Commentary by AG Capital Management Partners, LP

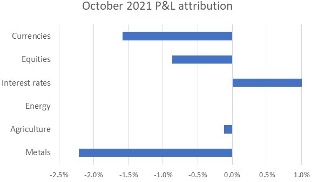

The Discretionary Global Macro Program generated a -3.7% return, net of fees, in October 2021, leaving YTD performance at -9.8%.

The “big picture” letter

We’ve had a tough year. Although our drawdown and performance are completely in line with what we would expect to see during tough patches (and mirrors the performance we experienced during previous drawdowns), it’s never fun. The one thing that we always do during trying times is extend our horizon, focusing on the big picture. In this letter we’ll outline those thoughts.

Macro investing can – and we believe should – be as clear and well-defined as equity or fixed income investing. It shouldn’t be a black box, one where the investor has no idea what the road forward will look like. If you invest in a value equity strategy, you know exactly why your portfolio manager has struggled for the past 11 years and you have a reasonable sense for what mean reversion might imply over the next handful of years.

There is no reason why we cannot offer a similar roadmap. Our portfolio is normally comprised of a mix of long-term themes (years in duration) and short-term trades (weeks to months in duration). When we are firing on all cylinders both our long-term ideas and our short-term trades are working. When we are not, we put pen to paper and refine our vision for the long-term.

Equity markets today are in the middle or end (tough to know until after the fact) of an epic bubble – look no further than valuation measures (Tesla trading at 25x sales) and behaviors (pixelated NFTs selling for millions via wash trades before being dumped onto retail bag holders). The level of speculation and wild market action eclipses the 1999-2000 dot-com peak. And yet, not just retail but many professional investors, including those who lived through the dot-com bubble, are questioning their convictions and wondering whether this is the ‘new normal’, or a ‘new era’, with monetary and fiscal interventions changing the rules. Veteran investors are unsure of themselves. In our view, this is exactly what you would expect to see at a bubble top. In the pages that follow, we will outline how we plan to manage the portfolio not just over the next year, but over the next decade, to safely navigate what we expect will be viewed as a secular equity peak with the benefit of hindsight.

Equities

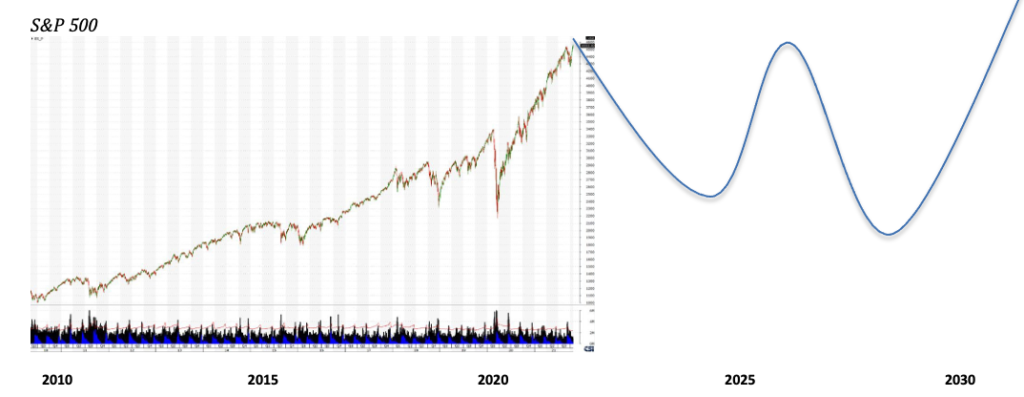

- The graphic above represents one “common sense” path forward for the S&P 500 – it is not meant to be predictive but rather a heuristic that allows us to think through how the current overvaluation/bubble extreme will be worked off.

- Like the periods 1968-1982 or 2000-2012, equities tend not to correct by going sideways after hitting secular peaks; instead, they whip around with multiple bear markets. Note that the stock market is currently more expensive than it was at the peak in 2000 on almost all fundamental measures – it’s easy to forget this fact as a 13-year bull market means that most investors just don’t care anymore.

- Our blue line is based on the potential for a mild recession starting soon (China deleveraging, oil prices tightening, fiscal stimulus turning into an outright contraction based on year-over-year changes) – one that is perhaps 30-40% in depth.

- A second, deeper recession could hit later in the decade as inflation truly takes hold and a lack of investment in energy CapEx dents consumer spending and confidence. The actual catalyst is irrelevant at this point.

