Investors generally feel the pain from losses twice as much as pleasure from gains. Investment judgment is skewed by initial information or experience, and investors assign excessive value to what they already own in their portfolios. These were the main findings by Nobel Prize winner Richard Thaler1 who used psychology to explore the cognitive biases of investors: endowment effect, loss aversion, and status quo bias. At J8 Capital Management, we coin these traits the ‘attachment bias.’ The hallmarks of such attachment bias are investors chasing performance and holding on to loss-making positions while selling profitable trades prematurely.

Our investment approach is designed to overcome this attachment bias by investing systematically in broadly diversified global markets and leaving emotions out of the equation. Systematic, rule-based investing may appear at times counterintuitive but essentially allows us to profit from arbitraging human behavior and thereby gain an edge over the market. Moreover, in combination with modern portfolio theory2, we intend to generate long-term capital growth, thus allowing for inter-generational wealth preservation and wealth creation.

The behavioral dilemma

We believe that deep-seated behavioral biases are not only prevalent but predictable, especially as they pertain to financial markets. Markets would be highly efficient if investors were rational about maximizing their wealth and well-being. However, most investors often behave irrationally, which leads to anomalies or deviations from what rational behavior would suggest. Certain anomalies are easy to identify and explain but hard for the conventional investor to predict with regularity.

Sophisticated institutional investors are tasked with deciphering and dissecting an endless stream of financial data. Unfortunately, individuals are not adept at quickly discerning the optimal action given a complex set of facts. Consequently, in these situations, they fall prey to more innate instincts like fear and greed: the attachment bias. Such attributes of behavioral finance present opportunities for a structured, systematic, and methodical strategy such as J8 GARS to profit from.

Our approach

Our investment philosophy comes from a core understanding of behavioral finance with an implementation based on efficiency, process, and statistical modeling.

Disciplined systematic rules based on rigorous statistical analysis and economic rationale provide us with a formulaic framework to exploit irrational human behavior. Moreover, it is a given that individual strategies have market environments where they perform better or less well. Therefore, a multi-strategy portfolio is our answer to reduce cyclicality and thus provide more consistent returns streams over time.

The challenge

We also believe that the constant validation and tempered evolution of an investment strategy is key to long-term success. Such processes require continuous research, focus, and deliberation: the more we know, the more the data points we analyze, the more opportunities we can identify for success. Validation also requires the ability to ask the hard questions, both of current and future strategies: will the strategies hold in the future? Market environments shift and change, so it is essential to develop adaptable, intelligent solutions and allow for exclusion when they temporarily fail. Our unrelenting pursuit of efficiency and rigorous analysis is a differentiating factor and a challenge we confidently take on.

Simplicity is key

A common thread among the best investment programs is a core understanding of why the strategy should work. In other words, a cause and effect. Not only why the strategy has worked in the past but why it should work in the future: what factors may influence results both positively and negatively? It sounds simple, but it is not as common as one might believe it. Simplicity, therefore, is not an easily accessed process!

Addressing too many parameters results in too many degrees of freedom and leads to overcomplexity and overfitting. The process of ‘overfitting’ is typically the nemesis of most trading models and a cause of models “breaking.” Models do not break per se, but there are developers who do not do a good job at the outset in creating the model, utilizing optimized singularity parameters. As a result, the historical numbers look great, but there is a low probability they will be repeatable.

There is a solution

At J8, we spend considerable time and effort developing our strategy to avoid such behavior. We choose parameters and explanatory models to deliberately avoid behavioral attachment bias. By combining distinct and independent signal engines, we built an overall unbiased model that is yet adaptable to change. Importantly, we want the model to work with a wide range of change within each parameter and thereby avoid overfitting. For this purpose, we test a wide range for each parameter for each variable in each model and do so in different historic market environments. The final strategy model then results in generating buy or sell signals which we implemented in the markets with confidence. We invest using exchange-traded futures on the largest, deepest, and most liquid markets. All our research and development are done internally and involve a rigorous trial of testing and auditing.

Benefits of J8 GARS

The J8 Global Absolute Return Strategy (J8 GARS) can benefit from both bull and bear markets and market inefficiencies. The strategy involves being long, short, market neutral, or in cash in the major liquid futures markets, with each distinct strategy driving the overall allocation. The holding period ranges from a few days or weeks to many months, depending on the specific strategy. Our goal is to capture alpha by performing in line during bull markets and substantially better in bear markets while avoiding being caught in whip-saw markets. Our correlation with the traditional markets and other strategies is negative or low. As such, we provide a significant diversifier to investment portfolios. Our return history shows persistence.

