The world is experiencing a convergence of tumultuous events, which seems rare. Amidst this backdrop, the two foremost players appear to be on a collision course. China, an ascending power, wants to establish itself on the world’s stage and increase its influence. To realize this vision, China is aligning itself with nations with the goal of challenging the United States, the reigning superpower. This endeavor necessitates a direct challenge to the US’s economic supremacy and geopolitical might, including its military prowess. They appear to be growing more confident in their ability to do so as they become more assertive with neighbors and openly cooperate with Russia despite their poor reputation on the world stage. However, this might be a sign of vulnerability as their economy struggles through a rare rough spot they are reluctant to openly acknowledge. After all, they promised their people prosperity in return for less freedom. Now, they might lose both.

Centrally planned economies often hit unforeseen challenges. Such is the state of the real estate market in China. Like the 2008 mortgage crisis in the United States, China’s housing market boomed with easy liquidity that pushed home prices higher and accounted for up to 30% of all their economic activity. Intense demand for new units prompted buyers to “pre-pay” for new properties to be built later. When large developer Evergrande collapsed, many of these investors were left with nothing, causing panic in the real estate sector. Zero COVID policies further compounded these issues by hindering economic growth and exacerbating unemployment, dampening demand. Country Garden now faces a similar risk, with 300,000 employees (Google has 190,000) and multiple missed debt payments recently. Evergrande is looking for bankruptcy protection and ironically filed for it in the United States.

One possible solution for China to avoid further contagion is simply hiding the data. This seems to be the strategy behind not releasing the youth unemployment report in July, estimated at a staggering 20%. Growth solves everything, so the government encourages firms to buy back shares, relax purchasing rules for homes, and inject stimulus into the property sector. Strength outside of China appears to be waning as exports fell by 14.5% in July, the largest amount in three years. It was the third month in a row that occurred. Given the choice between a weaker currency or growth, the People’s Bank of China chooses the former. This will make their exports more competitive but yield inflation at home. Spending on the military could act cumulatively, with an increase of 7% this year, as they continue to build outposts around Taiwan and are widely expected to push their interests in that region.

