Headlines trumpet the stock market gains driven by the “AI Revolution,” but there is company at the top as gold, Bitcoin, and cocoa also hit their peaks. Many would say this is a validation of a buy-and-hold strategy. Typically associated with equity markets and not commodities, bitcoin holders and gold bugs might argue that it also works for them. Even those with leftover Halloween candy might feel good about it as cocoa prices skyrocket (hyperlink our cocoa article here). The odd twist in these movements is that they move together when investors often use them to hedge the other side. This leaves us in a conundrum. Are these sectors going up because the outlook is good or bad?

Gold as a Hedge

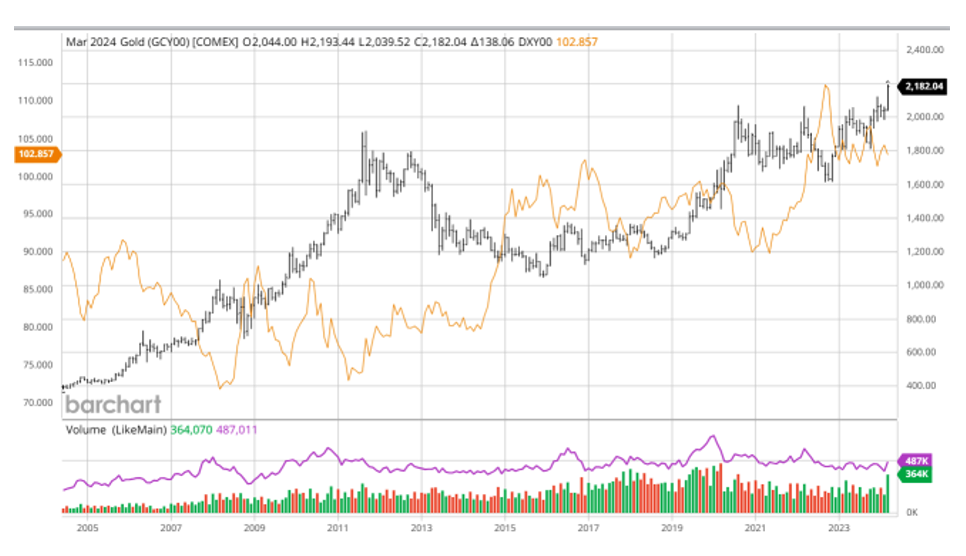

Throughout history, humans used gold as a medium of exchange and store of wealth. It is said that a single gold coin could buy a luxurious robe in ancient Greece and a top-of-the-line suit today. Thus, it provides a similar value throughout centuries. It follows naturally that hedging your local currency in the yellow metal makes sense. In a world flooded with COVID-19 dollars, exploding national debts, and leveraged financial systems, protecting the basis for your wealth from decay seems wise. The correlation shows that this is often effective over long periods. Recently, it appears that, unlike previous periods where it was considered a “safe haven asset,” it is following market risk up and down. This is the opposite behavior of what we would expect from a hedge. Perhaps the answer to why it is nearing highs is simple. Gold is up 21.49% since January 2021 while the Consumer Price Index (CPI) in the United States is 17.9% higher. It offset the decline in purchasing power almost exactly. Despite this relationship, the US dollar index continues to appreciate as well.

Monetary Policy Challenges

Recent approvals of cryptocurrency ETFs and other structures have made it easier for all investors to access digital currencies in the United States and, soon, in Europe as well. Invesco, Fidelity, Blackrock, Grayscale, and others were ready to move, with the largest of these programs already trading over $20 billion in assets. This coincides with record Bitcoin prices crossing the $72,000 mark per coin. This represents a staggering 312% gain since the beginning of 2023. Unlike government currencies, the ability to create new coins is limited. Simple demand curves tell you that the value will grow with a new appetite for cryptocurrency coming online and restricted supplies. Milton Friedman suggested that fiat currencies should follow the same pattern with defined growth plans rigorously adhered to so that consumers would have faith in central banks and inflation would grow at a similar rate to the money supply. His advice was ignored.

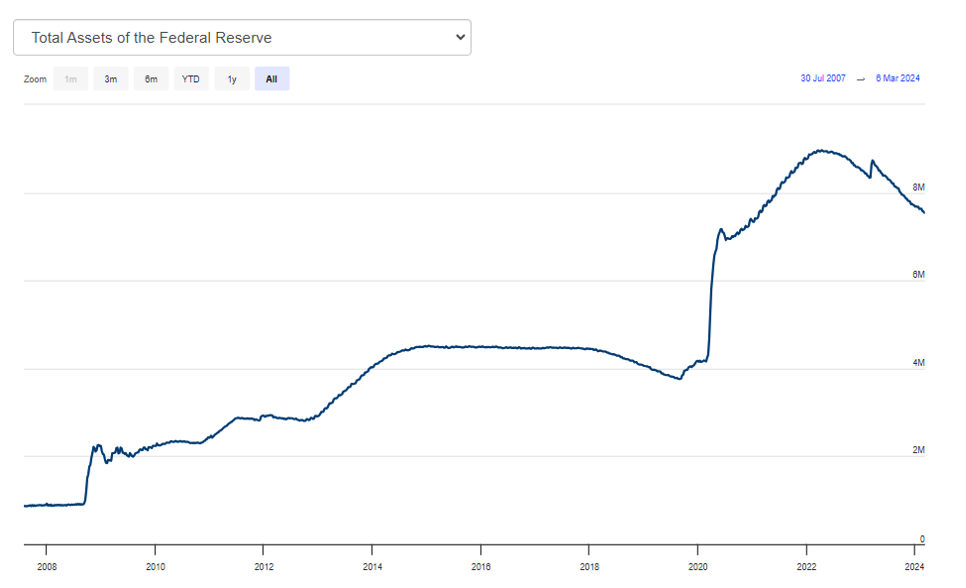

The US Federal Reserve instead grew its balance sheet and the money in the economy from $4.2 trillion before the pandemic to its current level of $7.5 trillion. While this almost doubled, the peak reached 8.9 trillion dollars before falling. This money must go somewhere and continues to go everywhere all at once. This creates an odd setup where the economy is growing with the backing of massive government expenditures, but the future debt picture continues to worsen. The good news is that productivity is increasing, which might explain the lofty market heights. Many think artificial intelligence can push this even further, which would help profits but force a massive shift in employment across many industries.

Uncertainty Amidst Success

Undoubtedly, we will learn how the COVID-19 experiment worked out and if the reaction to the pandemic created more problems than it solved. For now, the decisions appear to be working for those who own assets, despite the spike in inflation, GDP growth, and other indicators, including employment, showing that a “soft landing” is possible. Prices of gold and Bitcoin would suggest caution might be warranted, but it is okay to enjoy the ride—maybe even with a chocolate bar.

Photo by Christopher Burns on Unsplash