Conventional wisdom says that it should be doomed once any stock-picking strategy nears “sure thing” status. If everyone knows the secret to vast riches, how could the strategy possibly work anymore?

But there is a successful strategy that has been followed — and widely discussed — for decades, yet somehow persists as a relatively reliable money-maker: “momentum” investing, which is betting that the stock market’s recent winners will remain winners in the near term and, likewise, that the recent losers will remain losers. The strategy also is known as “relative strength” investing.

Read Momentum Investing: It Works, But Why? on the UCLA Anderson School of Management website.

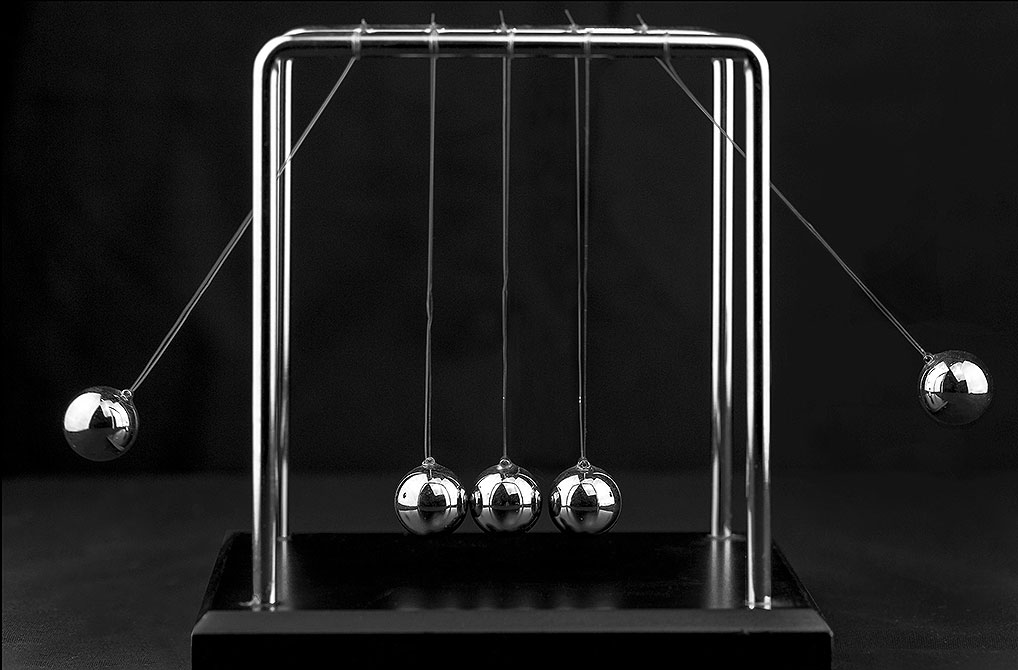

Image credit: Flickr