Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Do You Really Want to Live With a 60/40 Allocation in 2018? – Follow the Numbers and You Will Likely Underperform

Numbers and statistics are a funny thing. They usually don’t lie and are not fake. You can misinterpret them, but numbers tell a story and it is the job of the investor to either accept the story or come up with an alternative.

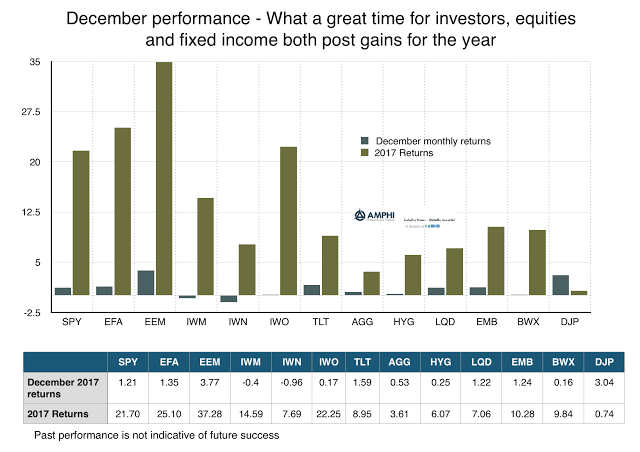

This Investing is Easy! Everything Positive for 2017, But Unfortunately We are Starting a New Year

Many pension and endowments are going to post double-digit returns for 2017. Most have exceeded their actuarial expect return assumptions of 7%. Family offices and general investors have also posted good returns for the year.

Forget About Overvalued Equities – Forecast Survey Expects 6% – Optimism Still Exists

Perhaps the market analysts making 2018 forecasts for the S&P500 did not get the memo on valuation. The equity markets are overvalued by most any measure, yet the median forecast is still expecting a 6% total return in the year-end Bloomberg survey.

Add Mental Models for the New Year – Broadening Your Thinking Process Will Improve your Productivity

Most New Year’s resolutions focus on the physical, “I will exercise more, eat less.” A better resolution should focus on mental muscles like, “I will add some mental models to my thinking.” This may help better manage time and effort and allows you to undertaken tasks more efficiently.

Slicing the Pie for Better Allocations Using Managed Futures

At the end of the year, investors will review their asset allocation decisions. Often investors will think about their pie chart exposures to different asset classes and strategies. Too often the focus is on asset class allocations and not enough on strategy differences. The problem with asset classes is that correlations may change significantly in a crisis with the usual problem being a movement to one. Diversification is not present when you need it.

Mean Reversion Is Not the Same as Contrary Thinking. A Big Confusion for Many Managers

Disagreeing with the consensus or trend is not always contrary thinking or mean-reversion thinking. It is sometimes being different for the sake of being different.

What We Look for with Trend-Following Beta – A Simple Set of Rules

Trend-following, as applied to managed futures, has been around for decades. Yet, there is no universal agreement on what is or should be a trend-following benchmark that can serve as the strategy beta or as a trend-following strategy factor. A trend-following benchmark can be used to measure the factor-beta of any manager. I can be […]

Is a Bond Bust More Likely Than an Equity Sell-Off? Look For Alternatives

The major drumbeat of asset class overvaluation has focused on equities, but perhaps a scarier place to invest is holding long duration bonds. Both asset classes may be overvalued, but a close look at the economic fundamentals may suggest that greater concern should be with bonds.

Looking at Commodities from Both a Macro and Micro Perspective – Different Stories

The narrative for holding an allocation to commodities by looking through a macro factor lens may generate different conclusions than taking a micro market-specific perspective. While the macro perspective is good for setting longer-term strategic allocations, the micro perspective helps with tactical decisions on where or how to put money to work in commodities.

Managed Futures is not Trend-Following but it is Close – Broadening the Product Spectrum has Added Strategy Complexity

I would not be the first person to engage in the lazy thinking that managed futures are synonymous with trend-following. For many years, there was little wrong with using both terms to mean the same thing. The majority of managed futures are still trend-following.

Back to Basics for Trend-Following – It is All About What It Does to the Portfolio

It does matter what an investment strategy will do on a stand-alone basis; however, it really matters what an investment will do when added to an already diversified portfolio. For any strategy allocation decision, it is all about the marginal contribution to portfolio return and risk. Most investors know this intuitively, but they often do not focus on the marginal portfolio contribution in practice.

Buy the Losers and Sell the Winners? Reverse your Thinking and Be Careful About Avoiding or Exiting Losers

The general view is that an investor should pick good managers who have had a track record of success, but a more nuance look at data suggests that buying when good managers underperform can be valuable. Whether past performance provides some indication on future success has been one of the key issues facing any investor. We now have an interesting perspective from Brad Cornell, Jason Hsu, and David Nanigian in their Journal of Portfolio Management paper, “Does Past Performance Matter in Investment Management Success”.

Buy in a Drawdown? Focus on Future and not the Past Performance

Managed futures, as a hedge fund strategy, have moved off of its max drawdown since June, its worst drawdown in the last five years, as measured by the SocGen CTA index. For some investors this type of drawdown means an exit from the strategy; however, some of the broader data on manager selection suggest a different approach. The idea of being careful about making investment decision based on a drawdown is consistent with the mean reversion performance analysis of winners and losers.