Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

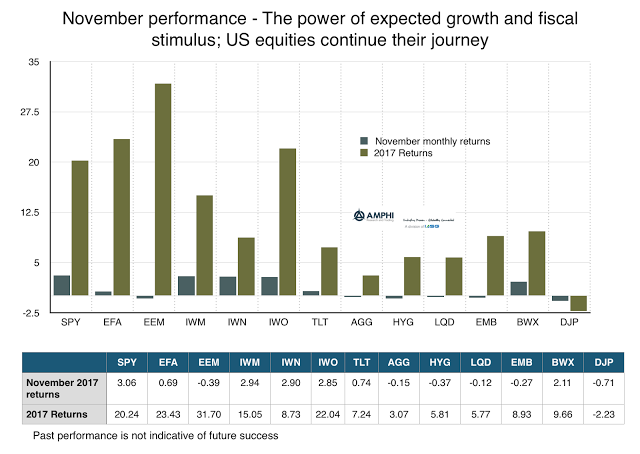

Stocks Continue Their Strong Performance – Hard to Fight Equity Trends; The Opportunity Cost of not Following Trends is High

A combination of good economic growth news and a fiscal policy tailwind again drove US equity markets. The discounting of a US fiscal accelerant shows up in the positive US-global return differential for the November.

Active Cash Management for Managed Futures – A Simple Addition to a Fund’s Return Profile

Managed futures have unique features given that margin is only a small potion of the total investment. This allows for active collateral management in ways that are more impactful from other hedge funds. For most hedge funds that use a prime broker and make long/short equity investments, the focus of collateral management is with reducing the cost of borrowing. For futures, the leverage is not through borrowing but through the ability to increase notional funding based on the level of margin to equity. A good portion of funds given to any CTA is not managed efficiently but rather just held in cash.

Expected Yields and Returns for Bonds are Still Low – Go Get More Alternatives

The asset allocation decision concerning the addition of alternative investments, especially for diversification strategies, is actually quite straightforward. One, find strategies that have low and stable correlations with stocks and bonds. Two, find strategies that have a minimum acceptable return that will beat a traditional diversifier.

Normalcy for Stock Bond Correlation Says You Need Other Forms of Diversification

The bond diversification story is based on the strong negative correlation between stocks and bonds that has existed for over a decade, yet it is not a given that stocks and bond returns will move in opposite directions. A quick look at a very long history from a Wellington Management chart tells us that the negative correlation is the exception not the rule.

The Tale of the Tail – Focus on the Where, Why, and What is Wrong; Use Strategy Diversification as a Solution

Along with any discussion of asset bubbles, there is a complementary discussion concerning tail risk. If there is a bubble, there is likely to be a tail in the future. Bubbles and tails are tied together, yet tail events can occur even if there is no bubble.

Strategic Asset Allocation – Adding Value in a Low Returns Worlds

Strategic asset allocation as the name implies requires long-term return assumptions. There are often wide variations in the future forecasts. Many forecasts we have surveyed show positive expected returns, but the numbers are significantly lower than what investors have seen historically since the Financial Crisis. In general, Research Affiliates provides a good tool for analyzing the past and expected returns that we find helpful.

Holding Period Diversification – Investing with Hedge Fund Managers that have Different Trading Time-Frames Adds Value

Diversification can come in many forms. One that is not often discussed is holding period diversification or the time- frame used for making a trading decision. Some strategies are successful based on the expected holding period of the investment and not just the trading process employed. For example, there could be two price-based systematic managers who use similar models, yet they will get very different returns based the calibration of the holding period, short-term versus long-term. In the case of trend-followers, there are some trends that last only a short-time and can only be captured through trading a short time-frame versus other trends that can last for weeks, months, or quarters. These are captured differently based on the look-back or speed of the models.

Volatility Shock – A Concern That Is Real, but Should Be Tempered By VIX Dynamics

We believe that a volatility shock will generate a feedback loop that will force equity prices lower. High leverage tied to volatility targeted risk management will mean that any increase in volatility will lead to portfolio rebalancing and position cutting. This negatively correlated leverage effect between equity returns and change in the VIX is real, as measured by researchers at the New York Fed, see “The Low Volatility Puzzle: Are Investors Complacent?”.

Commodities – A Great Place to Play in Alternative Risk Premiums

Investors have shifted their focus to alternative risk premiums as a method for defining and allocating risk within a portfolio. The alternative risk premium framework can be employed in all asset classes but is especially useful in commodities given the large dispersion in markets and structural features that lend themselves to time varying risk premiums.

Changing the Risk Profile from Credit to Macro – Take Away Liquidity Risk and Switch Alternative Risk Premiums

Investors should have a growing concern with the reach for yield in the current market. The reach for yield has pushed investors into illiquid issues where the risk profile has changed from credit/carry to credit/carry/illiqudity. Investors will generally receive a higher premium if an asset is illiquid. Unfortunately, illiquidity premiums are hard to measure; consequently, the traditional credit betas will not be properly measured and there could be the mistaken view that there is greater alpha from managers who hold these types of assets.

Ivy League Performance – Competing With Top Tier Endowments Can Be Done

The latest performance numbers for Ivy League endowments have been nicely displayed in the chart below along with the 60/40 stock/bond portfolio. Since the development of the “endowment” model associated with Yale and the attention on Harvard, the largest endowment, there has been an unusual focus on these funds. There is a fair amount of dispersion between the best and worst managers in the group.

Being Short Volatility is Risky in a Crisis – Do You Know Your Volatility Premium Exposure?

Implied volatility is usually higher than realized volatility so there is a positive volatility risk premium, except when there is a crisis or volatility spike at which time the volatility premium turns negative. A recent CBOE seminar presented a chart on the volatility premium to illustrate the risk.

The Growing Danger from a Market that is Complacent of Risk – A Variation on Minksy

Investors should be concerned about the unintended behavior from low volatility. Low volatility will lead to higher volatility in the future when investors become complacent about risk, the “Volatility Paradox”. This paradox has been discussed by Richard Bookstaber as early as 2011 and recently referred to in a post on his blog, Our low risk (low volatility) world.