Commentary provided by Todd Delay of Gamma Q

Further consolidation occurred in July with range-bound trading for corn and soybeans. Wheat was the leader with deteriorating conditions across many areas, particularly the Northern Plains supporting price. The July WASDE report reduced wheat stocks by nearly 100 million bushels, and we feel further reductions need to be made. Our long bias to wheat drove returns for the month.

As was touched upon in our last newsletter, the middle of the growing season in North America witnessed a continuation of two distinct weather conditions for the corn belt, East and West, with Iowa in the middle. Crop condition ratings declined slightly for corn and soybeans through July, while spring wheat conditions fell sharply in the U.S. and Canada. Further, regarding the global crop, wheat conditions deteriorated in Russia/Ukraine. Wheat continued to be the largest long holding for the fund, with a small net long soybean/ soybean oil and a small net short in corn in place to finish July.

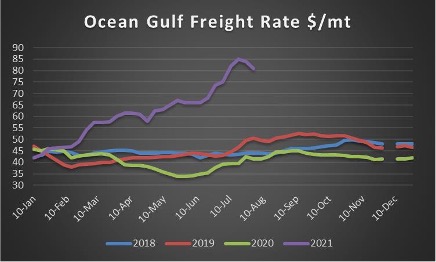

Chinese grain import margins have been hit with a confluence of factors that have caused them to contract dramatically, from lower domestic prices in China, lower hog prices and sharply higher freight. The chart to the right shows ocean freight rates from the U.S. Gulf to Japan for grain shipments. Not a grain quote but illustrative of the overall shipping increase: spot containers from China-U.S. East Coast have climbed over 500% from a year ago, reaching $20k this week, compared to $11k at the end of July. China to the U.S. west coast is slightly below $20k, and China-Europe is nearly $14k. Domestic feed use will likely stagnate over the next 12 months, but lower global corn production in Brazil and massive losses of all crops in Canada are likely to become supportive factors for corn production within the next 60 days.

Crop size in the U.S. is always a major driver of price this time of year, with most estimates hovering around the 174- 179 bushel per acre range. As we approach the next few WASDE reports and review market expectations, the risk of getting a yield much above 179 is low, and current weather forecasts, if verified, likely move us closer to 174 than 179. The difference today vs 5-10 years ago is the market weighting of crop condition ratings. In previous cycles, current ratings would have corresponded to lower expected yields, but the resilience of the grain crops has caused analysts to discount the ratings. This does lead to the risks going into the first field survey from USDA being higher yields.

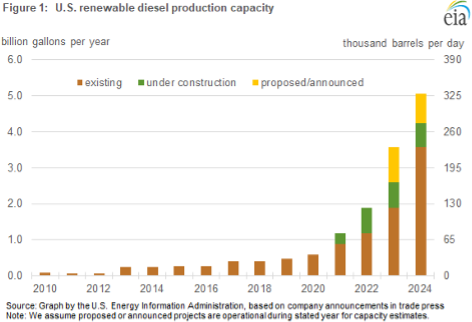

Turning our attention to soybean demand, freight rates have had a similar effect on Chinese crush margins which are currently unattractive and has some lowering imports for 21/22. We do not anticipate any meaningful decline in Chinese bean demand and the demise of the Canadian Canola crop (20% or more below current WASDE estimate) is supportive to soybeans/ soybean oil in the fall and winter. There is still uncertainty how large and how fast renewable diesel production will contribute to soybean oil demand for 21/22 but the projects under construction / proposed are significant (see attached chart). The EIA estimates capacity at the end of the year at 1.2B gallons and almost 2B by the end of 2022. Using the estimates above and a conversion rate of 7.6 lbs. of vegetable oil per gallon of renewable diesel would imply total oil use 9.1B lbs. Not all of the feedstock will come from soyoil, but it could become a structural market changer.

As we begin to construct next year’s balance sheets, there is the need for additional acres for many crops. Odds seem low that total principal crops acreage will increase dramatically, especially given the experience of this current season. Many analysts were looking for big net acreage increases due to the high spring prices but were left disappointed.

The likelihood of gaining soybean and corn acres will be difficult with wheat acres offering improved returns and requiring 1 ½ to 2 million additional acres as well as other minor crops like barley / oats / sunflower/ canola all needing to secure additional acreage. Sharply higher fertilizer and anticipated increases in seed and cash rent does not offer farmers as attractive planting opportunities for 2022 as they did in April of 2021. Our interest in December 2022 corn and November 2022 soybeans is growing.

Wheat has taken over leadership as record or near record low spring wheat conditions in the U.S. and Canada is in place. Production prospects in the Ukraine and Russia have also declined with many estimates for Russia lowered from 85MMT ‘s to 75-77MMT’s. Freezes in Brazil and Argentina are chipping away at these minor producers with global wheat production for 21/22 perhaps 20-25MMT’s below WASDE July estimate…. This is significant! Weather’s importance to price discovery will be waning in the next 60 days but the development of La Nina again could be supportive to wheat as dry conditions in the central plains (Kansas) could lead to subpar start to hard red winter wheat this fall.

The challenge of too many cattle to slaughter vs kill capacity is still here but slowly fading. Drought forcing larger cow kill is also dampening enthusiasm short term. Reduced numbers in 2022 and incentives for small or local packing plants to increase kills hopefully becomes price positive later this fall and winter.

USDA will be releasing its August crop production report Thursday, August 12th. This is NOT a field survey but a scientific farmer survey with satellite imagery perhaps weighing in more heavily in the production estimate. NASS will be using a new satellite tool called CASMA. That acronym stands for “Crop Condition and Soil Moisture Analytics.” It is “a web-based geospatial application designed for users to utilize the remotely sensed geospatial soil moisture and vegetation index data derived from NASA SMAP and MODIS missions to assess both U.S. crop vegetation and soil moisture conditions.” It could make for an interesting report; we will have additional commentary if necessary once we have time to digest the report.

The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results.

References to “we” in this letter refer to Gamma-Q, LLC, the Fund’s General Partner. This letter includes forward-looking statements, and there are risks that actual results could differ materially from the forecasts, projections or conclusions in those forward-looking statements. The information in this letter should be considered as background information only and should not be construed as investment or financial advice. Further, it should not be construed as an offer or solicitation to buy or sell securities or commodities. This letter includes information from sources believed to be reliable and accurate as of the date of this letter’s publication, but no independent verification has been made and we do not guarantee its accuracy or completeness. Opinions expressed in this letter are subject to change without notice. The risk loss in trading futures and options can be substantial; therefore, only genuine “risk” funds should be used in such trading. Futures and options may not be a suitable investment for all individuals and individuals should carefully consider their financial condition in deciding whether to trade. Past performance is not necessarily indicative of future results.

Photo by Waldemar Brandt on Unsplash