“A politician’s first goal of governing is to get re-elected. It is also the second goal. Everything else comes after that.” While seemingly trite, this phrase was repeated by my professor throughout my business school class on strategy in non-market environments. I often think about this concept as our leaders consistently make decisions contrary to their country’s best interests. However, looking closely, it is clear that these priorities are good for them because it ensures they keep their job. One of the ways they stay in power is to build money for re-election, and there is no better way to do so than to grant favors to groups that donate to your campaign. And why wouldn’t these organizations donate? Nobody spends more than the government while demanding less of their vendors. It is easy to do when you own a money-printing machine.

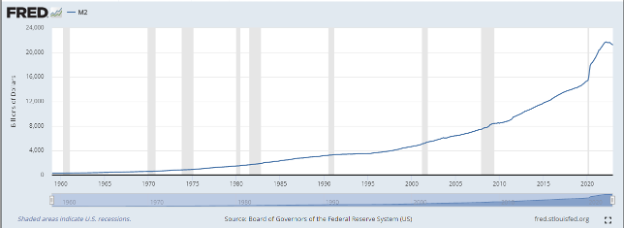

Fortunately, the United State’s status as the world’s reserve currency and largest economy allows the most flexibility in this department. Despite the risks, in just two years, the Biden administration passed a $1.9 trillion “rescue plan” and a $1.2 trillion infrastructure bill on top of normal spending. This followed a massive increase in the M2 money supply starting in March 2020 when COVID struck. To put that growth into perspective, the United States, in its entire history, built its supply to $15.4 trillion as of January 2020, and by March 2022, it hit $21.7 trillion, a 41% increase in less than two years. The predictable result? Inflation.

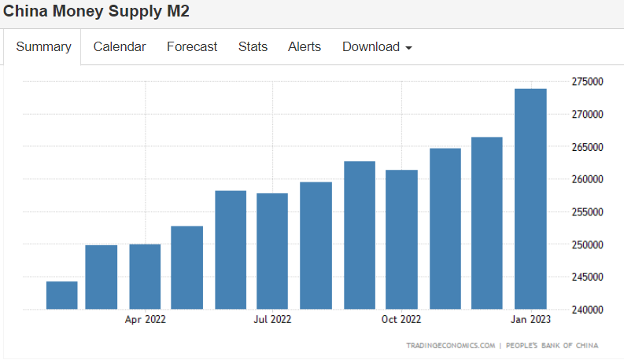

Inflation is bad for getting re-elected, so we will see politicians rail against the debt for now, but actually fixing it requires tough policy choices. It is easy to hide and avoid these choices, though, and look to the Federal Reserve to clean up the mess. Thus, in January 2022, we saw the Fed consistently begin to raise interest rates and reduce the money supply. But not everyone got the memo. After all, other countries answer to their people also. Oddly, concerns about intellectual property did not stop many countries from outsourcing their currency printing to China. Starting in 2013, Beijing launched its Belt and Road initiative designed to stimulate growth in countries in Europe, Africa, and Asia. Part of this plan involved taking over currency printing for other countries. Customers as of 2018 included Thailand, India, Brazil, Poland, Sri Lanka, and others. In fact, China is the largest money printer in the world, with over 18,000 employees (compared to the US counterpart that uses less than 2,000) dedicated to the task. So, it should not be surprising that after their “Zero COVID” strategy slowed their economy and created a rare political failure for the Xi administration, they would resort to stimulus—time to fire up the presses.

Government intervention naturally distorts markets. In the case of China, post-lockdown consumption and loan growth is higher than the banks can handle. Thus, on February 10th, the People’s Bank of China (PBOC) injected the largest ever amount into their lenders. This followed a significant increase in their M2 money supply in January (chart below).

Despite their desire to print more, the worldwide environment is shifting as other countries prioritize restricting the money supply to tame inflation. This puts China in an awkward spot as they must balance the risks of devaluing their currency too much, which would force foreign companies to convert massive amounts of yuan to more stable currencies. Rising interest rates demanded from investors for additional borrowing only compound this problem.

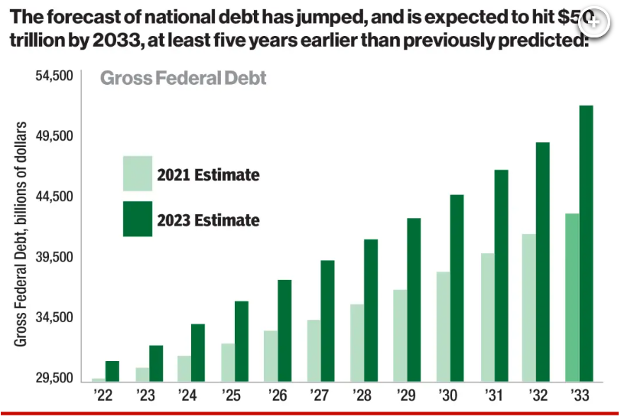

What will our leaders do if they cannot keep spending at their current rates? We may not find out. Not yet, it seems. It is hard to break old habits even as predictions of soaring national debt become a reality. The chart below shows how much the projections changed for the United States in the past two years. This does not include the $430B in student loan debt forgiveness being considered by the Supreme Court this week.

Voters love handouts, and politicians willingly provide them until they cannot. Unfortunately, the deluge of cash created during the pandemic is resulting in economic pain for many and distorted markets for everyone. As one country stops adding to the problem, another takes its place. This probably will not end well, but the people that voted for it will be fine. After all, it got them re-elected.

Photo by Eric Prouzet on Unsplash