- Importantly, we are not looking for a full reversion to 1920-2000 median valuations (i.e. an average P/E of 15x). We do believe that fiscal and monetary interventions truncate the potential for a truly devastating bear market. Instead of 50-70% equity drawdowns, use 30-50% declines as a base case.

- The decade of the 2010s was a decade of terrible GDP and wage growth and excellent stock market returns; this decade (2020s) could easily be great for GDP and wage growth and terrible for stock market returns – that would make logical sense given starting valuations and the potential for margin/multiple compression.

- Our strategy: short equities next 1-2 years. Look to range trade equities over the next decade with multiple 1-3 year bullish and bearish reversals.

Bonds

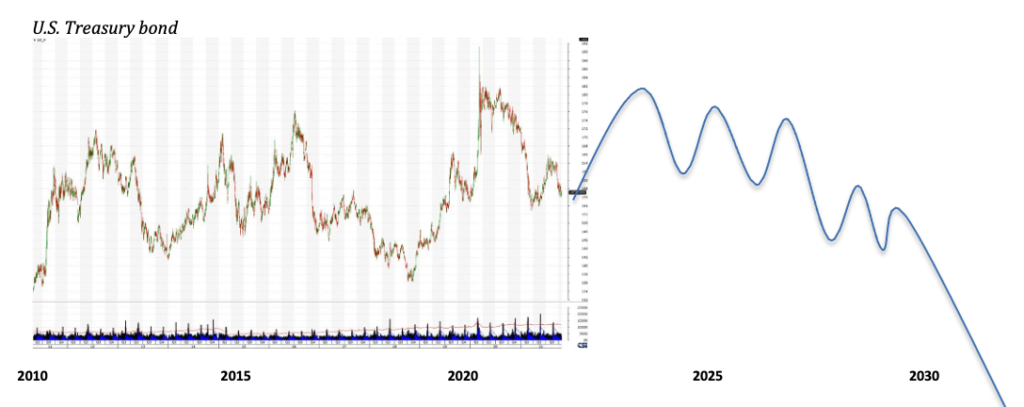

- Key takeaway: a 40-year bull market in the price of money does not end in a quick inflection driven by inflationary fears, but rather in a gradual topping process (for prices; bottoming process for yields) that will take all decade before the onset of the next secular bear market.

- As the massive fiscal stimulus from 2020-2021 wears off, the disinflationary forces of last decade will temporarily re-assert themselves, driving bond yields lower. Massive amounts of unproductive debt have been added in response to the pandemic – this is still deflationary.

- Populism is not going away, and no political party in power will look to cut spending. As the decade wears on, inflationary forces (wage increases; commodity, and intermediate and finished goods price increases) will create the forces for steadily rising inflation.

- Given the debt backdrop, it’s impossible for a 1970s style inflation to take hold – ultimately, long-end Treasury yields may make their way to 5% by decade end. An ongoing bond bear market into the 2030s will be predicated on some sort of reduction in debt/GDP ratios; otherwise yields are limited in how far they can rise.

- Our strategy: long bonds next 12-18 months, then range-trade bonds until we look for the signs to establish an outright short position for the second half of the decade and beyond.

