Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

On the “Fog of War” – No One gets this Quote Right, but the Concept Stands

Many have used the metaphor “fog of war” to describe the uncertainty faced in risky situations. It is attributed to Carl von Clausewitz from his work On War. It has had a profound effect on military thinking. Unfortunately, many have used the phrase without reading the book. The phrase “nebel des krieges” was never written by Clausewitz. You cannot blame many for this mistake given it is a dense work written in 19th century German and translated into English in the 1870’s.

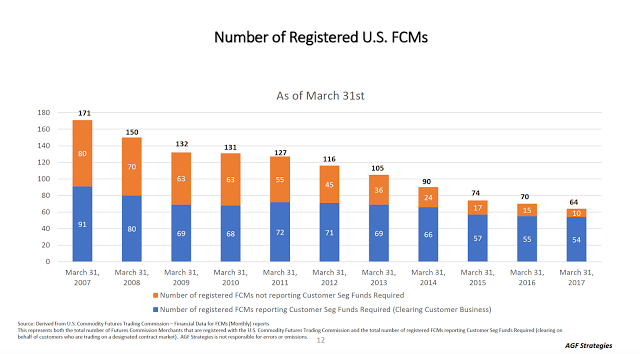

FCM Concentration – Is This Good for Futures? We Don’t Know

Market structure matters regardless of the industry. The interaction of economic agents will impact market behavior and drive pricing. Competition reduces markets frictions and transaction costs. If there is less competition, the cost of execution will be higher, and there will be less liquidity. This applies even to highly regulated markets like futures trading. A simple graph shows the decline in the number of FCM’s operating in the futures markets. The number has been cut in half since 2011.

US Army Risk Management – A Process for Dealing with Uncertainty

We have already focused on the US Marine Corps’ approach to risk management. Still, the Marine Corps is not alone in the military in formalizing approaches to decision-making under uncertainty. The US Army addresses the issue with a variation on the problem in its risk management manual. Again, the focus is on process and discipline, […]

Risk Parity and Volatility Targeting as a Danger – Let’s Get Real with Some Numbers

There is growing talk that volatility targeting and risk parity are the dangerous new “portfolio insurance” strategy of the decade. In the post-’87 crash period, the view was that portfolio insurance sowed the seeds of market destruction by creating a market decline feedback loop. As an option replication strategy, portfolio insurance automatically increases risk exposure […]

Risk Management the US Marine Corp Way – It Is a Process

If you have to ask most people what is one of the riskiest professions, it is likely being a soldier. The downside is huge, death. The uncertainty of any battle situation is extremely high. No amount of planning can truly address the uncertainty and dynamic situations associated with battlefield situations. This uncertainty and risk is why training and risk management are so critical for armed forces.

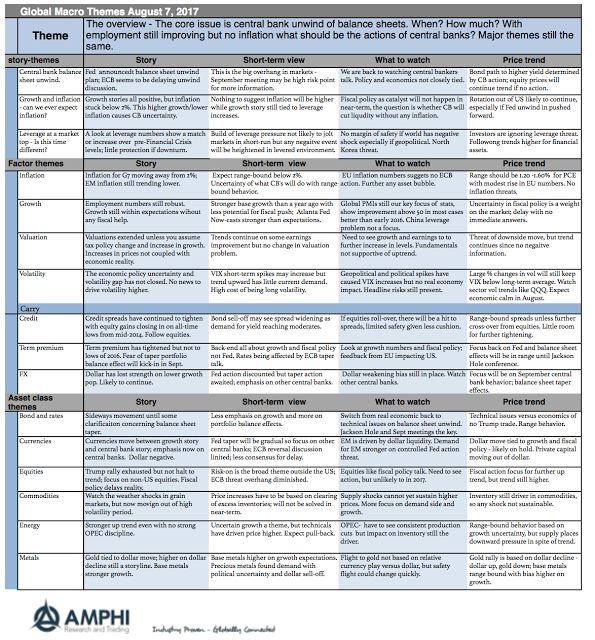

Global Macro on One Page – The Complexity of Central Banking

How often are we going to hear about the overvaluation in equity markets? It already seems too much, yet talk is cheap because markets continue to trend higher. The focus should be on what events will cause this trend to reverse; nevertheless, a trend in place will stay in place until there is a reason to change. Unfortunately, a change in a trend usually comes from a surprise.

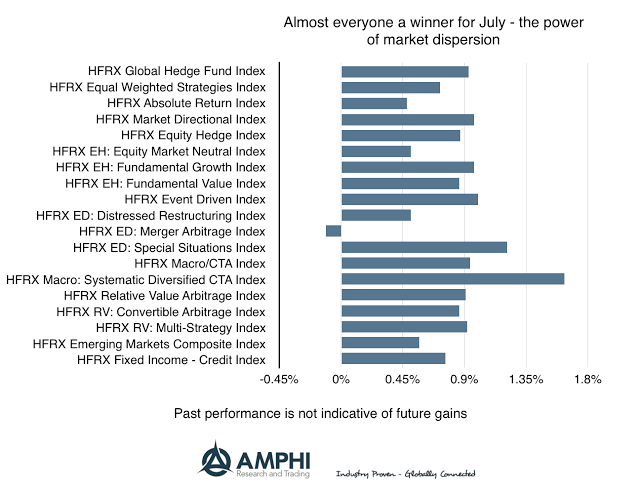

With Asset Return Dispersion Increasing – Hedge Funds Generate Gains

Almost all HFR hedge fund strategy indices were positive for the month of July. In many cases, the strategies beat small cap and value indices for the month. Our take on this good performance is that the increased dispersion in returns, lower average correlation across equity pairs, is a key reason for the gains. Greater dispersion means there are greater opportunities for stock pickers to differentiate themselves.

