Commentary by GZC Investment Management

Global balances in crude have been tight in 2H21 but since then have been globally neutral to soft. Great disparities between OECD and non-OECD countries have been noticeable. In short, OECD has been drawing oil stocks rapidly until recently while non-OECD countries, particularly China, were constantly building stocks, allowing them to be at very healthy levels. China has record oil stocks, and the western world has pockets of tightness, especially in the most visible oil products storage hubs.

The most uncommon part of 1H22 is the disparity between extreme market pricing in crude curves and an otherwise mediocre S&D over the last six months. Indeed, current crude oil demand is well below the 3Mbd YoY growth the IEA predicted at the beginning of 2022. Current demand growth is tracking closer to +1Mbd YoY and about -1Mbd since the end of 2021. Even if China had not locked down, YoY demand growth would be much below expectation. There are notable disappointments in various oil demand sectors. For example, US gasoline demand is down 600Kbd and seems to have recalibrated lower secularly post Covid. Even global Jet oil demand has been down 400Kbd since December 2021.

On the production side, the YoY numbers are pretty robust with +3Mbd (including 0.7Mbd of non-OPEC production) but have materially weakened in the first half of 2021. Over 1H22, global production was higher by only +0.2Mbd with +0.45Mbd from non-OPEC, which means that OPEC and OPEC+ combined delivered -0.25Mbd over the period. It might sound terrible, but the market did not require more barrels to be balanced since global stocks rebuilt during this period. Should demand have been better, core OPEC countries would likely have delivered more. One can see the situation as a question of a glass half full or half empty. We see it as demand was not there, so additional supply did not need to materialize.

So how come tension in crude oil pricing was acute with S&D balances not particularly exceptional? We think the prime reason was OECD buyers, post-Russian invasion, desperately bidding oil for storage. There, it is arguable that core OPEC was not particularly generous with additional supply. In the coming months, the US and Europe might convince core OPEC countries to deliver extra crude specifically for OECD storage. Something core OPEC countries could deliver since we see 1.5 to 2Mbd of crude oil quickly available.

OECD storage levels have started deviating from the 5-year average in 2H21. Since then, the situation has improved even if more still needs to be done to reach the average level. Yet, the global storage situation remains comfortable thanks to China’s chronic builds since 2020. Global storage is a story of OECD barrels being lost to China. Over the past six months, global crude oil storage has increased by +5 Million barrels (Mb), with commercial stocks built of +110Mb (balanced by a decline of -105Mb coming from SPR barrels). Yes, commercial stocks are up significantly despite markets trading as if the last drop of oil on earth was gone.

Here, we reference Brent cash market that has been trading at a historical premium to the first futures month. As we previously pointed out, European refiners have been bidding increasingly aggressively for quickly deliverable oil to build extra storage, creating stress on the balance of short-term cargoes. Overall, crude balance implied from global storage change ex SPR releases has been in oversupply of 0.6Mbd on average for 1H22 (relatively normal for the first half of the year).

The S&D in oil products markets has been much more supportive and resulted in global stocks drawing -130 Mb since Jun 2021.

Like crude, the first half of 2022 was not as dramatic, with a draw of only -30Md. Since demand has been increasingly disappointing while, paradoxically, refinery margins remained incredibly strong, it is likely that more spare refining capacity will come back to finally fill the storage gap, especially in OECD. Though, tensions will remain for a few more months with extra support in gasoil coming from natural gas substitution. We think part of the strength in middle distillate is linked to natural gas substitution, and this could further increase if Russia’s natural gas supply to Europe is cut entirely. In such a scenario, global LNG prices will remain extremely elevated, enacting a search for substitutions that include coal and, to a lesser degree, oil.

