Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

There is Value in the Bundle – Blending Alternative Risk Premiums – The Two Key Advantages

There is a host of alternative risk premiums that are available in the market; some have low returns and low volatility, some good returns but low information ratios, and others have had spotty returns that have moved between good and bad periods. Yet, there is a significant value with these strategies when they are blended together through total return swaps. The value is created through two key features, the low correlation across strategies and the executing through swaps which provides variable leverage.

Risk-Taking – Is it Nature or Nurture? – You May Not be Able to Escape Your Past

Why are some investors risk takers and others are not? Is risk-taking something that can be taught or is it innate? Risk-taking – is it nature or nurture?

The Yield Curve is Flattening – What is it Telling Investors and What Should You Do about It?

There has been a litany of stories on yield curve flatness as if this is the signal that will provide the investment secret to success for 2018. Investors should watch the yield curve closely, but it is important to focus on what it is and is not signaling. There is a cost with trying to be preemptive to what is being signaled in the yield curve.

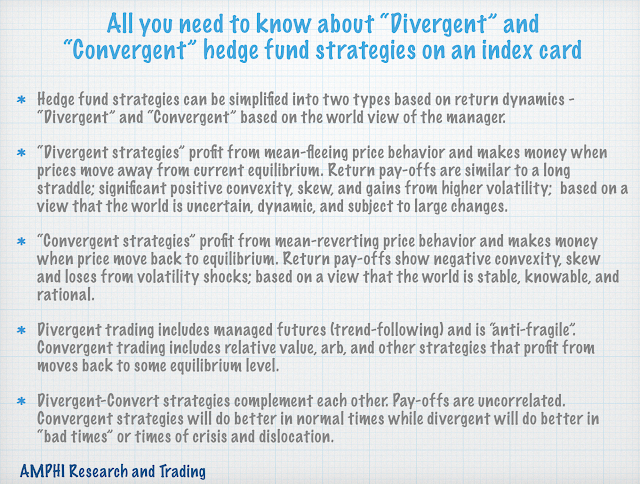

The “3 by 5 Index Card” on “Divergent” and “Convergent” Hedge Fund Strategies

This is the second in our series; all you need to know about a topic should fit on a “3 by 5” index card. We think the complexity of hedge fund investing can be simplified if the simple dichotomy of divergent and convergent trading is used as a primary method of describing potential return pay-offs.

Long/Short Commodity Funds – Adds Value to Equity and Bond Portfolios

Static investments in long-only commodity indices have had a checkered past since the financial crisis. With the end of the commodity super-cycle, there has been a long commodity unwind and passive investing in commodities has provided negative annualized returns for investors for years. There has not been any bounce to pre-crisis level like we seen in equities. The interest in commodities as an inflation hedge has waned with this poor performance.

Option Strategies Over Hedge Funds – Why Not? The Number Tell a Good Story

There has been a consistent drumbeat that investors should use hedge funds as a core means of portfolio diversification. This has been at the expense of other methods of hedging. A diversification strategy makes sense when there is no investor information advantage or no view on the direction of markets, but in reality, investors often have some view on market direction or risks at the extreme. However, given the uncertainty on market direction and the inability to form conditional hedges, the investor focus is usually on strategy diversification through hedge funds.

Speculators and Commodity Markets – The Data Does Not Support a Bias in Prices

Do speculators drive prices away from commodity fundamentals? This is one of the core commodity futures markets questions. One approach to answering this question is through looking at the price dynamics, but the advantage of futures is that we have reporting of position information by specific traders groups. Trade flows can be divided into producers, money managers (speculators), swaps dealers, and indexers. The relative balance between these groups can tell us about the market structure, a dynamic agent-based analysis.

Morningstar Star Prediction – Signal to Noise is Low

Morningstar star ratings – Do they really work or are they a dangerous tool? This is important to revisit given the increased number of hedge funds that now have ’40 Act fund structures that are ranked by Morningstar.

What Should You Get with Complexity in Beta Strategies – Smoother Return to Risk

There has been an explosion of alternative measures and methods to access market betas and risk premiums, yet it is not always easy to explain what this added complexity should give investors. We want to simplify the discussion to a simple trade-off – added beta “complexity” through either decomposing, diversifying, or managing the set of betas should reduce the range of return to risk.

The Evolution of Trend-Following Firms to Alternative Risk Premiums and Quant Shops

Trend-following CTAs and managed futures has evolved over the years. Many of the largest firms today would not be recognizable from those who were the largest during the 1980s and 90s. Some of this change in leadership is due to business decisions, but it also has to do with the evolution of the investment process. CTAs have evolved with research trends in finance, the changing focus of overall money management, technological developments, and structural changes in markets.

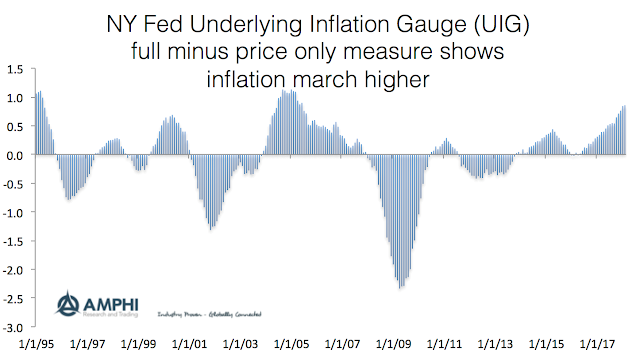

Inflation is Here – Now Focus on the Next Question, Where is it Going

Inflation is here. There is no doubt, but that number will be around 2%. The only question that is unclear is whether there will be overshoot beyond the 2% level. Clearly inflation in the Eurozone is still not near 2%, but all inflation placed bets seem to surround the target level that have set by central banks. Investors have to ask the simple question of whether the beyond 2% is realistic.

Mutual Funds Versus ETF Liquidations – Their Market Impact May Not Be The Same

There has been a significant capital switch from mutual fund investing to ETFs, from active to passive investing. This has been a significant positive for many investors because there are many “active” managers who are closet indexers and active managers who do not show skill.

Decomposition of Credit Markets – Simple but Important Conclusions

Should investors be worried about credit spread return expectations or expectations of credit default losses in the current environment? Before we answer the credit questions about the current environment, investors may need a framework for weighting the types of risks in the credit markets. This is the fundamental question concerning holding any credit exposure, and an exhaustive research using variance decomposition of a large dataset shows that you should be worried about both. See “What Drives the Cross‐Section of Credit Spreads?: A Variance Decomposition Approach”, by Yoshiio Nozawa in the October 2017 Journal of Finance.