Economists often look for the proverbial “canaries in the coal mine” to predict where we head next. Specific areas of the economy tend to presage slowing growth earlier than others. The shipping of materials from one place to another is one such area. A supply chain is either gearing up for future sales or reducing supply to match waning demand. By any measure, the industry is preparing for the latter as rates and volume decline across the board. Perhaps this is expected after pandemic-fueled excess, but the economic ramifications persist. Like many indicators, this one must be viewed in the context of the overall data for it to provide value.

Impact on Shipping Rates and Volume

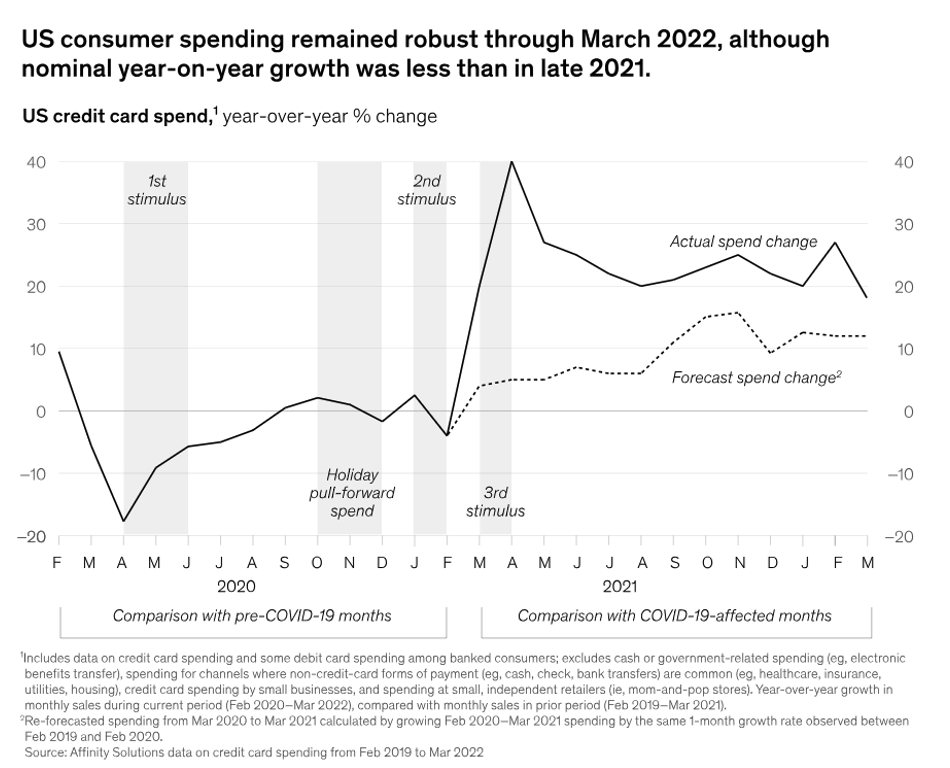

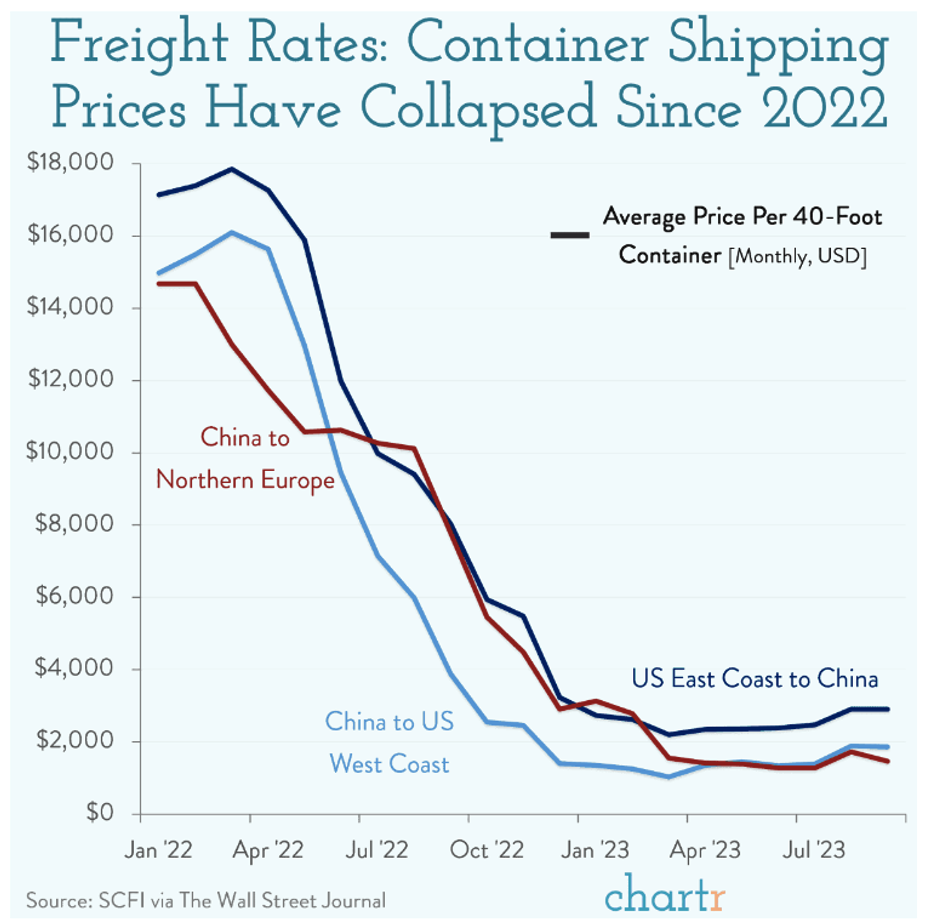

Freight encompasses all commercial transportation of goods. This includes shipping, train, and truck, amongst others. In many ways, it is a commoditized industry. An auction system allocates containers on boats, rail cars, and semis to the top-paying customers. This efficient mechanism aligns the value of goods with their supply and demand curve. Flush with government stimulus and excess savings, consumers exiting the pandemic purchased “hard goods” at a rate well beyond predicted metrics. In a textbook definition of inflation, “We had too much money chasing too few items.” This aligned closely with a vaccine release and a third stimulus in the United States. Shipping rates surged as well. Moving a container from China to the West Coast spiked to $16,000 as retailers scrambled to fulfill orders. That same container can now be sent for $1,000.

Diesel Fuel Sales as an Indicator

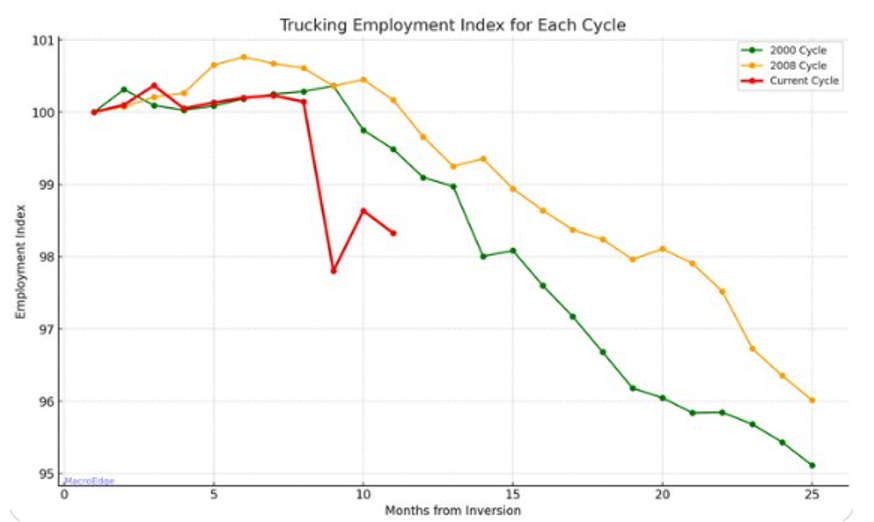

These reduced prices and slowing volume reverberate through the supply chain. Trucking companies’ excess capacity shows that fewer containers coming in means less distribution through the states. Yellow trucking is the most prominent domino to fall so far. Their 30,000 truckers lost their jobs in September when they closed their doors and declared bankruptcy. Digital freight broker Convoy followed in October, just 18 months after achieving a valuation