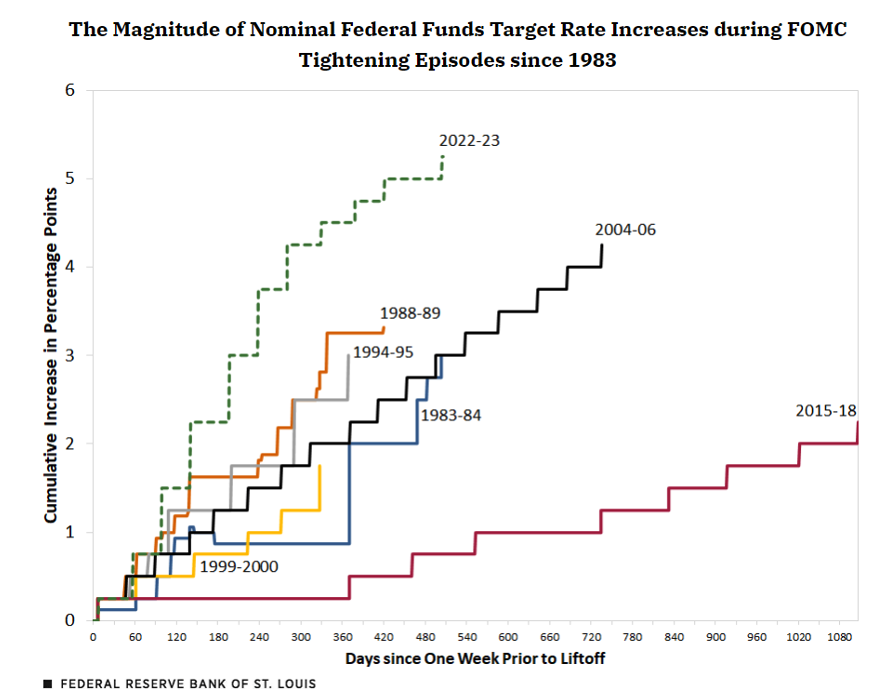

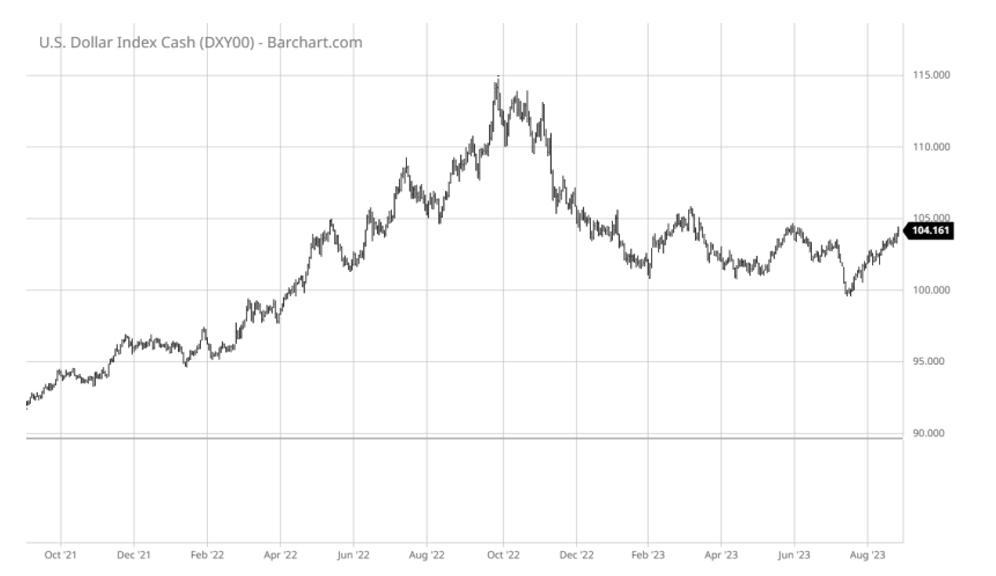

Conversely, the United States is embarking on a divergent path. High inflation fueled by an influx of cash during the pandemic resulted in a tightening process explicitly designed to cool down the economy. The enduring dominance of the US currency, as evidenced by countries like Argentina suggesting they will adopt it as their means of exchange, complicates this endeavor. The United States dollar is often viewed as a safe haven asset; thus, investors flocked to that medium as markets declined under rising rates in 2022. Consequently, the Federal Reserve is embarking on its fastest rate hiking cycle in the past 40 years, as illustrated in the accompanying chart. Their intention to take liquidity out of the system seems matched by the spending desires of politicians as the so-called Inflation Reduction Act followed the $2 trillion Build Back Better bill and the $280 billion CHIPS Act. This confluence of factors is compelling more companies to move out of China, lured by new subsidies, thereby exacerbating an already contentious trade relationship. Furthermore, the $76 billion sent to arm and finance Ukraine’s war with Russia, an ally of China, adds another layer of complexity to the situation.

While both countries want to maintain their dominance, they share mutual dependencies paradoxically. The United States spends more than it brings in, and China lends significant sums of money to finance its outlays. Japan is the only country that holds more US debt. China also produces most of the rare earth metals used in batteries and solar power needed for the “green transition” desired by Western governments. A recent event highlighted this interplay as China blocked the export of two rare earth metals, setting off a scramble to find replacements. As previously mentioned, China depends heavily on the United States for export income. US companies leaving their mainland and slowing domestic growth pose a tangible risk to China’s economic expansion.

The BRICS countries (Brazil, Russia, India, China, and South Africa) would like to influence the global financial landscape collectively. Their proposals include a new currency backed by gold that could supplant the US dollar. However, the practical realization of this ambition is hampered by various factors, including China’s decelerating economy. The confluence of these challenges presents a complex backdrop to the aspiration of challenging the dollar’s global dominance.

In essence, China and the United States find themselves with a strong mutual reliance developed for many years despite their aspirations for self-sufficiency and supremacy. We can expect this tension displayed through power struggles at the IMF, the UN, trade pacts, and more over the coming decades. History tells us that collisions result in collateral damage. We can hope somebody turns in time to avoid the crash.

Photo by Martin Sanchez on Unsplash