Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Non-normal distributions – Assume tail risks are higher than normal measurements

If you assume a normal asset return distribution world and it does not exist, you will be surprised with return performance especially in the tails and unlikely for the better. Of course, when in doubt, the rule of thumb for any sample of return data is to assume normality. Using the central limit theorem is a good starting proposition for any discussion, but it is not where the return discussion should end. The distribution assumptions are a place for danger with decision-making.

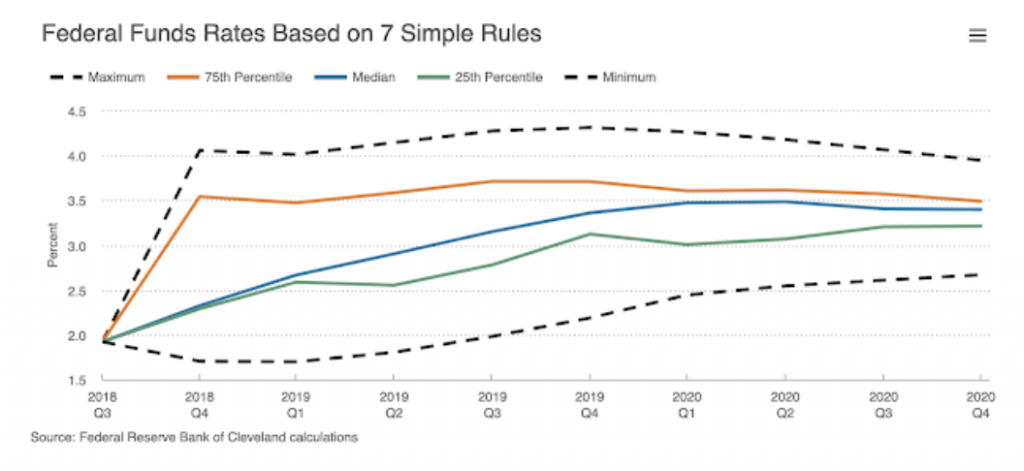

Bracketing Fed Funds rates through a known set of model – Getting good probabilistic estimates

An ensemble approach to modeling can be an effective way to get a good idea of the consensus and differences in forecasts on futures moves in the Fed funds. This is an effective alternative to looking at Fed funds futures and options as a market estimate.

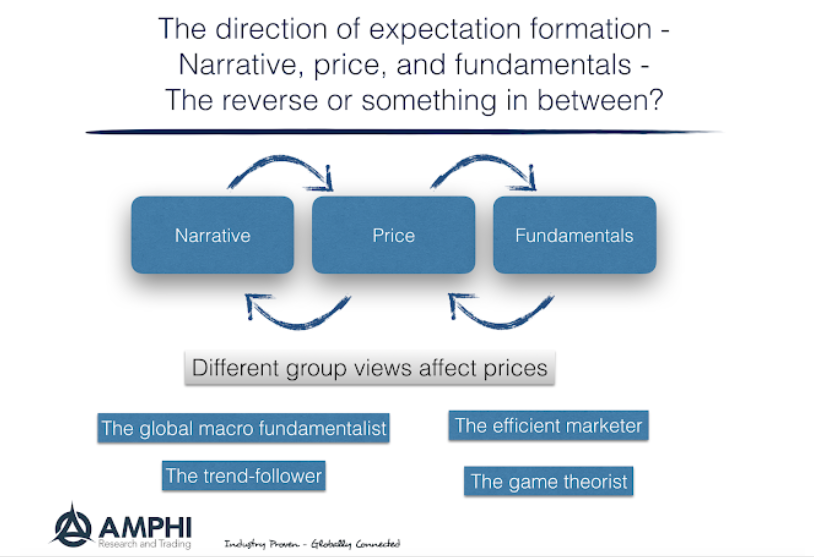

Trend-following is not the same as following the herd of opinions

Investors may be viewed as trend-follower because they chase performance, only picks recent winners, and sort on performance. However, trend-following professionals often exploit this undisciplined, casual, and unsystematic approach to trends through the investment scaling of chasers. Investor behavior driven by tracking the opinion of peers is a form of trend following and may create price trends; however, it is not the same as a disciplined approach to finding trade opportunities through rules-based behavior.

Mastering Market Philosophy: How Your Investment Strategy Shapes Your Profits

Any investor needs to know two things: what is the philosophy that drives his decisions; what is the philosophy that is driving the market as a whole. Are you price, fundamental, efficiency or narrative driven? Is the market currently price, fundamental, or narrative driven? Know your expectation mechanics.