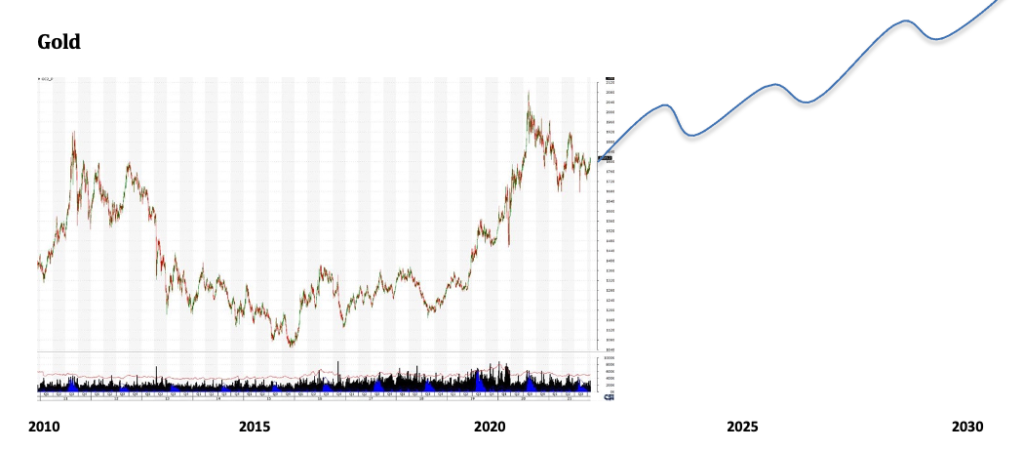

Gold

- Gold remains the anchor of the global monetary system – the only reserve asset that the Fed holds on its balance sheet, and the reserve asset of choice for central banks globally. During periods of deflation (1930s), high inflation (1970s), severe negative real rates (2010s) – all of which line up with secular bear markets for equities – gold acts as the anchor of a portfolio. Improperly viewed as a “crisis hedge” when it should be viewed as a return generator during those periods.

- Gold has recently (incorrectly in our opinion) been perceived as having lost its title to bitcoin as the preferred “inflation hedge” going forward. This is good, as bull markets in any asset class only begin when the asset in question is left for dead and given up on by the majority. [side note: bitcoin is a tech stock on steroids, not a currency or inflation hedge. Pull up a chart of Tesla and bitcoin and note how the two trade virtually identically. It would not surprise us to see bitcoin trade at or below its current price a decade from now. We will occasionally trade it long and short but have no sense of what its path may look like. Stock-to-flow models are garbage – more on that at another time].

- As populism, negative real rates, inflation, and social disorder pick up this decade, central banks will maintain deeply negative real rates. A clean balance sheet for the 2030s, 2040s, and beyond requires a higher gold price to re-set system-wide confidence. Even a partial backing of gold relative to debt could see a realistic gold price of $4,000-$5,000 by decade end.

- Our strategy: build a long position that we will dial up and dial down based on how extended the price is at any given point. Maintain a long position all decade.

Currencies

- After a small move higher over the next year, we expect a sustained bear market in the dollar for most of the decade.

- First line of analysis is always real interest rate differentials – these are expected to turn against the dollar. At this very moment, you can see emerging market central banks in full throttle tightening mode with rate hikes. Developed market central banks are starting to follow. Only the Fed can taper without even providing a semblance of when rate hikes will begin – we believe the Fed will continue to lag all other central banks over time for two reasons:

- First, the dollar is the global reserve currency. All other central banks must keep one eye on the perceived value of their currency via markets; only the Fed + U.S. Treasury can create new dollar reserves and spend them into existence, a privilege that we believe the U.S. will abuse just as it did in the 1960s before France called the bluff.

- Second, populism and social disunity is highest in the U.S. relative to other nations – the pressure for fiscal and monetary policy to stay looser is therefore higher, which will weigh on the dollar.

- In the near-term, the dollar is trending away from the 90 line in the sand in the chart above – we believe this continues for a few more quarters as liquidity is tightened and the massive Covid stimulus fades. As the next economic downturn hits, additional stimulus should send the dollar lower.

- Our strategy: maintain a flat to slightly long dollar bias near-term, but prepare for the real trade of the decade, which will be shorting the dollar, particularly as it breaks below support at 90.

Commodities

- Commodities are not much of an asset class – in real terms, they’ve gone down decade after decade for the past 200 years, as humans have improved yields via technology and enhanced productivity.

- The 1970s (very high inflation) and the 2000s (China’s incredible industrialization) were two anomalies and should be treated as such. That said, our view is that this decade will be broadly positive for commodities, but in a bumpy fashion.

- Near-term, we are bearish oil and metals such as copper, as bullishness on them hits a crescendo in the public realm. China’s slowdown and a mild recession should cause them to correct sharply.

- The back half of this decade will likely coincide with higher commodity prices, particularly in select industrial metals such as copper and in oil and gas where demand will exceed supply due to lack of investment.

- Our strategy: broadly short commodities for the next 6-12 months, then range trading into a bull market. As always, commodities are a mixed bag and should not really be lumped together – we plan on trading various commodity markets as we see fundamental and technical setups emerge.

Current portfolio

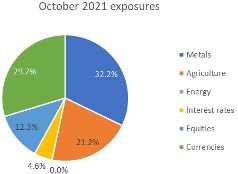

Our current portfolio broadly encompasses all the themes mentioned above. Note that we are positioned to reflect the fact that our views on a 12-month horizon (sharp global slowdown) differ in many cases from our longer-term views. Our only other unique position continues to be long coffee, predicated on damage to Brazil’s crop from a back-to-back drought and frost.