Commentary provided by Todd Delay of Gamma Q

Our long bias to corn and the soybean complex drove returns for February. Deteriorating weather conditions in South America ratcheted down production estimates, providing support to corn and soybeans; then, as the month came to an end, it was marked with the opening of the Russian invasion of Ukraine, which sent volatility skyrocketing and some of our markets into new record high prices. Intense volatility has led to some fundamental breakdowns across many agricultural commodities.

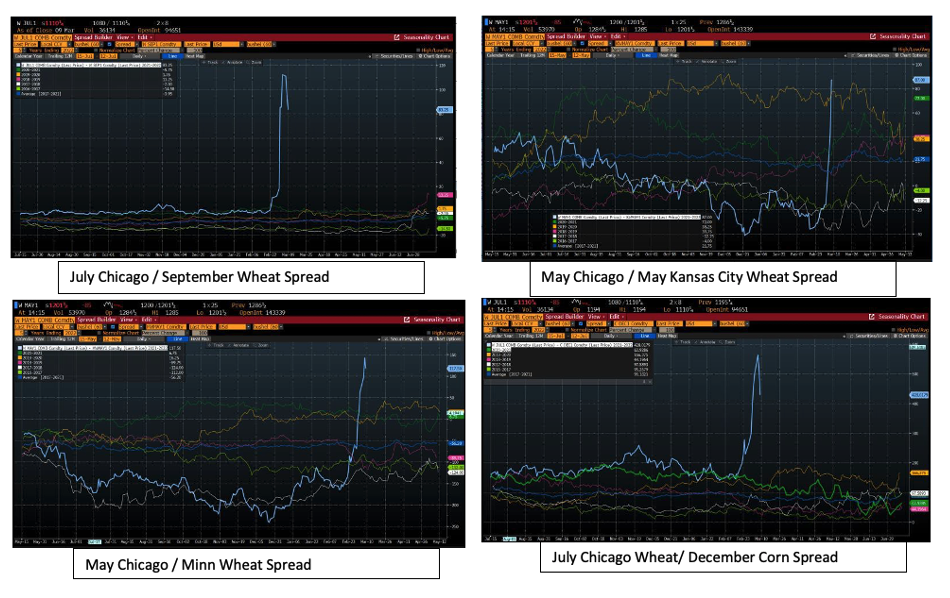

The focus of the extreme volatility has been on Chicago SRW wheat, which resulted in 6 locked limit-up sessions, which forced illogical trades to other parts of the wheat complex.

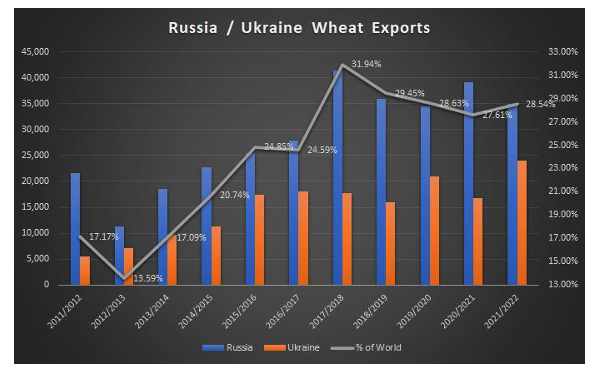

The Chicago wheat (SRW) future is the most liquid wheat futures contract globally and is often utilized as a hedging instrument worldwide. Australia had just completed a record harvest, with some portion of this crop hedged against Chicago. Ukraine and Australian wheat are predominantly high protein, which specs better align with KW or Minneapolis wheat. Still, with the liquidity Chicago futures offer and the general sense that HRW and HRS would outperform SRW, it seemed prudent to hedge all of this global wheat in Chicago. Before the invasion, managed futures carried a long Kansas City Wheat futures net position of 40k contracts, net long 7k contracts of Minneapolis Wheat, and short 20k contracts of Chicago Wheat. Drought in Kansas resulted in many funds placing long Kansas City (KW) short Chicago wheat positions. Wheat and most ag commodities rose with the invasion, but for a brief period, it seemed Russian forces were moving rapidly, and the initial Western sanctions and response were perceived weak. Friday, Feb 25th, May Chicago wheat futures closed locked limit down a full $1 per bushel below the high early in the day.