To summarise, in the first half of 2022, there was no shortage of crude oil, and we think the situation will remain similar until year-end unless major changes in Russian exports happen- which is always possible if G7 leaders manage to frame a cap on Russian oil prices. A policy that could backfire if Russia cuts its production dramatically. For most of 2022, crude oil has been trading with a supply risk premium that masks an otherwise disappointing demand trend. Yet, the oil complex is likely to remain supported by oil products in general and middle distillate in particular. European natural gas shortages will remain key support for energy prices at large. As refiners ramp up activity further into the second half of the year and benefit from high refinery margins it is likely that oil products stocks will normalize ahead of natural gas and eventually allow for more price disconnection; the risk being that oil becomes such a good value versus natural gas that all sorts of substitutions that we do not see at present materialize.

There is also complexity with oil demand in case the Russian gas supply to Europe was turned down completely. In such an event, European GDP would likely drop at least 2%, and state rationing would have to be implemented. If numerous activities were forced to stop, reminding covid 19 lockdown situation, oil demand is likely to become a casualty.

Oil prices will be driven by balancing the influence of exploding LNG prices and lower industrial activity. In such case, volatility should increase significantly. The above goes without saying that supply risk premium in crude oil and aggressive bids to replenish stocks would all disappear in case of a diplomatic resolution in Ukraine. We do not assign a particularly large probability for that event, though it is important to bear in mind that crude prices would likely drop $40/barrel in one week in such a scenario.

SCF finished the month of May at -0.86%. We went into June with very limited exposures, mostly because we think supply risk premium overwhelms short-term fundamentals. We also see now the risk of total interruption of Russian natural gas to Europe as a material probability, and the implications for oil remain to be defined. In such an environment, the desperation to rebuild OECD storage is likely to persist. However, at some point later this year, enough oil is expected to have been re-stored, and we should see a reducing supply risk premium. Hence, the oil market should refocus on pricing a very mild demand growth while US production finally ramps up.

Trading futures involves a substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results.

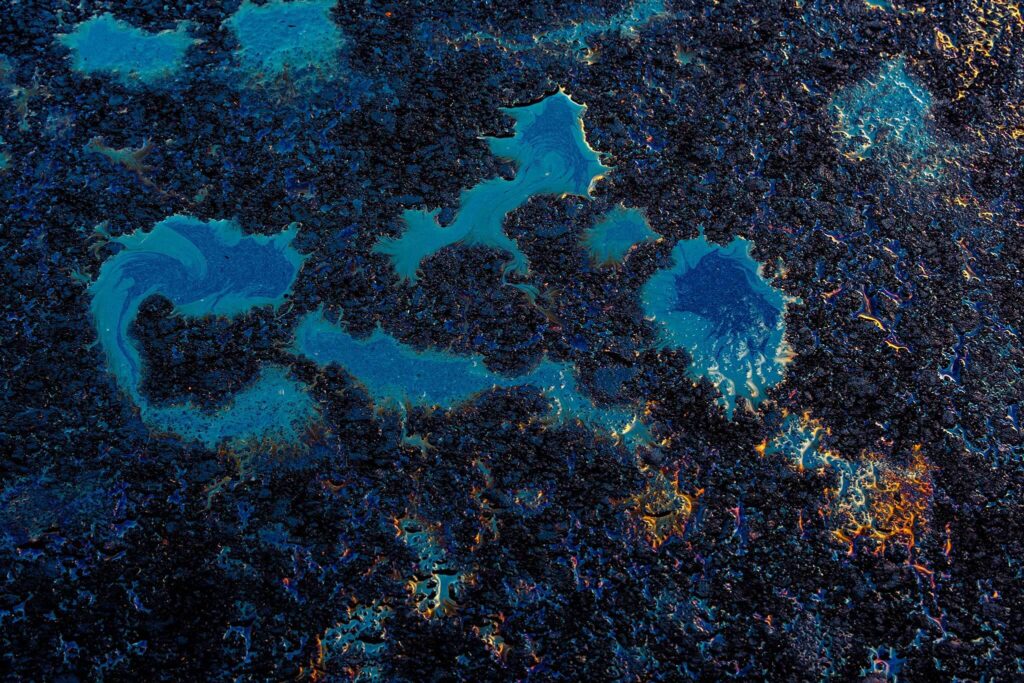

Photo by Roberto Sorin on Unsplash