Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

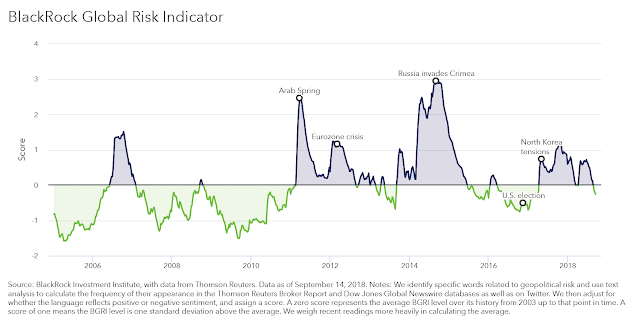

Geopolitical Risk Is Not the Driver of Any Market Decline

The BlackRock Global Risk Indicator is an interesting measure of uncertainty through looking at key work searches across a broad number of market news sources. I cannot say that this is a risk measure. Rather, the indicator is a measure of geopolitical negative news focus. It is a sentiment indicator that may lead to risk, as measured by negative market performance.

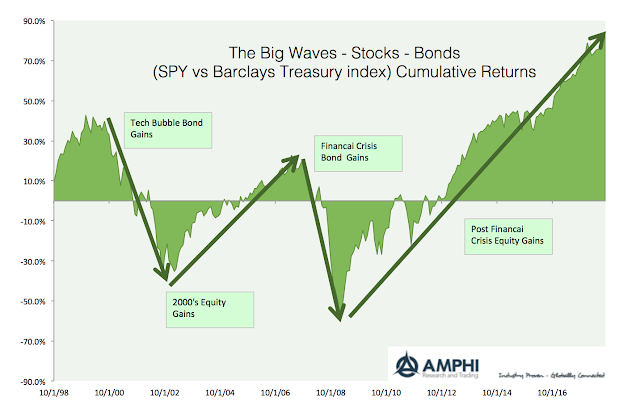

The Big Waves for Stocks, Bonds and Commodities – You Have to Exploit These Trends

Simple visuals can be very powerful at telling an effective investment story. I have compared equities, bonds, and commodity relative returns for the last twenty years to see the big wave cycles that investors needed to participate in to have a successful portfolio. The trends from these asset class cycles are long. An investor does not have to get in on the turning points, but they do need to hold the trends as long as possible. The secret to relative asset class success is commitment.

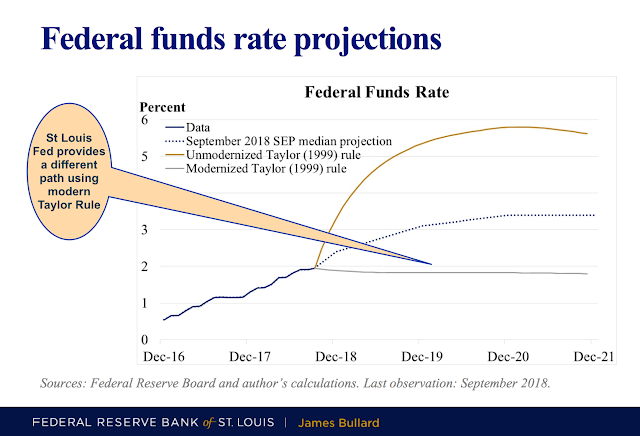

Mixed Signal from a Fed Official – A Modernized Taylor Rule Says Stop

Simple assumptions to some classic monetary models will produce very different policy views for the direction of Fed action. These significant policy divergences are the reason for the recent pick-up in bond trading. A dispersion of opinions on Fed action will lead to more volatility, trading, and potential rewards in these markets.

The Empirical Process Needs Narrative – Filling In the Space Between Data

The concept of investment narratives has been given a bad reputation especially by quants, yet these stories are often the glue that holds together data. Quants say, “Only look at the data”, yet the data may only be useful through words that extend meaning to the data.