However, over the weekend of Feb 26/27th, additional strong sanctions were announced by the West, Germany seemed to do an about-face, and the reality that black sea wheat and corn would be unavailable left importers scrambling for replacement with Chicago wheat trading limit up Feb 28th and closing limit up through Mar 7th. Massive short covering was apparent in Chicago front-month futures as hedged Ukraine and Australia wheat needed to be unwound. While force majeure may be an option delivering Ukrainian wheat, it doesn’t relieve one’s obligation to unwind a Chicago wheat futures contract which contributed to Chicago wheat gaining on other wheat classes in addition to front-month futures in Chicago gaining on Chicago deferred contracts. This created a snowball effect of Class wheat spreads needing to be unwound (Long KC and Minneapolis vs. Chicago), further pressuring these spreads.

The massive premium that May and July Chicago wheat are trading to Kansas City, Minneapolis, and MATIF is now moving spring and hard red winter wheat into Chicago, effectively turning spring and HRW wheat into SRW and potentially diverting some EU wheat going to the Middle East and North Africa where it is needed to the US where it isn’t. Wheat’s unprecedented premium to corn should reduce feed use in the US to 0 and perhaps shift much larger foreign feed use of wheat to corn. In addition, SRW calendar spreads (premium July to Sep) have gone to unsustainable levels as we approach harvest and July delivery. A 2-billion-bushel wheat crop would be dumped on the market at once since it would be unwise to place wheat in storage worth $1 per bushel less in 2 months than selling directly out of the field. We are sure there are several other items we are missing. Still, these unusual events have set in motion the movement of wheat to capture these dislocations from commercials that increase the odds of convergence as we get closer to the North Hemisphere harvest. If we end up transferring too much HRW/ HSW with added imports, a sharp move in wheat class spread relationships in the opposite direction to what may seem unrealistic levels could occur the other direction.

