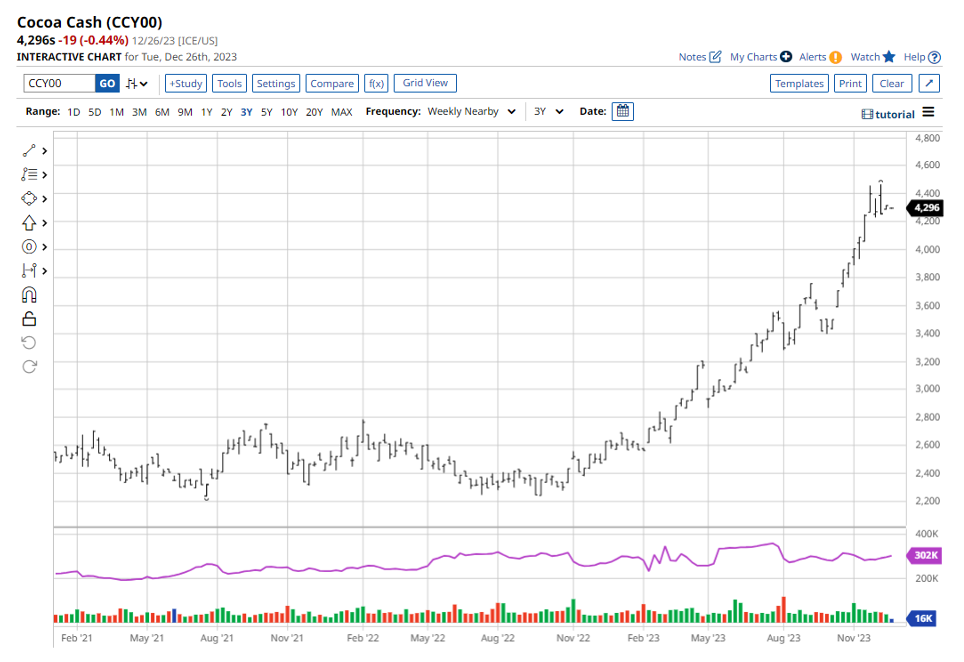

While grocery prices grab the headlines, chocolate might be the story of 2024. The standout trend of 2023 was one that most people overlooked in their day-to-day lives. Cocoa futures surged over 70%1 for the year, and this rally2 seems to have staying power. Smaller trend managers benefited from seizing this opportunity, unlike larger programs that couldn’t trade the limited available volume. Many candy producers reserve their supply nine months or more in advance, so consumers might be in for a surprise. Slowing increases in butter and other ingredients used to make the final product might help overall costs, but brace for higher prices in 2024.

Cocoa Production Dynamics

Cocoa beans, known as the ‘food of the gods’ scientifically labeled Theobroma cacao, predominantly thrive in Africa and South America. The Ivory Coast (Cote d’Ivoire) and Ghana are primary producers, cultivating 2 million and 800,000 tons, respectively. Notably, cocoa and its derivatives contribute significantly to their economies, constituting over 35% of Cote d’Ivoire’s total economy and 10% of Ghana’s. Around 81% of all cocoa beans are cultivated in West Africa, flourishing within 20 degrees of the equator.

Innovative Use of Cocoa Fruit

Traditionally, cocoa is the base for chocolate, cocoa butter, and nibs. However, more than 70% of the fruit is discarded during this process. To minimize waste, efforts are underway to repurpose the remaining pulp3. Innovators seek to create other products like flour, fruit bites, and cocoa water from this residual fruit. The fruit boasts beneficial properties, including magnesium (increasingly popular as a sleep aid), antioxidants, and fiber.

Climate Challenges and Impact on Harvests

Cultivating cocoa necessitates warm temperatures, as depicted on the map above, ideally beneath the filtered light of rainforest trees. The trees thrive in regions where ample rainfall, evenly distributed throughout the year, promotes optimal fruit production. However, current conditions pose challenges; a drier climate affects pod moisture, leading to a reduced yield in the crop, attributed partly to the ongoing El Nino pattern.

The recent climate fluctuations have impacted harvests significantly. Excessive rainfall preceding these conditions delayed harvests and facilitated crop diseases. Compounding these issues, this marks the third consecutive year when demand exceeded supply. Responding to the grim projections, the Ivory Coast regulator halted sales on December 1st to assess production forecasts.

Coincidentally, Ghana also grapples with unfulfilled contracted deliveries for the second consecutive season. Moreover, escalating costs associated with materials, labor, and transportation may lead to substantial price hikes, potentially surpassing the already elevated inflation rates observed elsewhere.

Global Consumption Trends

While many might assume that Americans, not widely recognized for the healthiest diets, consume the most chocolate, their average consumption of 9-12 pounds per person does position them at the top of the list. However, when it comes to per capita consumption, European countries take the lead.

Swiss chocolate, renowned for its worldwide popularity, achieves this acclaim by blending traditional techniques with cutting-edge technology, producing high-quality chocolate. Notably, Switzerland’s government imposes stringent quality standards for the composition and labeling of their confections. As a result, it’s perhaps unsurprising that each Swiss citizen consumes an impressive 19 pounds (8.6 kilograms) of chocolate annually. Other European nations like Germany, Austria, and Belgium also rank high in chocolate consumption. These countries boast thriving candy industries, contributing to their elevated per capita chocolate consumption.

Short-Term Challenges and Long-Term Prospects

In the end, the equilibrium between supply and demand will be restored. Short-term price hikes are expected to encourage increased tree planting, exploration of alternative recipes, and reduced consumption. Following a 46-year price peak, there might be ample trading opportunities on the downside. Farmers in the affected regions will either flourish if they can boost production or face dire consequences if their crops fail. Considering that the per capita income in cocoa-producing African countries hovers around $2,000, even slight changes can significantly impact cities and villages.

The Elastic Demand for ChocolateUnfortunately, for many of these growers, the demand for chocolate is elastic. Nobody needs chocolate, but it will always have a market. Popular since 1500 BC and known as a “gift from the gods” to the Mayans from 600 AD, it is still represented in the top candies worldwide, including M&M’s, Snickers, and Reese’s Peanut Butter Cups. Next year, it will just cost more. A lot more.

Sources

1https://www.barchart.com/story/news/22960008/cocoa-prices-slip-on-end-of-year-positioning

2https://finance.yahoo.com/news/worst-cocoa-rally-yet-come-100000155.html

3https://www.wellandgood.com/cacao-fruit-uses/

Photo by Alexandre Brondino on Unsplash