Deglobalization and the Decline of the Liberal Order

The post-WWII period is special in political history. Instead of sovereign conflicts driven by self-interest, the world engaged in a successful experiment in multi-lateralism using world organizations to facilitate cooperation and resolve conflicts. This dominance of classic liberalism, albeit at times imperfect, was led by the United States that showed exceptionalism by furthering this global view and not normal imperialism.

Pew Charitable Trusts State Pension Review – No Good News Here

State pensions have changed their portfolio composition during the last ten years to increase their allocations to alternative investments, yet this adjustment has not helped them reach their targeted returns. This gloomy story was presented by the Pew Charitable Trusts State Public Pension Funds’ Practices and Performance Report.

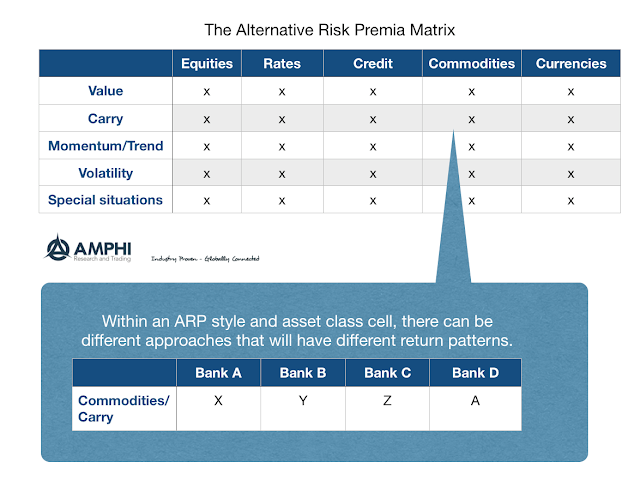

The Alternative Risk Premium Matrix – A Good Way to Jumpstart A Portfolio

An alternative risk premium (ARP) matrix is an effective way to start any portfolio construction exercise. A matrix divides risk premia through two criteria, asset class and style. We think in terms of a 5×5 style/asset class matrix. The asset classes include: equities, rates, credit, commodities and currencies. These asset classes have inherent differences that make them unique even when looking through an alternative risk premia lens. For alternative risk premia we include: value, carry, momentum/trend, volatility, and special situations. These styles are been well-defined and identify risk premia that can be exploited through forming long/short portfolios and are actively traded and structured through the bank swap market.

Corporate Debt Growth Has Exploded – The Added Macro Shock Sensitivity Creates Real Risks

There is no question that the explosion of corporate debt has caught the attention of many investors. This debt growth has been especially strong for BBB-rated companies which on the cusp between investment grade and high yield. Yet, like the boy who cries wolf or the doomsayer who is predicting the end of the world, warnings of a credit crisis do not seem to have affected investor activity. Corporate spreads are still tight and the reach for yield has continued almost unabated. Investors have not been given reasons to care about this debt issue today and have pushed any risks into the future.

Cliffwater State Pension Review – There Is Work to Be Done To Reach Expected Returns

There are still significant funding challenges for state pension funds even with the bull market over the last decade. The consulting firm, Cliffwater, analyzed state pension performance over the last decade in the recent review. State pensions have not been able to meet their actuarial return assumptions. This under performance places them further below their funding requirements. These funding shortfalls exist even though most funds beat a 70/30 stock bond benchmark. There is also strong return dispersion across states with the best states generating returns 25 percent over the median state return and the worst states over 30 percent lower than the median.

Forward Guidance – When In Doubt Expect a Cautious Fed

President Trump mused that it would be “crazy” for the Fed to raise rates in December, but his comments miss the point on how the Fed is operating. The continued themes through Fed forward guidance are caution and flexibility. Investors are looking for certainty about the policy path, but the Fed is only going to give fuzzy guidance. Policy will be adjusted slowly so as to not make a mistake. There will be no rules that will bind behavior. When in doubt, do not change from the status quo. We are still living a Yellen Fed world.

