Much like my children would love to eat nothing but desserts, consumers prefer spending power with few limits that come with low interest rates. Thus, we see the shock from the talking heads on CNBC and other investment channels when central banks tighten. Sugar and cheap borrowing both create addiction, and both can also lead to negative outcomes, including obesity and housing bubbles. As the Fed is expected to loosen rates again, we look to the counterarguments to easy money. There are many.

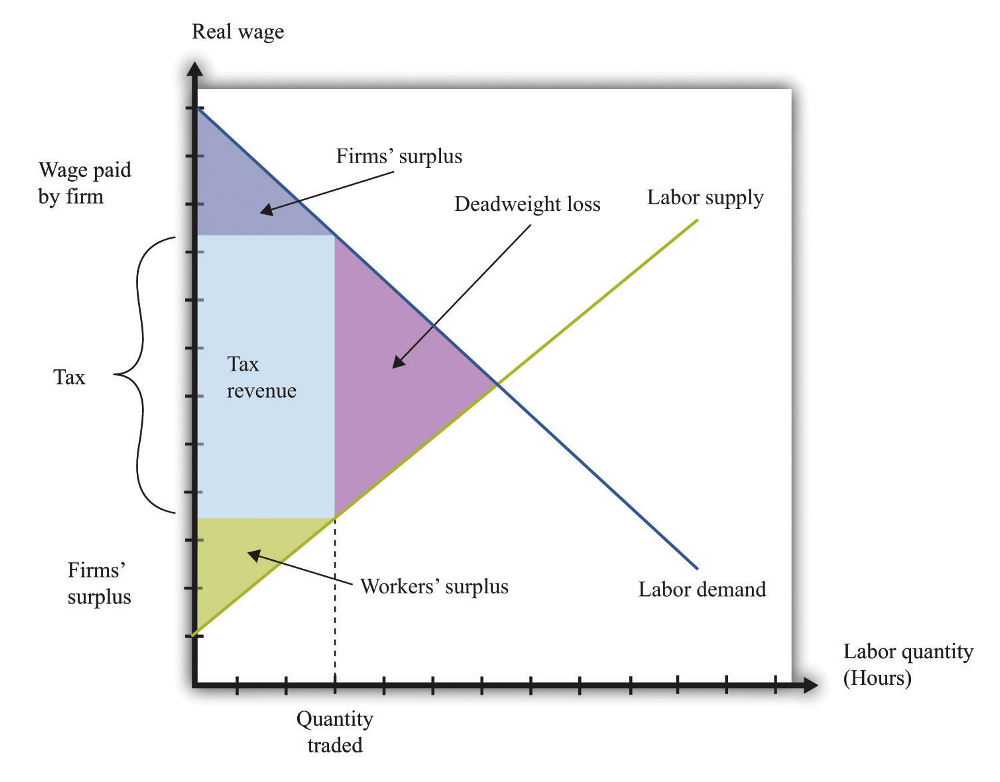

Supply and demand charts provide a simple view of the effects of distortions in an economy. The most common of these is taxes, but they are hardly the only ones. Regulations, borrowing costs, and incentives all affect the curve. A typical chart shows a line for supply and another for demand. They meet at the market clearing level. If a firm aims to achieve a 20% margin on their goods but taxes take a large chunk of their profits, they need to charge higher prices. This pushes the supply curve up (higher prices) and reduces the demand because fewer people want to buy at the new cost. This mismatch creates a “deadweight loss,” demonstrating the lost efficiency affecting both parties. Fewer consumers buy at the higher price, and the supplier sells fewer items. Everyone loses. In the example below, a company hires fewer workers than they otherwise would and provides fewer jobs; the area of benefit in purple shows the lost efficiency.

Interest rates create similar changes in the behavior of economic participants. These distortions create winners and losers in an economy. Most recently, we addressed how recent college graduates hit with rising rates, inflation, and a 40% jump in home values found themselves on the wrong end of an economic cycle. Commercial real estate grew at a rapid pace, fueled by cheap money and clients’ ability to pay. This came to a startling halt during the pandemic and may never return. We now find ourselves with an enormous mismatch between supply and demand that even falling prices might not arrest. After all, building values skyrocketed with low rates, causing a buying spree of iconic properties. We predicted the vacancy would increase in our article, The Unraveling Real Estate Market. Here in Chicago, those predictions continue to be borne out, as almost 30% of the downtown offices were available in Q1 of 2024. This is up almost 5% since the end of 2023.

Good intentions do not protect participants in the economy either. Despite low unemployment, a growing economy, and a record-high stock market, more banks failed in 2023 than any year since 2017. The reason most failed was their “mismanagement” of their balance sheet. They invested too much in government and private sector bonds, which cratered in value when rates increased. Silicon Valley Bank could only redeem these at a steep loss and could not meet withdrawal requests without becoming insolvent. Investment advisors provide similar guidelines to their retirees to shift assets from riskier stock allocations to bonds to avoid losses. 21% inflation through a period of low yields on their fixed-income portfolios resulted in a decline in value in real terms.

| Year | Bank Failures |

| 2024 | 1 |

| 2023 | 5 |

| 2022 | 0 |

| 2021 | 0 |

| 2020 | 4 |

| 2019 | 4 |

| 2018 | 0 |

Clearly, winners emerge from these policy decisions. Equity holders see the values of their holdings increase. Businesses build their balance sheet to maximize efficiency for tax purposes. With massive cash stockpiles, companies like Apple still issue billions in bonds. Traditionally, this money would be used to finance the growth of the enterprise. Instead, the trend in recent years is to buy back shares. This can exacerbate distortions as they buy dips to support their share price artificially. Governments love the low-rate environment, and investors buy bonds for close to zero percent interest. This level seems comical as the expected rate of return with inflation is negative or close to it. Much like the government, many homeowners find themselves in a similar situation as they sit on 3% mortgage rates. With the value of a dollar declining by 3% or more annually, they earn a “free lunch” as the bank is paid back in cheaper currency and carries loans below the rate they currently borrow from the Fed.

In most cases, low interest rates benefit asset holders as they push the value of everything higher. In short, the rich get richer. When rates rise, only those at the top can afford to buy. Those who were able to take advantage of the low rates cannot sell because they would pay substantially more for a similar home or car with the new terms. Firms like Blackrock use this leverage to purchase thousands of houses to rent out to those priced out of ownership. This confused atmosphere leads to further poor decisions and misallocated resources.

The current rate is at the low end of the long-term average. According to government reports, which often require some deeper digging, the economy is doing very well. Inflation is still running above the target rate but seems to be normalizing. Employment is at 4.0%, which is considered full employment. This estimate can vary over time but is tight by historical standards. Many local businesses near me restrict their hours because they cannot find enough workers. The dual mandate of the Fed is price stability and maximum sustainable employment. We seem to have both right now. Still, expectations of a rate cut next month remain high.

Political pressure to reduce rates always exists as politicians prefer a hotter economy that produces more tax revenue and cheap borrowing so they can spend profligately and thus get re-elected. We see the result of this with the US national debt crossing the $35 trillion mark (officially) this week. This is not sustainable, with rates above 5% as they are now. Much like I limit the candy my kids eat, the government could also use a diet. Higher rates encourage better investment decisions, reduce the desire for leverage on personal and corporate balance sheets, and provide a rational counterbalance to asset prices. Sugar highs are fun until they aren’t. It may be time to accept a healthier approach. We might all benefit in the long run.

Photo by Ursula Gamez on Unsplash