Disclaimer: While an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and in fact result in further losses in a portfolio. In addition, studies conducted of managed futures as a whole may not be indicative of the performance of any individual CTA. The results of studies conducted in the past may not be indicative of current time periods.

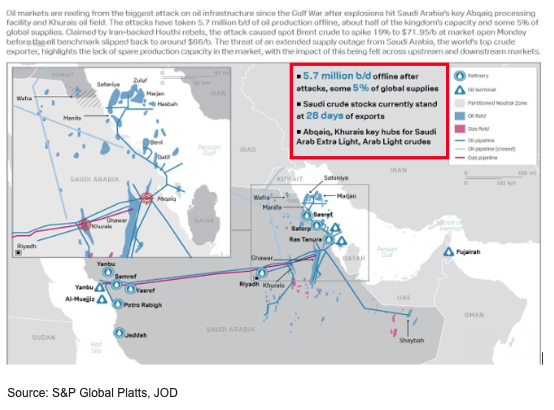

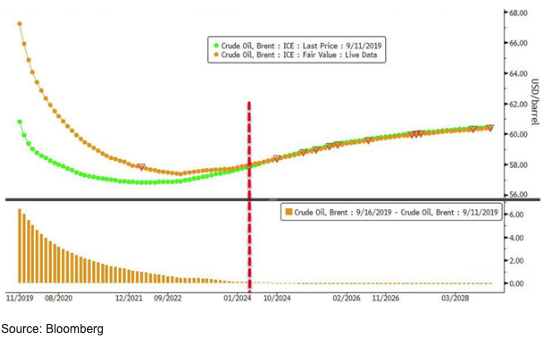

Today Oil surged around 14% after the Saturday attack on Saudi Arabia Oil processing complex Abqaiq. Meanwhile, there is uncertainty as to if the Aramco will be able to restore full capacity, while the US is blaming Iran for the aerial attacks, increasing geopolitical Risk.  This sudden disruption in energy markets is one of the largest in history, Aramco lost about 5.7 million barrels a day of output, creating high uncertainty in the energy markets and moving all term structure higher until 2024.

This sudden disruption in energy markets is one of the largest in history, Aramco lost about 5.7 million barrels a day of output, creating high uncertainty in the energy markets and moving all term structure higher until 2024.

Given the challenging investment environment, we want to give clarity about how we are analyzing the current energy market, how the program can get impacted, how we are positioning our portfolio and why we are optimistic about Sigma’s potential performance over coming quarters.

Fear, Uncertainty, and Overreaction.

This disruption indeed surpasses the loss of Kuwaiti and Iraqi petroleum output in August 1990, when Saddam Hussein invaded his neighbor. It also exceeds the loss of Iranian oil production in 1979 during the Islamic Revolution, according to the International Energy Agency. However, in our view, energy prices have overreacted to this situation, creating disruptions of different expiration contracts in the term structure for WTI, Brent, and Products. We expect normalization in volatility and prices when more certainty arrives in the coming days/weeks regarding restoring capacity and production, and we see potential opportunities to profit in different spread strategies.

It is common to see in those extreme events:

- Short squeezes and a reduction in liquidity

- Choppy spread prices moving several standard deviations,

- Margin calls that force liquidations

- Short gamma and volatility funds hedging and closing positions, and

- Producers taking advantage and hedging at high prices.

Those events can potentially keep the price momentum in Crude Oil continuing affecting the term structure and creating diverse opportunities in spreads.

Sigma Advanced’s goal is to identify materially mis-priced spreads where we believe we have a unique and differentiated perspective that will generate strong investment returns over time. Therefore, we have positioned the portfolio to take advantage of this situation. Our portfolio has increased exposure in energy, but it remains diversified and risk-balanced among other sectors (grains, soft and meats). Although we expect higher volatility in the coming weeks, we remain confident that our disciplined, model-driven analysis and risk management approach will reward our investors.

Despite choppy market conditions, Sigma Advanced has continued to grow and protect client assets based on our comprehensive investment process. We believe we are well-positioned to succeed in 2019 and beyond.

» View performance related to Sigma Advanced Capital

Sigma Advanced Capital Management, LLC (“The Advisor”) an Illinois limited liability company is a Commodity Trading Advisor registered with the Commodity Futures Trading Commission (CFTC) and Member of the National Futures Association (NFA). It specializes in commodity futures, relative value and calendar spread strategies seeking absolute returns across a wide range of economic cycles and market environments. The Global Advanced Futures and Spread Program (GAFS) focuses on a risk-adjusted balanced portfolio of calendar spreads, relative value strategies, and outright futures.

Carlos Arcila Barrera, CFA is the Advisor’s founder and sole principal. As such, he is responsible for managing all aspects of the Advisor’s operations. Mr. Arcila has over 7 years of derivatives trading experience across a wide range of commodity markets with a specialization in futures and spread trading. He is the Adjunct Professor of Derivatives Markets at Universidad de Los Andes, and Project Leader of The Financial Markets Research Center (CIMEF) at the University. During his professional career, Carlos worked as an Investment Analyst for the endowment of the Universidad de Los Andes, from 2013 through 2014 he worked as Energy Risk Associate established and managed the electricity risk program of Optima Consultores S.A.S, where he developed diverse hedging and trading strategies in electricity futures for Latin-American companies. From 2014 through 2016, Carlos worked for a prominent CTA in Chicago, his primary responsibilities included fundamental and quantitative research, financial modeling, trading, and risk analysis of the portfolios of the fund. In 2016 Carlos started the Global Advanced Futures and Spread program (GAFS), focused on the strategy, research and trading of the program.

Carlos holds an MSc.in Finance from the University of Notre Dame (Magna cum Laude) and B.S in Business Administration from Universidad de Los Andes, he is member of the International Association for Quantitative Finance (IAQF) and the American Finance Association (AFA), Carlos is a CFA Chartholder and CAIA Level II Candidate and hold the Series 3 license.