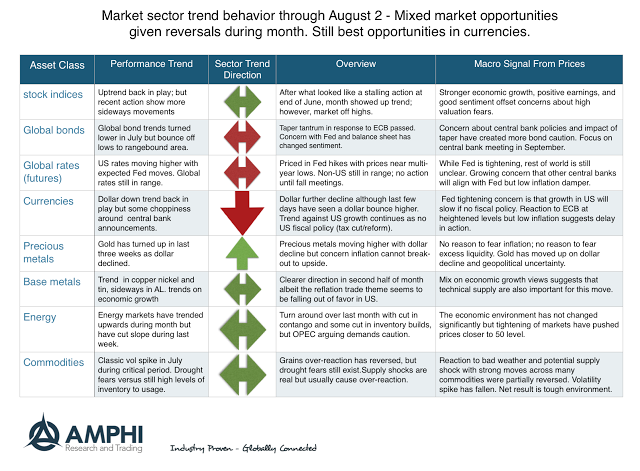

July was a Currency Trend Month – Likely to Continue

For trend-followers in July, currencies were the big winners. Strong trends with relatively low volatility made for many winning trades. These trends as well as moves in precious metals are likely to continue in August. Currently, this is the place for greatest upside opportunities. The currency moves did see some short-term reversals around central bank and key economic announcements which may have hurt traders with tight stops, but the general direction in 2017 continues.

Stock Market Confidence Off the Charts – But Also Lurking Fear

The Yale International Center for Finance conducts monthly surveys of individual and institutional investor’s confidence in the stock market. While there are other surveys available, the Yale Center provides a long term view of what investors may think about the markets.

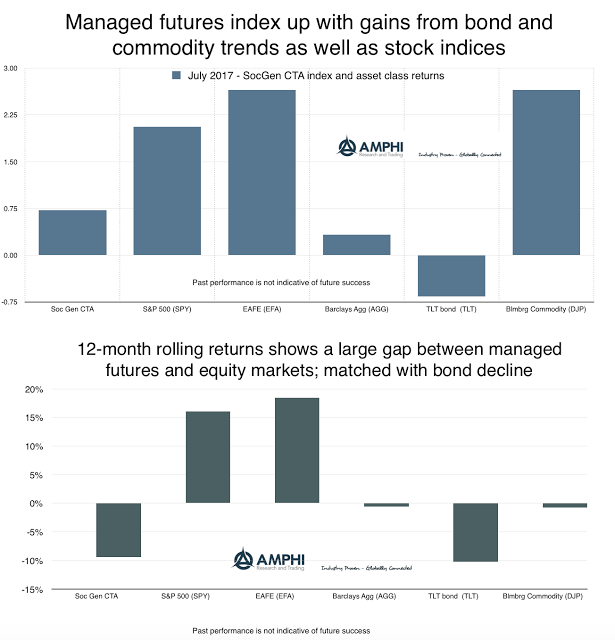

CTA’s Find Trends to Reverse Some of Last Month’s Poor Performance

The month began with some very promising trending opportunities, but with some choppy moves in both bonds and commodities, returns were generated by those who were nimble at position-sizing and getting out of losing trends before profits were completely given back to the market. This was a month where trend timing length mattered. Long-term trends ride through short-term choppiness. Short-term trend following is often able to profit and exit on reversals. A difficult problem is matching model to trend length and is often the reason for a diversity of timing models.

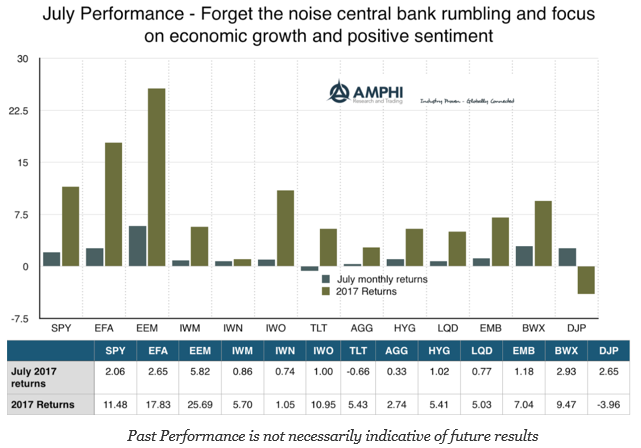

Sector Dispersion Continued for July – Value from Picking Winners

The equity markets again continued to march higher with strong gains in international and emerging markets. However, it should be noted that non-dollar equities were given a nice tailwind from the decline in the dollar, (take off 2-3+ percent). After the currency adjustments, there is less reason for large celebrations. What should be a concern is that the biggest moves were in large cap stocks with more modest returns for small cap and value indices. This should be expected on a dollar decline given the international nature of large-cap earnings, but lower breath is not a positive sign for follow-through with the trend.

Rhetoric versus Reality for July – Watch the Cash Flow and Growth

The drumbeat of over-valuation continued in July, but investors do not seem to be listening to any negative stories as stocks around the world continued to move higher. The view that economic growth will pick-up in the second half of the year coupled with rosier earning forecasts have pushed equities higher. Any worry about valuation will be for tomorrow. Today, the focus is on buying risky assets around the world.

How Many Asset Classes are Necessary for Asset Allocation? No One May Know

Here is a simple question that should have an easy answer. Name a universal set of asset classes that can be employed to categorize the investments for a large university endowment. The answer to this question may astound you. There is no agreement on the number of asset classes an endowment should have in order to make asset allocation decisions. That’s right, the largest university endowments cannot agree on this basic number for how to categorize investments. See the paper, “The evolution of asset classes: Lessons from university endowments”, Journal of Investment Consulting Vol 17, no 2, 2016.