Surging liquidity encouraged by central banks and government stimulus pushed inflation rates to a 40-year high causing surprise to leaders that thought they could support markets without consequence. In a desperate bid to slow these price increases, they are taking a page from the movie industry by removing Everything, Everywhere, All at Once. Not on purpose, of course, but they did not mean to cause inflation either. Unfortunately, the simple method of removing their liquidity from the market may mean turning off even more than they anticipated. Way more. In fact, they inadvertently may have trapped millions of investors in assets they would otherwise sell.

Financial Institutions and US Treasury Bonds

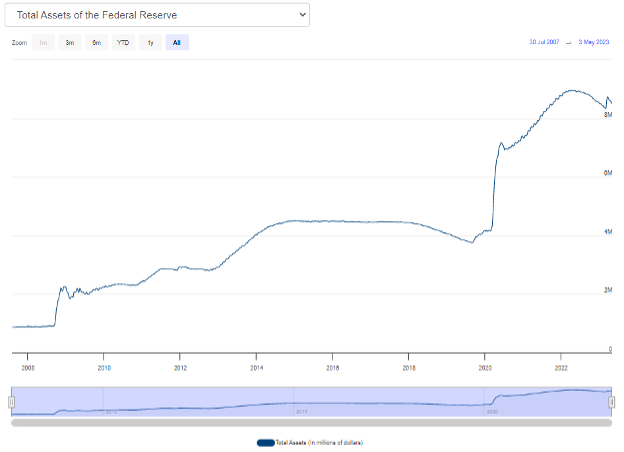

We addressed the first major victim of this process in our article, “How SVB Banked on Low Rates and Lost Big.” Financial institutions in the United States were able to carry US Treasury bonds on their balance sheets at their full value despite the spike in interest rates that impaired them significantly. Selling these holdings would result in realized losses, so they did nothing. When deposit growth slowed and withdrawals increased, some were left with negative valuations, and SVB failed. This dented Fed’s efforts to reduce its balance sheet, as evidenced by the $300 billion “blip” in March 2023 in the chart below. Despite this assistance, small regional banks continue to hemorrhage under the weight of the interest rate change. PacWest Bancorp is down over 80% from their 2023 high, and bank failures this year eclipsed the asset levels of those that failed in 2008, with over six months to go.

Challenges for Homeowners

Homeowners flush from rising prices seem to be weathering the storms thus far but also face a dilemma. They cannot move unless they want to pay more or downsize. Current interest rates for a 30-year mortgage are approximately 7%. Comparing this rate to the 3% available just over a year ago would increase the monthly payment on a $500k house by more than 50%. Assuming a 20% downpayment, the payment changes from $1,686 to $2,661 before additional taxes or fees. Quite simply, the math of owning a home changed drastically. Oddly, this also creates a shortage of homes for sale, which seems to be propping up values for now.

Corporate Balance Sheet Restructuring

Corporations will restructure their balance sheets dramatically to adjust to the new normal. Modigliani and Miller derived the economic theory based on companies’ capital structure. For example, proposition II states that in a world where interest on debt is deductible, and taxes exist, carrying as much debt as possible will create more value for shareholders. This happens because the bonds used to finance the growth in place of equity reduce future taxes owed. You can read more about them here.

Impact on Corporate Bond Issuance

Right now, companies like Apple and Exxon keep bringing in cash. Normally, they might reinvest in the company or decrease leverage, but with high-interest rates, they can choose a few routes. A simple one many choose is to put the money into US government debt, paying 5% interest with little risk. Given the expectations for higher rates, many of them refinanced in the low-rate environment and paid less interest than that level for their debt. This will not last as investors demand higher compensation on corporate debt going forward relative to Treasuries. If these prices get too high, expect corporate bond issuance to suffer. More of the most well-off companies will just do share buybacks. This helps dispense cash while reducing the outstanding shares, which can be canceled or kept as treasury shares. This benefits both the return on assets as well as return on equity. It also might be why the stock market remains resilient through the recent bank failures. New rates on their bond offerings will force them to de-lever and carry a lower debt-to-equity ratio than in the past. This may take some time, but unless rates drop again, their financing charges will increase.

Lending Standards and Auto Loans

Finally, banks will need to re-evaluate their lending standards. Now that they are earning money on deposits again, the incentive to lend is reduced severely. Auto lending may be the canary in the coal mine as reports say Capital One shut off their dealer floorplans which provide (often cheap) financing for new cars sitting on the lot. Ally pulled many of their lines of credit in this area, also. We saw in 2008 the power of auto manufacturers and their economic value. Now, consumers who purchased cars at inflated prices might lead to a wave of repossessions as they default on autos with loan balances larger than their value. Overall borrowing levels in the United States just eclipsed the $17 trillion mark for the first time. This represents an increase of $2.9 billion from the pre-COVID era and a sign that spending is outpacing wage growth. Financial institutions would be wise to build reserves for eventual write-offs.

Spreads on treasury futures indicate that many expect the Fed to reduce rates soon. This might unleash market liquidity at the risk of exacerbating inflation again. The Fed chose Scenario 1 from our article The Fed Pickle whereby they raised rates quickly to tamp down inflation. Hopefully, they know what they are doing because markets go up slowly but come down all at once. Especially if the funds needed to support it are trapped.

Image: Midjourney