Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Not Buying the Fed Package – The Fed, Yield Curve, and Bonds

The take-away quote from Yellen this week, “The relationship between the business cycle and the yield curve may have changed.” There was little supporting evidence for her view. It is the hope of the Fed that further rate increases which may further flatten the yield curve will not reverse the current course of the economy.

Factor Risk Premium Differ Across Countries – Make Sure You are Factor Diversified Globally

Equity factor risk premium ranks change through time. The best performing factor premium today may not be the best premium tomorrow even if there are long-term gains across major factors. Most investors would agree with this statement; however, the dispersion of factor performance is more complex.

Commodities Versus Financial Assets – There is Value Here

Equities are overvalued! Bonds are overvalued! In the minds of many investors everything is overvalued given central bank distortions, yet there may be an exception. Look at commodities. The difference between financial and real asset could not be larger. Financial assets have steadily moved higher while commodities have fallen or at best moved sideways relative to risky stocks in the last 5+ years. This relationship has applied to all equity indices around the world to varying degrees.

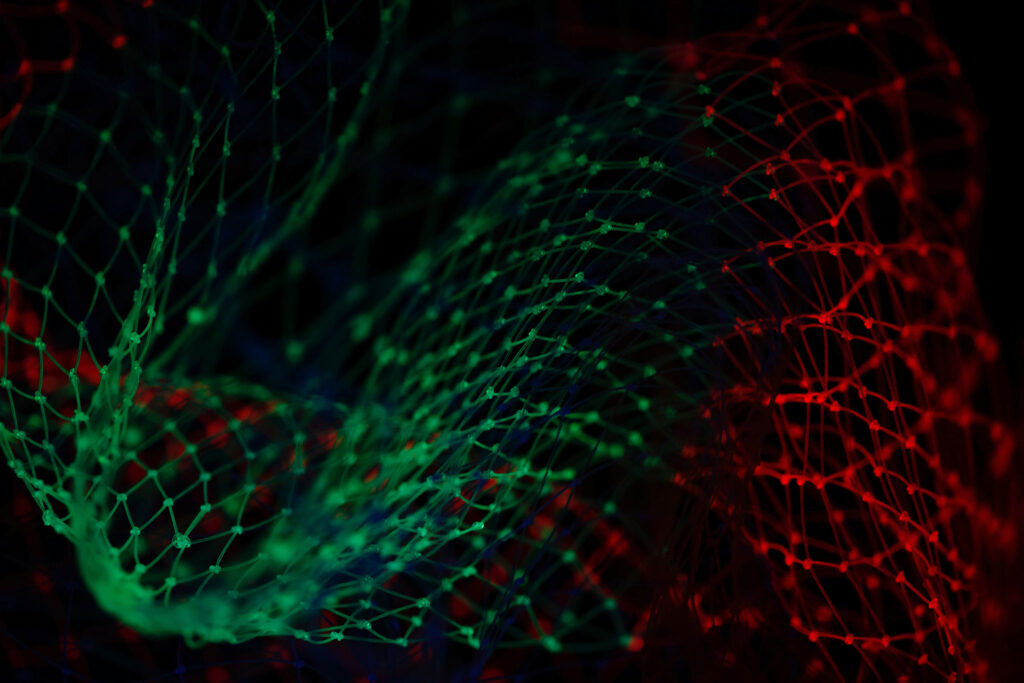

How Much Machine Learning is Your Quant Using? Not Clear, if you have not Defined Terms

The current buzzword used with quant investing is “machine learning.” Many quants may like to appear more intelligent by peppering their strategy discussions with comments like, “We use machine learning to create new and enhance our existing models.” Yet many investors don’t fully appreciate that machine learning is a term that refers to a broad […]

Producing Alpha Is Not Easy – The Solution to Making Effective Decisions in an Uncertain World has not Been Found

“What I think HBS does and does very well is train people to, in situations of ambiguity, to take imperfect information, uncertain outcomes, and tight deadlines and figure out what to do in the most effective, efficient, and powerful way.” – Casey Gerald from The Golden Passport: Harvard Business School, the Limits of Capitalism, and the Moral Failure of the MBA Elite by Duff McDonald

Corporate bonds and Managed Futures – A Winning Diversification Combination

Managed futures may not generate crisis alpha if there is no crisis, a sustained decline in equities. In addition, managed futures may not provide as strong a cushion diversification effect during normal times since the correlation between equities and managed futures is slightly positive, and there is no managed futures yield. So how can an […]

Financial Conditions – No Signal of Tightening. Trend Says Stay the Course with Risky Assets

The Fed has become more focused on financial market conditions since the Financial Crisis. There is less interest in the classic goal of managing full employment since by many measures we may beyond the natural rate of full employment, and there is admitted confusion on how to control inflation.