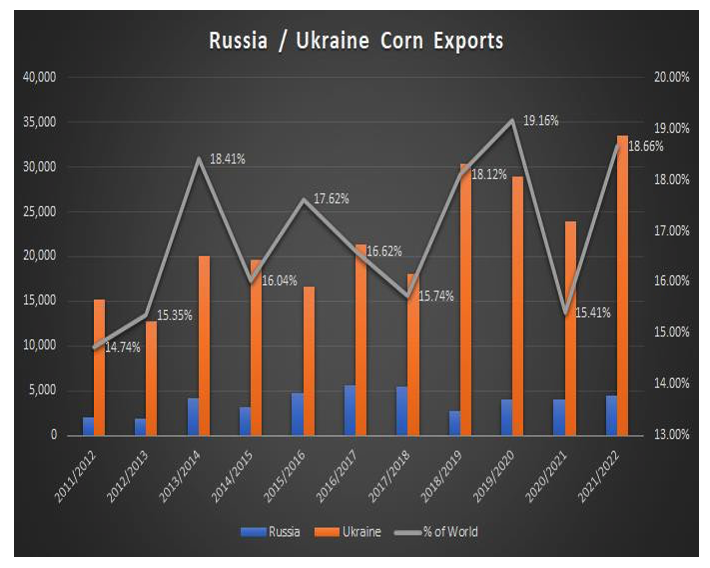

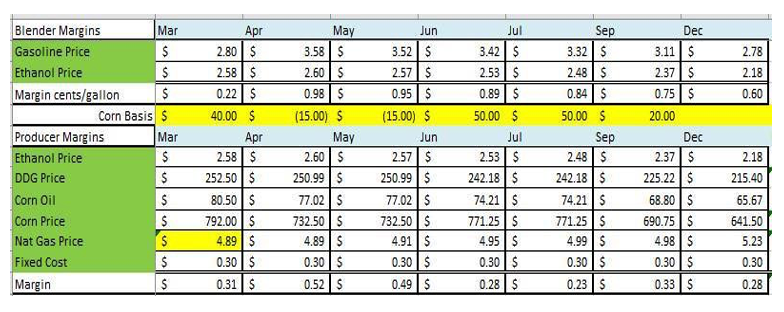

If we have an issue with wheat in Ukraine, we have an even bigger issue with corn. Ukraine exports significantly more corn than wheat, and Russia produces much larger quantities of wheat than corn. Corn has rallied from the events of the past two weeks but not to the extent of Chicago Wheat. It’s anticipated our exports will jump significantly for the current marketing year (replacing Ukraine corn exports) and in the new crop from reduced South American supplies and low exportable supplies from Ukraine. Spread relationship corn vs. wheat is extreme and likely to shift some residual wheat feeding to corn. We have also seen the soybean corn ratio drop towards 2.25 improving corn’s profitability versus soybeans, but we question this close to planting if acreage plans will shift much? Fertilizer prices, particularly nitrogen, increased dramatically, and this could be a story impacting new crop futures not only for 22/23 but 23/24. UK Nat Gas prices are ~ $50 per MMBTU vs. $5 in the US. The cost to produce Urea in Europe is likely $1200 to $1500 per ton. US nitrogen producers will have attractive export opportunities keeping fertilizer prices sharply higher for the foreseeable future. The CEO of CF Industries recently said he sees opportunities to export fertilizer. The increase in March, May, July corn futures have increased farm sales weakening basis. Acknowledging changes are occurring fast; this is providing ethanol plants hedging opportunities and fostering increased exports.

Soybeans have been calm compared to wheat and corn. Production shortfalls in South America are well defined. Headline risk to announcements potentially impacting biofuels with concern for food prices is ongoing. We are constructive soybeans, particularly new crops, as acreage is unlikely to produce a negative surprise. Other crops seem likely to take acreage away from soybeans next year if price relationships are maintained through summer. US crush margins are attractive, and soybeans can address feed for livestock and calories for humans. (4,000 calories in each pound of soy oil). We look for domestic and global balance sheets to tighten further.

Live cattle have corrected, pressured by disappointing trade in the cash markets. Packers continue to have the leverage in the physical market. Substantial liquidation has occurred in the breeding herd laying the foundation for a longer-term uptrend. Additional liquidation is possible if drought conditions worsen, but traditional liquidation that would occur with high feed costs in the ’80s ’90s is not anticipated.

Hog futures are approaching historic highs, but the liquidation of the breeding herd has already occurred; action in other commodity markets opens the door to new all-time highs for both cattle and hogs.

The risk loss in trading futures and options can be substantial. Past performance is not necessarily indicative of future results.

In this letter, references to “we” refer to Gamma-Q, LLC, the Fund’s General Partner. This letter includes forward-looking statements, and there are risks that actual results could differ materially from the forecasts, projections, or conclusions in those forward-looking statements. The information in this letter should be considered as background information only and should not be construed as investment or financial advice. Further, it should not be construed as an offer or solicitation to buy or sell securities or commodities. This letter includes information from sources believed to be reliable and accurate as of the date of this letter’s publication, but no independent verification has been made, and we do not guarantee its accuracy or completeness. Opinions expressed in this letter are subject to change without notice. The risk loss in trading futures and options can be substantial; therefore, only genuine “risk” funds should be used in such trading. Futures and options may not be a suitable investment for all individuals, and individuals should carefully consider their financial condition in deciding whether to trade. Past performance is not necessarily indicative of future results.

Photo by Melissa Askew via Unsplash