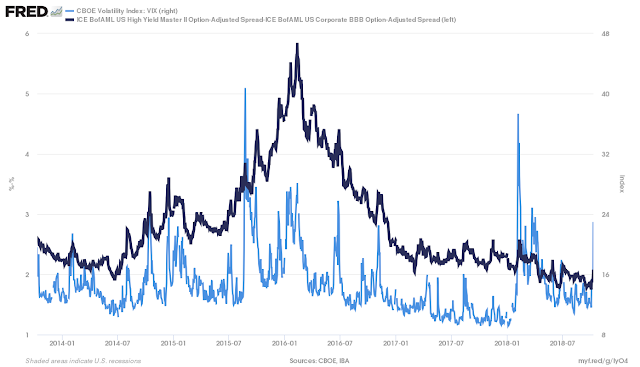

Corporate Spreads and Carry versus Volatility Shocks – Risk Potential Higher

Volatility has spiked higher with the decline in equities, but there are also volatility effects on other markets. Using a Merton debt framework, corporate bonds can be thought of as a risk free bond and a short put position on the value of the firm minus its liabilities. Hence, if market volatility increases as measured by the VIX, there should be an increase in corporate spreads. Additionally, the spreads should increase more for highly levered firms or firms that have higher risk such as those represented in the high yield market. This increase in spreads is related to the increase in the volatility of the value of the firm and not the volatility of interest rates or call features which will be incorporated in the option-adjusted spread.

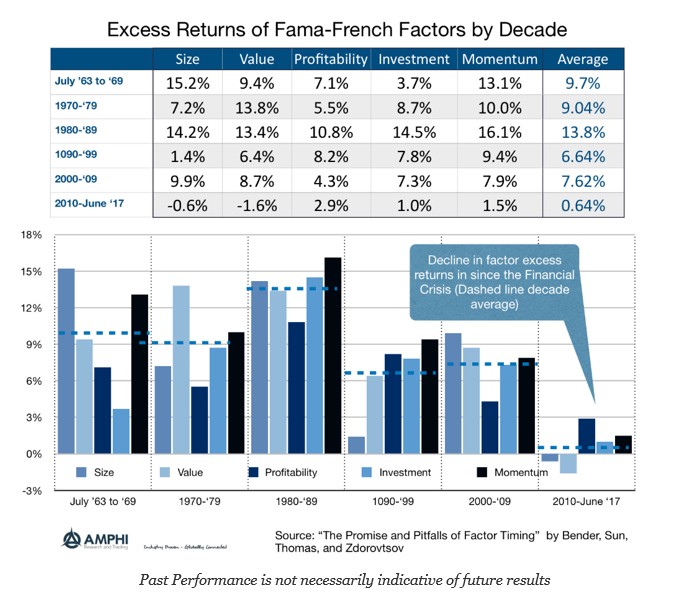

The Post Financial Crisis Decade: Unusually Low Factor Returns and an Investment Drag

The post Financial Crisis has been an unusual periods especially when measured by factor excess returns. Simply put, there were no traditional factor returns as measured by the classic Fama-French factors. A comparison across decades show that factor returns are variable but generally positive and average from 6+ percent to just under 14 percent. The average excess returns for Fama-French factors since 2010 have been less than 1 percent. If you tried to make money playing these risk factors you got paid nothing. Since factor investing is the bread and butter of equity hedge funds, this is a clear indication why hedge fund investing has under-performed or disappointed many investors over the last few years. Forget about alpha decay, there has been limited return from investing in risk factors.

10 Years after the Financial Crisis: What Have We Learned For Asset Management?

Let’s ask a simple question. After a decade, what are special lessons that money managers internalized from the Financial Crisis? If there was no financial crisis, money managers would have learned many of the concepts of behavioral finance. Investors would have learned the value of passive investing and ETFs. Asset manager would still have allocated to hedge funds, and diversification strategies would still be employed. Perhaps the Financial Crisis intensified these trends to alternative diversification strategies, but ten years after the crisis many of the concerns, fears, and behavioral changes may have been lost in a bull market