How it works

The strategy utilizes established fundamental and behavioral theses that can be accessed and exploited quantitatively. We conduct ongoing proprietary research, which builds on our experience and results in the development of improved or innovated models housed in strategies to monetize our theses. While our overall portfolio objective will not change, we can incrementally enhance our underlying models over time in a constant and ongoing research process. Such evolution takes time and is a slow, deliberate process.

A recent example of an enhancement was the introduction of further downside protection by adding a rule on the portfolio level to half the existing market exposure during a quarter if a certain drawdown threshold is exceeded. This attribute of our enhanced program helps to protect an investor’s quarterly returns and potential drawdown risk. Furthermore, the said strategy feature also resulted, through our testing, in reduced recovery periods. Hence, we create more efficiency as our drawdown to the recovery period is lessened.

Outlook

It is critical for the ubiquitous investment industry professional to continue innovating and creating new and unique solutions for investors. Typically, and is often the case, we become too comfortable with existing themes and do away with diversification and protection. The current bull market has focused investors on long-only equity strategies. While this may have been the best solution in the past, what is the best solution going forward?

Often, the investment process, especially at the asset allocation level, relies too much on historical data and recency bias. Investors believe what has happened recently will be repeated going forward. They fall prey to the ‘attachment bias.’ No one has a crystal ball, but investors need to spend more time identifying investment opportunities and expectations that hold when going forward. The adage of buy low, sell high needs to be at the forefront of investors’ minds and price momentum at its core. The current bull market appears to be priced to perfection and has undoubtedly been driven by substantial liquidity. How will investors protect themselves if, for example, the Fed starts to tighten monetary policy or some other event that leads to a significant correction or prolonged bear market? What are they willing to pay for the protection? Typically, individual investors are notoriously bad market timers. A process-driven, professional investment structure is a prudent diversification tool.

Investment case

The key is understanding where the strategy fits within the asset allocation. A systematic investment strategy such as J8 GARS may serve as an “insurance policy” for the portfolio, only that this insurance policy also “pays” a premium.

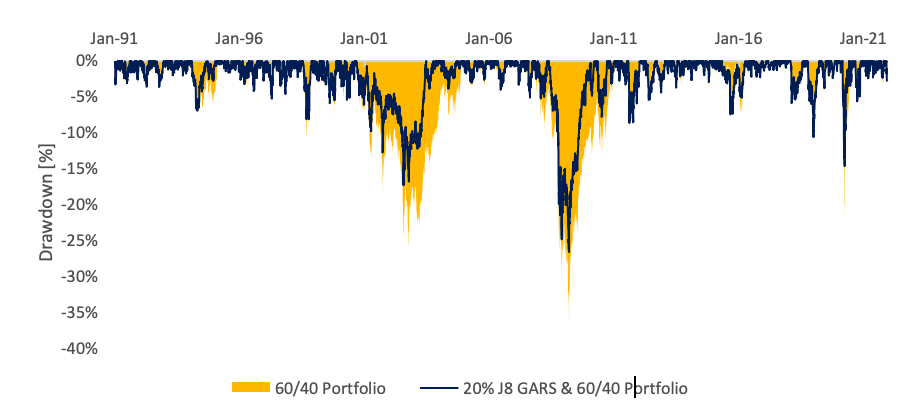

For example, historical data illustrates the power of pairing J8 GARS with a long-only 60/40 equity/bond portfolio. Theoretically, if an investor allocated 80% of their portfolio to the S&P 500 Index and investment-grade bonds (Bloomberg Barclay US Aggregate Bond Index) and 20% to our strategy, they would have seen the Sharpe Ratio increased by around 60%, a low correlation between the S&P 500 and bonds and our strategy of -0.01 and 0.08 respectively, and a reduction of the maximum drawdown by well over 25%. Reducing risk is the hallmark of well-diversified investment portfolios.

Figure 1 below juxtaposes the drawdowns of a classical 60/40 portfolio with a 60/40 portfolio that contains 20% of J8 GARS. The drawdowns with J8 GARS included are less, and the recoveries are shorter.