Equity Asset Class Value Rotation – Look Outside the US for Upside and Protection

The talk has focused on the overvaluation and “bubble” with US stocks, but there are other relative opportunities in risky equity assets. A comparison of CAPE across the world shows that the UK, euro area, and Japan valuations are closely tied together, significantly below highs from 2008, and all relatively cheap versus US.

“Risk of a Rapid Repricing in Global Markets” – (ECB) With this Narrative, Investors Need Strategies that Generate Portfolio Gamma

“Risk of a rapid repricing in global markets”; this ECB quote was a key talking point in the press release from the ECB Financial Stability Report issued last week. Note that “rapid repricing” is a polite way of saying asset price declines.

Hedge Fund Performance Mixed, but some Bright Spots with Fundamental Growth and Systematic Macro

Hedge funds returns were mixed for November, but the fundamental growth and systematic macro strategies generated strong returns of over 1 percent. The fundamental growth strategy is the HFR leader for the year with a return profile at over 17%. The macro systematic strategy again generated a strong positive return. The HFR macro systematic index return was significantly higher than other systematic indices for November which suggest a high dispersion across managers in this category. The macro/ CTA which includes discretionary managers was actually down for the month. The absolute return, special situations, and emerging markets strategies were the biggest down strategies for the month, but all showed declines of less than one percent.

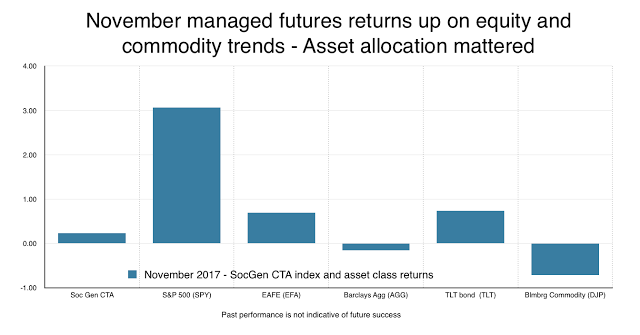

Managed Futures Slightly Positive in a Choppy Environment – Performance Driven by Asset Class Weights

Managed futures managers were, on average, positive for the month with returns beating commodities and the fixed income Barclay Aggregate index. Managed futures did not beat the strong equity performance but that should not be a surprise given that equity exposure will only be a small portion of the total risk exposure for managers. Most managers will cap the equity exposure within the program, so even if equities are trending higher, performance will lag a long-only index.

Sector Return Performance for Equities Strong across the Board – Hold Overweight in Equities

Equity style sectors were strong across the board with only emerging markets posting a negative November return; however, emerging markets have been the best performing sector year to date. The value index showed a strong gain although it still lags the growth index year-to-date. Trend indicators are all positive except for emerging markets and the short-term trend in the small cap index. Price indicators suggest that there is no reason to cut equity exposures.

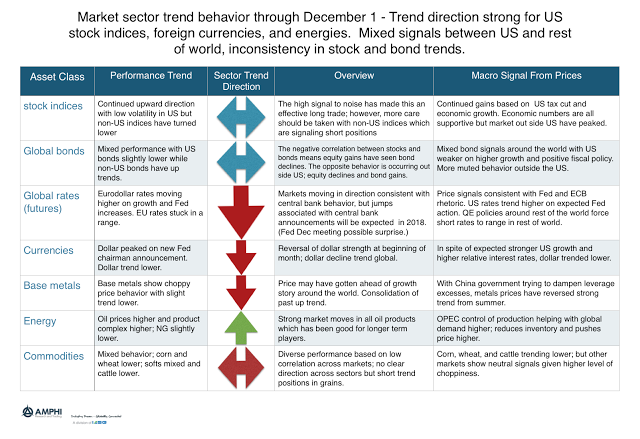

Trends Signals Still Mixed in Many Asset Classes – Long US Equity Indices Still Strongest Signal

Trend behavior last month was mixed for many CTA managers. The allocation weights had a significant impact on November performance. We believe there may again be significant dispersion in performance because trend dispersion is high. For example, US stock indices show strong up trend signals while non-US stock indices are showing clear short signals. The opposite is the case for bonds where US bond signals are for short positions while non-US bonds signals point to long positions.