Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

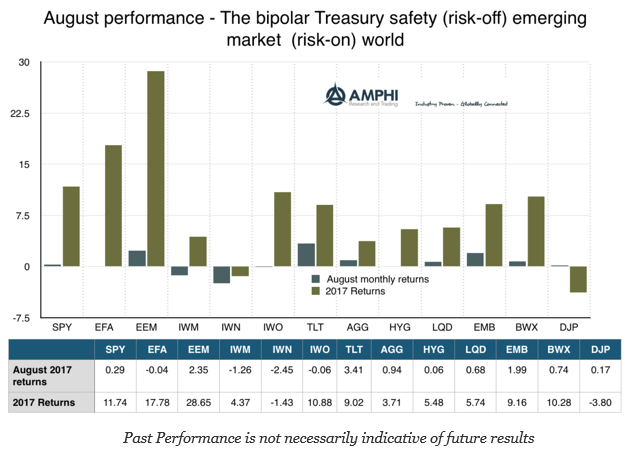

August Performance – Living in a Bipolar World of Safety and EM Risk-Taking

Global returns in August were unusual because of the bipolar behavior across market sectors. The strong performance on the long-end of the Treasury curve coupled with the negative returns for small cap and value suggests there was a flight to safety by investors, yet one the best performing sectors was the riskier emerging markets sector.

Downside Analysis to the Next Level – Look at Partial Moments for an Edge

A close look at the VIX index shows a very skewed distribution as low levels push against a barrier. There is more risk that the VIX will rise versus fall. The same can be said for many other asset prices. Normality is out; non-normality with respect to distributions is in. The value of looking beyond standard deviation is all the more important in the current environment.

Big Events Often Capture Little Attention – Noble Group and Credit Default Swap Market Failure

There are events that do not capture headlines but can turn into a major market catalyst. Call it the twig snapping in the savannah. One event and the herd starts to move which may begin the stampede. Recent events in the credit default swap market could be one of these catalyst events. The herd may not react right away and this could turn out to be nothing, but we believe this is the type of catalyst that can change market perceptions.

Clear Thinking Requires an Open Mind – Why Models may be better than Discretion

The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he already knows, without a shadow of a doubt, what is laid before him. – Leo Tolstoy

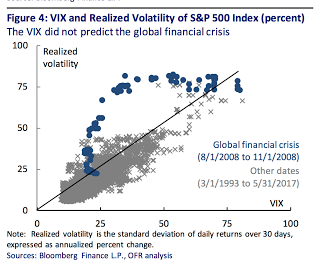

We Will Get Volatility Wrong at Transition Periods – Need to Prepare Before the Event

A provocative chart from the research piece The Volatility Paradox: Tranquil Markets May Harbor Hidden Risks by the Office of Financial Research Markets Monitor shows the poor forecasting of volatility when there is a regime change. Of course, tranquil markets harbor hidden risks. Low volatility is pricing in a lack of imagination of what the future may hold. The markets usually say that tomorrow’s change will be represented by the deviations of yesterday. We have learned from reading Minsky that low volatility will lead to risk-seeking behavior as investors reach for yield, employ leverage, and become complacent. Hence, a shift in regime will lead to more dramatic change in volatility.

Carry and Trend Complements – Blend Premiums

Momentum works, whether structured as a times series or a cross-sectional strategy, across many asset classes. Carry strategies or risk premiums also work across a wide set of asset classes. More importantly, we know when these strategies do not work, or we at least know what are times to avoid. Also, when trend-following (time series momentum) does best, carry will likely under-perform and when carry is doing well, trend strategies are likely to under-perform. These are statistical relationships, but there are good narratives for why these two strategies are complements.

Risk Premium and Betas – What do you get from Quant Managers

Interest concerning alternative risk premiums has surged over the last few years. With this increased interest there has been questions with how to best access these premiums under real market conditions and not just measure them through existing asset classes. Investors want to know how to operationalize the theory and research.

More on Algorithm Aversion – It Can Be Eliminated if Given Some Choice

In spite of the strong growth of systematic trading, the problem of “algorithm aversion” is real and must be addressed. In many cases and in many disciplines, models do better than humans, but humans feel anxious with models and do not want to place decision-making in the hands of a machine. Even if a model does better at forecasting, individuals may still prefer the discretionary or non-alto approach if there is the perception that the model is imperfect. It seems as though individuals will like to have the optionality to choose an approach (model or discretion) as opposed to being locked into one choice. See our posts: “Algorithm aversion” and managed futures and Algorithm aversion or just a desire for low cost optionality

History, Linear Thinking, and Addressing Market Noise

To be a good investor, there needs to be a strong sense of history. To understand financial panic and crashes, the past crises have to be studied. To understand why opportunities sometimes persist or disappear, there needs to be an appreciation of past behavior and market structure. Nevertheless, history is not linear. The same investment mistakes are made as past lesson are often never learned. There is not really an arc of progress that can be bent or even followed. Progress in finance and in particular valuation can lurch forward or it can fall back based on the latest behavior of the crowd.

Kuhn and Systematic Research – Solving One Crisis at a Time

Thomas Kuhn, the science historian, developed big ideas like the paradigm shift in science, but his ideas can also work on the “smaller” ideas of finance research. The Kuhn cycle, which has been applied to the evolution of science, is a durable model for how real world research is conducted. It is an effective way to look at one critical part of the systematic research process. Quantitative research for many firms is broken into two parts:

1. A search for new models and strategies that are either uncorrelated with existing models or a new variation on an existing strategy theme, or

2. Maintenance of existing models through improvement and enhancements of existing parameters and frameworks.

Global Macro – Managed Futures as an Alternative to Corporate Bonds

Corporate bond risk is rising. Of course, with improvement in the overall economy and continued bond flows many will not believe it, but the statistical data suggest that spread moves are no longer symmetrical. There is more potential for spread widening versus continued tightening.

What do CIO’s Care About? Only Four Things

The comment from Kip McDaniel provides a roadmap for what any hedge fund needs to address when marketing to a pension or any client. It is not about you, the manager, but the investor.

1. How does this investment fit within the asset allocation framework of the pension? Why does it matter?

2. How should this investment be delivered to the client? How does it fit within the overall portfolio construction and use capital efficiently?

3. What is your edge versus other managers and how can you generate confidence that this edge can be achieved?

4. What will be done by your fund to protect the money allocated to you? How will your investment help protect the overall portfolio?

The questions are relatively simple, but the answers require a lot of thought if the manager wants to truly be a top service provider.

Navigating Risk: Lessons from the US Navy for Money Managers

The US Navy has an structured approach to risk management which is slightly different than the Marine Corps and US Army. See our posts on US Marine Corps and US Army risk management. The US Navy actually has a trifold brochure for Time Critical Risk Management. Would you ever expect to see this from a money manager? Certainly, the ABCD process is a loop for determining any trade or portfolio action.