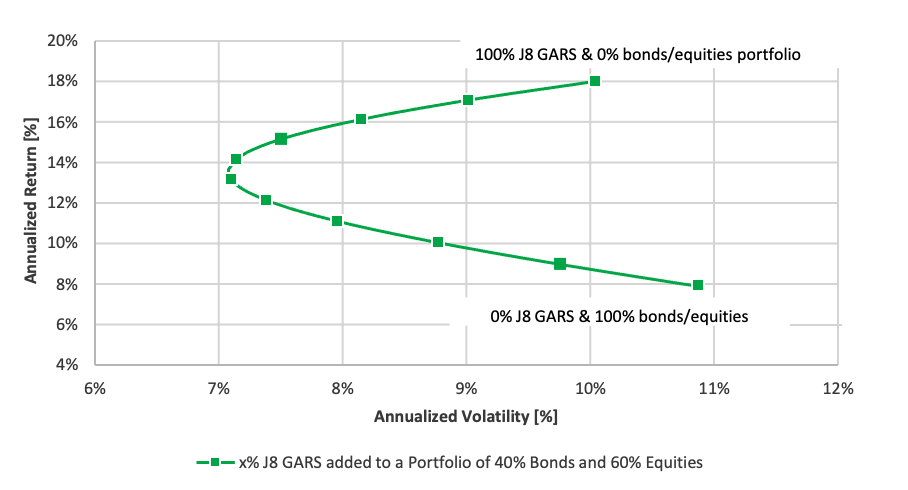

Figure 2 illustrates the improvement of the efficient frontier of a 60/40 portfolio when the allocation to J8 GARS is incrementally increased.

1 Richard Thaler, Nobel Prize in Economic Sciences 2017. “How do human traits govern individual economic decisions, and what effect do they have on markets as a whole? Since the 1980s, Richard Thaler has analyzed economic decision-making with insights from psychology. He has paid special attention to three psychological factors: the tendency not to behave completely rationally, notions of fairness and reasonableness, and lack of self-control. His findings have had a profound influence on many areas of economic research and policy.” Source: https://www.nobelprize.org/prizes/economic-sciences/2017/thaler/facts/

2 Modern portfolio theory (MTP) was first introduced by 1990 Nobel Prize winner Harry Markowitz in 1952. “The basic concepts of portfolio theory came to me one afternoon in the library while reading John Burr Williams’s Theory of Investment Value. Williams proposed that the value of a stock should equal the present value of its future dividends. Since future dividends are uncertain, I interpreted Williams’s proposal to value a stock by its expected future dividends. But if the investor were only interested in expected values of securities, they would only be interested in the expected value of the portfolio; and to maximize the expected value of a portfolio, one needs to invest only in a single security. This, I knew, was not the way investors did or should act. Investors diversify because they are concerned with risk as well as return. Variance came to mind as a measure of risk. The fact that portfolio variance depended on security covariances added to the plausibility of the approach. Since there were two criteria, risk and return, it was natural to assume that investors selected from the set of Pareto optimal risk-return combinations.“ Source: https://www.nobelprize.org/prizes/economic-sciences/1990/markowitz/biographical/

THE RISK OF LOSS IN COMMODITY INTEREST TRADING CAN BE SUBSTANTIAL. YOU SHOULD, THEREFORE, CAREFULLY CONSIDER WHETHER SUCH TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION. THE HIGH DEGREE OF LEVERAGE THAT IS OFTEN OBTAINABLE IN COMMODITY INTEREST TRADING CAN WORK AGAINST YOU AS WELL AS FOR YOU. THE USE OF DIFFERENT STRATEGIES UTILIZED IN COMMODITY INTEREST TRADING AND SIGNIFICANT CONSIDERATIONS SHOULD BE GIVEN TO WHICH STRATEGY IS APPROPRIATE FOR YOUR PARTICULAR FINANCIAL SITUATION. AS WILL ALL TRADING STRATEGIES, PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURES RESULTS. ALL INVESTMENTS IN THE COMMODITY INTEREST MARKET SHOULD BE MADE WITH RISK CAPITAL ONLY PLEASE ENSURE THAT YOU ARE FULLY AWARE AND UNDERSTAND ALL RISKS, FEES, AND OTHER CONCERNS RELATED TO YOUR INVESTMENT BY REQUESTING THE COMPANY’S COMPLETE DISCLOSURE MATERIALS.

Backtesting

This material contains data derived from backtesting of data and is provided in good faith using our standard methodology for information of this kind. The methodology relies on proprietary models, empirical data, assumptions, and such other information that we believe to be accurate and reasonable. We make, however, no representation as to the accuracy, completeness, or appropriateness of such methodology and accept no liability for your use of the information. Specifically, there is no assurance that other investment managers and advisors or brokers, or banks would derive the same results for the backtest period. No reliance may be placed upon the information or opinions contained in this document. No representation or warranty, express or implied, is given by or on behalf of J8 Capital Management LLP or any of its members as to the accuracy, completeness, or fairness of the information or opinions contained herein and, to the fullest extent permitted by law, no responsibility or liability is accepted for any such information or opinions. The information included within this material does not disclose all of the risks and other significant aspects of entering into any particular transaction; any investment decision should be made solely upon the information contained in the final offering documents relating to the relevant transaction.

Photo by Weston MacKinnon on Unsplash