Futures traders often do their best in discrete periods of significant market movements. So-called “Fat Tail Events” in a normal distribution happen more than statistics suggest. This observance documented in the Nassim Taleb bestseller “The Black Swan” posits that people underestimate the likelihood of crisis conditions. While nobody predicts these events well, we can identify a range of scenarios that might contribute to a disruption. Giving validity to this possibility, relatively extreme moves picked up at the end of July 2024 and continued into early September. These swings often presage a larger break. While this may be another false alarm, the conditions remain ripe for a fire. Here are a few situations that I am watching.

Market Movements and Investor Anxiety

Investors like predictability, and a United States presidential election always brings anxiety to our country and the world. Kamala Harris and Donald Trump both provide sufficient reasons for this stress. Harris replaced Joe Biden shortly before the Democratic National Convention, which officially nominates their party’s candidate. Leaving a race just 107 days before an election is unprecedented in American history.

Impact of Candidates’ Policies

Normally, a new candidate would run against a field of candidates, debate them, and advocate for policy positions to be selected. Since Harris did not run, her views appear murky, including changing stances on energy production, border enforcement, and tax plans. All share ramifications for inflation, the economy, and the country’s security.

Trump brings his own baggage as well. Polls show that the former president consistently achieved an unfavorable rating above 50% (Kamala is just slightly better), but many in the country intensely dislike him. He lists several policies that he says will bring the world back to peace and the country to prosperity. His first three years give some evidence for this as strong growth and no wars occurred. However, tariff threats, unexpected tweets, and infighting not only with the Democrat party but his own affected day-to-day market movement. The end of his administration shifted to pandemic response and budget-busting spending. Both candidates promise more of the same with different funding methods.

Economic and Taxation Debates

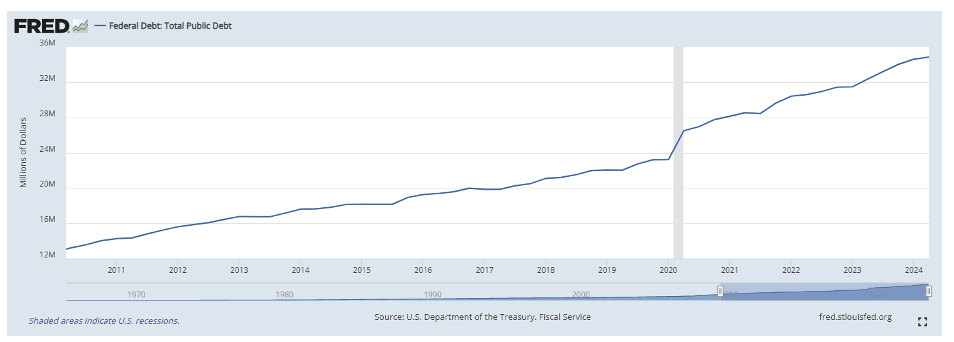

Trump vows to reduce tax rates on corporations and make his previous adjustments permanent to encourage growth. He believes that this will generate more revenue for the Federal government. Despite predictions to the contrary, it is difficult to see much difference in tax collection from year to year between administrations. Spending however continues to outpace collection with debt now 68% higher than the first quarter of 2016. Harris conversely wants to tax the rich at a higher rate including on unrealized gains. This sounds nice in theory as the extremely wealthy can hold shares forever and borrow against them to avoid paying the government. Many plan to donate shares upon their death to avoid estate taxes altogether (or maybe they are altruistic). A 25% tax on current assets could force massive liquidations. Billionaires alone own an estimated 7% of the entire stock market. With a plan targeted to those with $100 million and higher that percentage would be even greater causing even more disruption.

Federal Reserve and Debt Concerns

The election pressure is on top of the US Federal Reserve balancing full employment goals against dollar stability and the specter of inflation. An 818,000 downward revision to job creation in August, as measured by the Bureau of Labor Statistics (BLS), shows that employment strength might have been illusory. Expectations for a series of rate cuts conflict with still high but dropping inflation readings. A flood of borrowing could reignite prices negating two years of restrictive policy if they move too soon. Ballooning government debt could use the reprieve as daily interest costs now average $3 billion a day. The trillion dollars in debt servicing by itself is larger than the GDP of all but 19 countries. History shows that rate cuts often precede equity weakness. This in turn requires further rate cuts. Outside events could accelerate this process.

| Fiscal Year | Revenue |

| FY 2023 | $4.44 trillion |

| FY 2022 | $4.90 trillion |

| FY 2021 | $4.05 trillion |

| FY 2020 | $3.42 trillion |

| FY 2019 | $3.46 trillion |

| FY 2018 | $3.33 trillion |

| FY 2017 | $3.32 trillion |

| FY 2016 | $3.27 trillion |

| FY 2015 | $3.25 trillion |

| FY 2014 | $3.02 trillion |

| FY 2013 | $2.78 trillion |

| FY 2012 | $2.45 trillion |

Global Geopolitical Risks

Compiling a list of these potential worldwide events could be an article by itself. Headline-grabbing stories include the continuing war in Ukraine, conflict in the Middle East between Israel and Hamas, and Houthi rebels attacking ships in the Red Sea. Less talked about is weakness in the Chinese economy, Iranian nuclear progress, and unrest in South America with questionable election results in Venezuela and protests in Brazil. Deflation in China could be the biggest threat to the world economy as their citizens scale back spending. Military escalation in either Europe between NATO countries and Russia or the Middle East where Israel could engage in full-scale war with Lebanon or Iran seems as close as ever. Successful assassinations of the top Hamas negotiator and a senior Hezbollah commander in Beirut by the Jewish state may force a response. Thus far the impact has been minimized. Questions arise about what diplomatic trades might be responsible for the subdued retaliation. Money released to Iran in previous negotiations is undoubtedly funding some terrorist groups now. With the current US President seemingly moving on from his post already, the potential for a breakdown could be higher than usual.

Where we see smoke, it sometimes leads to fire, and a few places are smoldering now. With clarity in our elections and peaceful resolutions to the world’s conflicts, the Fed might be able to engineer a soft landing. Nobody said Jerome Powell’s job would be easy, but he is probably as surprised as anyone to know how hard it has become. Unfortunately, quite a few things need to go right for success. Trillions in spending float all boats for a while but not forever. We may soon find out exactly how long it can.

Photo by wang binghua on Unsplash