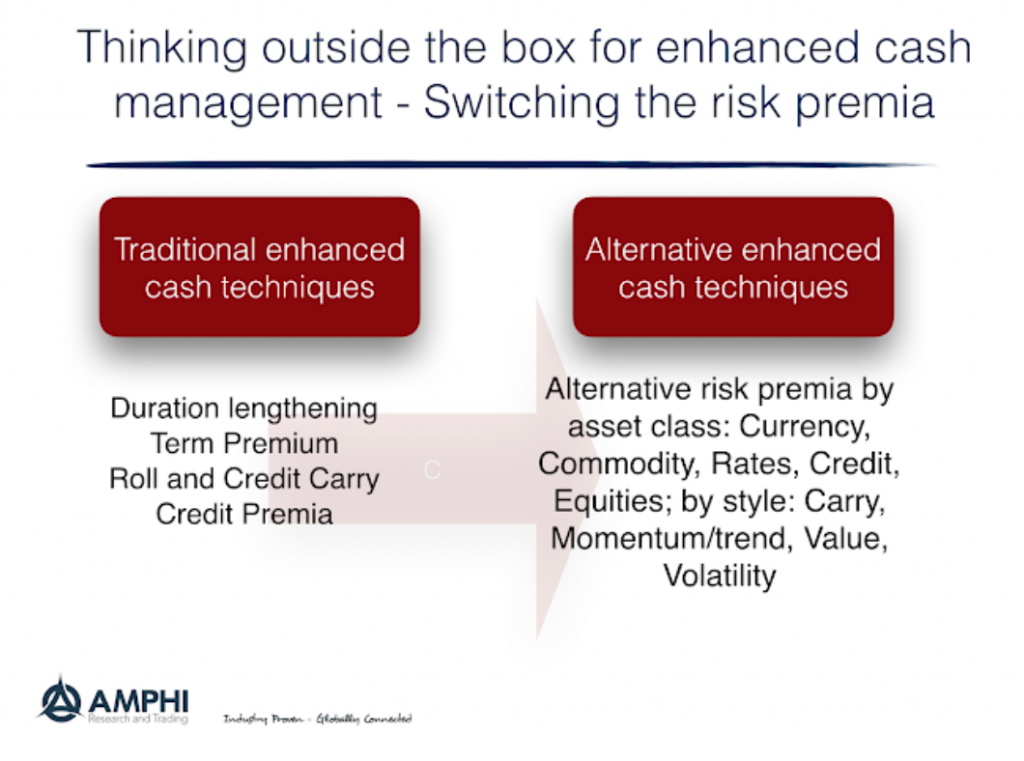

There are only a limited number of ways to generate enhanced cash returns: duration, term premium, roll and credit carry, and credit premia. An investor can move out the yield curve to take duration risk. This will help the potential total return but at the expense of higher volatility. The investor may move out the yield curve to capture the higher yields associated with the term premium. Roll carry is associated with buying longer duration debt instruments when the curve is downward sloping and capturing the gain from selling their bond at the lower yields at lower maturity. This is diminished if the yield curve is flat or inverted. Finally, there are credit spreads as compensation for buying riskier debt. There is roll value as duration falls. Money market investors will increase their demand.

At different times, these yield improvement propositions will be enhanced or diminished. A steep yield curve is a credit time for enhanced cash. Wide credit spreads are also a good time to move out the curve. Similarly, tight spreads and a flat curve is a better time for shortening duration in the front-end of the curve.

Given the changing conditions for fixed income in front-end of the curve, it may make sense to determine when to breakout of traditional thinking and investing in other types of risk premia. There is a set of alternative risk premia across asset classes and styles. Investors can move beyond the rate curve and credit premia choice set. First, these other risk premia have low correlation with credit. Second, these alternative risk premia can be delivered through total return swaps. Hence, these risk premia can be an overlay against a Treasury portfolio. A credit portfolio is a combination of Treasuries plus credit spreads. An alternative risk premia portfolio is a combination of Treasuries plus alternative risk premia. The investor can choose the “spread” or alternative risk to Treasuries. The amount of downside risk can be adjusted based on types of risk premia and the level of exposure or leverage.

Appreciating the value of diversification as a choice improvement tool is a key principle of finance. Anytime there is in increase in the set of alternative opportunities there is improvement in the return to risk choices. Using risk premia beyond rates and credit can improve return opportunities. It may take investors out of their normal comfort zone, but it will help when traditional opportunities are limited.