of $3.8 billion. While some slowdown might be expected, the pace is much faster than many anticipated. Diesel fuel sales confirm this trend, according to Todd Garner of World Kinect Energy Services. “We have been seeing commercial demand for fuel drop for most of the year, but the last few months have been larger than normal. This industry is one of the leading indicators when it comes to the future of the economy. It could be seasonal, but it doesn’t feel like it. Demand is starting to retake center stage, and this time, it will be tough to ignore.”

Changing Consumer Behavior and Doubts

It is easy to draw parallels between previous trucking employment cycles and economic slowdowns, as shown when comparing previous periods seen below, but doubts remain. COVID changed consumer behavior in many ways. Social distancing pushed normal spending patterns away from contact-intensive services and towards durable goods. Home improvement and home entertainment were the only options for many that benefitted retail sales. The vaccine and re-opening influenced a reversion to the mean as travel and leisure activities exploded starting in the second quarter of 2022. A guide put it in perspective during our family’s COVID-delayed trip to Italy in June. “We expected a massive surge of travelers this year, but there are four times as many as predicted. It has been crazy.” Perhaps we are seeing a normalization of demand that was pulled forward. After all, you don’t replace your dishwasher and car every year.

Potential Challenges Ahead

Like any data point, freight is just one of many factors to consider. The US Federal Reserve and other central banks stated that their goal is to slow the inflation rate. One cannot do that without also affecting the growth rate of an economy. Higher borrowing rates will continue reverberating in ways that might catch many by surprise. We may appreciate lower energy prices and a return to a normal pace of price increases, but we should be careful what we wish for. If the pace of failures in the trucking industry is any indication, we might be in for more than a slowdown.

Photo by Victoire Joncheray on Unsplash