An esoteric trade caused dramatic sell-offs in the equity markets this month. A surprise rate increase by the Central Bank of Japan (BOJ) tipped over a complex set of dominoes, resulting in a 165% daily spike in the VIX contract in the United States and a 10% drop in the S&P over just a few days of trading. We explain how this trade works and why it might happen again.

Central Banks’ Objectives

The Federal Reserve of the United States and other players in the global economy focus on a core set of objectives. These include price stability and maximizing employment. This so-called “dual mandate” can sometimes be at odds with one another. Easy money policies, including low interest rates, can inject money into an economy, which drives consumption and creates jobs. It can also lead to inflation as demonstrated by the trillions spent on stimulus during COVID (and after) because you have too many dollars chasing too few goods. This did well in providing maximum employment but missed the 2% target for inflation by many multiples.

Global Economic Reactions

Fortunately for the Fed, other central banks made the same mistake, which provided a buffer for the value of the US dollar. After all, while our central bank was printing money and giving cheap loans, most other developed countries were doing the same. Thus, everyone’s currency is debased at the same time. Cash was not a safe place to hide. Money flowed to the stock market, real estate, crypto, and commodities. Starting in 2022, the Fed and other national banks began a campaign to raise rates to a level that would bring them back to price stability. A rule of thumb many use is that interest rates must be higher than inflation. If it is below this level, one could simply borrow money and pay it back at a future date with less valuable currency, thereby earning a “free lunch” on their money. We see this play out with those lucky enough to get 3% mortgages. Banks now need to borrow at 5% and lend at a higher rate. Borrowers make 2% a year more than their lenders in theory. The carry trade works in much the same way.

The Carry Trade

When there is a differential between what the European Central Bank (ECB) pays in interest versus the United States, one can borrow at a cheaper rate and then lend at a higher rate. Let’s see an example using a typical bank as an example:

Bank A offers unsecured loans at 1% for qualified buyers. Bank B pays 3% on deposits. An investor can borrow from Bank A and lend to Bank B for a risk-free 2% return up to the level that Bank A will lend. Bank A would be better off investing these funds with Bank B and skipping the loan risk.

Real-World Example

The carry trade is a bit more complex. In the current real-world example, the interest rates in Japan through the BOJ were -0.1% from January 2016 until March 2024, when they were increased to 0.1%. This means that prior to March 2024, you would lend the BOJ money, and they would give you less back at the end of the loan. Who would buy these bonds with no yield? Oddly enough, the Bank of Japan is its own biggest customer, with more than 50% of the debt sold sitting on its balance sheet. This pushed liquidity into their market to drive growth and influenced the rate borrowers paid in interest. Traders took advantage.

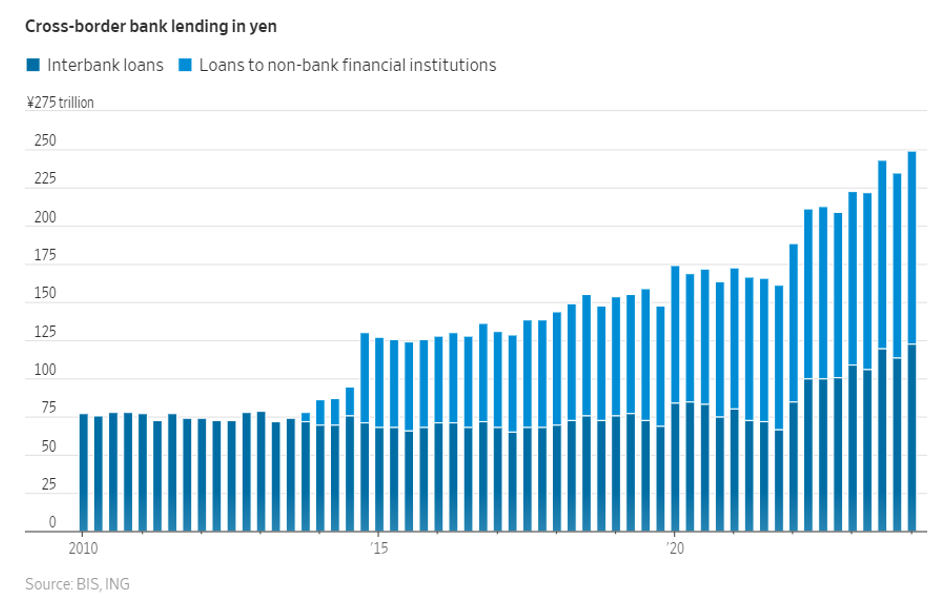

By borrowing at lower rates from Japan, like the simple example above, and then investing in higher-yielding assets, including bonds, T-bills, and equities, investors could keep the differential between the two numbers. With US Treasuries yielding 5% annually and the S&P up over 30% since January 2023, the temptation to go big and use as much leverage as possible proved irresistible. Below is the amount of lending done in Yen to non-Japanese markets. The 250 trillion Yen mark represents over $1.7 trillion in loans. Like any trade, it is not risk-free.

Currency Stability in Carry Trades

The stability of a currency is an important element of the carry trade. If I borrow one million dollars of Japanese Yen at 1% and then buy bonds from the US government in USD at 5%, I earn a 4% differential. If the value of the Yen changes relative to the value of the dollar, the story changes rapidly. This is exactly what occurred at the end of July 2024. The BOJ surprised markets with a rate increase (when others were cutting), which strengthened the value of the Yen.

Let’s look at that same example with currency changes. I borrow one million Yen at 1% and lend it at 5%. If the Yen appreciates 2% against the dollar, I still need to convert my dollars back to Yen to pay off the loan. Therefore, my 4% gain is cut in half to only 2%. I close my position and get out with a small gain. Money flowing back into the Yen pushes the value of that currency higher, forcing even more investors out of the trade. This creates a cascading effect, starting with those in the riskiest asset classes and moving down to the safest. It occurs slowly and then all at once. It also brings us back to a recurring theme.

Historical Parallels

Central bank decisions continue to cause distortions in normal pricing models. Artificial stimulus in one place flows to all asset classes. When the tide of money flows out, we see who is swimming naked. We saw the “Dot.com” bubble burst, and we saw the housing market collapse in similar situations. In a normal world, a 0.25% rate increase would not threaten the international economy or even be noticeable. That is not the case for now. Hopefully, our subscribers will not be caught off-guard when the tide goes out again.