WYSIWYG, Hedge Funds, and Alternative Risk Premia – The Business of Product Marketing

WYSIWYG – “What You See Is What You Get”. This is a phase that has been applied in computing to describe the standard that what is on a computer screen should translate to what is on a printed page.

That’s crisis not correction alpha, you fool! Trend-following value is in simplicity

I discovered from reading an informative piece on managed futures and CTA’s from HedgeNordic magazine that trend-followers will produce “crisis alpha” but not “correction alpha”. A crisis is defined as a significant and extended downturn while a correction is short-term drawdown. Unfortunately, one man’s correction is another man’s crisis. All crises start and end as corrections.

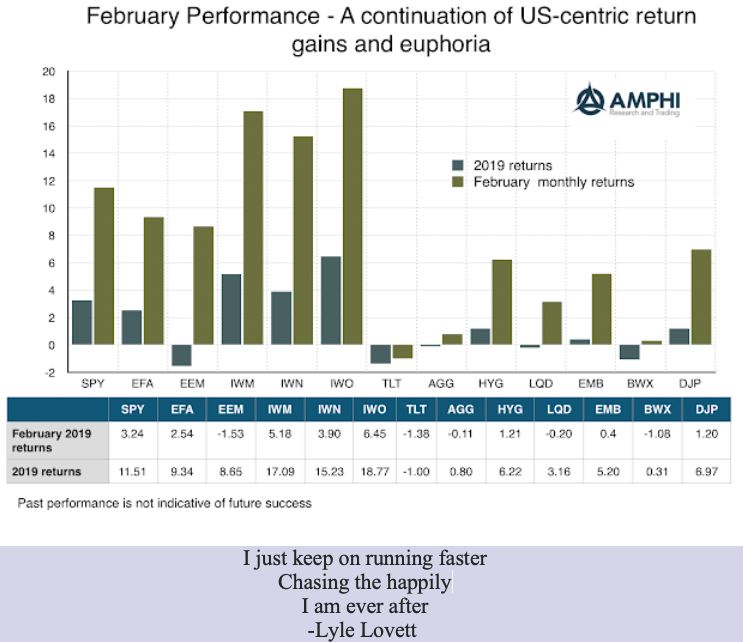

Risk-on with trends – Hard to take the opposite side regardless of fundamentals

The trend is with risky US assets which is not what we saw in the fourth quarter of last year. The reasoning for risk-on is sound; equity volatility has been reversed and financial stress has fallen. These effects have dominated the US market and have had a stronger impact on riskier assets.

The limits of investment stories – Better to have a sample of data

I have an anecdote, but not an antidote, for whatever ails you; that is the problem. Stories or tales of past economic events do not solve investment problems. Investment tales may persuade as a device for action. They may provide useful background information, but they do not provide the basis for an effective solution.

Are you prepared for a tail event? – Investing for extremes

Everyone is expecting a big negative credit event. Leverage is high. Overall debt is high. Growth is still low. Loose monetary policy continues at extremes through quantitative easing that has supported the extension of the global credit cycle. Nevertheless, the knowledge of a large downside tail event does not mean that investors are prepared with an action plan for when the downturn arrives. Investors can still be unprepared for what they will do with their portfolio when the time comes.

Follow police procedure when investment modeling – Use independent models as witnesses

“To derive the most useful information from multiple sources of information, you should always try to make these sources independent of each other. This rule is part of good police procedures. When there are multiple witnesses to an event, they are not allowed to discuss it before giving testimony. The goal is not only to present collusion by hostile witnesses, it is also to prevent unbiased witnesses from influencing each other.” – Daniel Kahneman – from Farsighted Steve Johnson

Follow Howard Marks – Know where you are in the business cycle

Farago provides a useful framework for describing the great short book Mastering the Markets by Howard Marks. The Marks approach is simple but often not given enough attention. Know where you are in the business and credit cycle and you will make better decisions and miss blow-ups.

Gell-Mann Amnesia – Be an investment skeptic and do your own research

The Gell-Mann amnesia effect may seem to be an interesting behavioral novelty for cocktail conversation, yet it provides an important lesson for doing research in any financial markets.

It is a good story, but you will not find it in any behavioral finance discussion. There is no actual research on this effect. Crichton wrote about it years ago in a posting “Why Speculate?”. He actually stated in the article, “I refer to it by this name because I once discussed it with Murray Gell-Mann, and by dropping a famous name I imply greater importance to myself, and to the effect, than it would otherwise have.”

Thinking about skew – Alternative skew measures

I was having a discussion about the merits of managed futures relative to other hedge fund styles. Managed futures funds will often have positive skew versus other hedge fund styles. The measurement of skew is tricky and is not present with all managers but for trend-followers who allow profits to accrue, it is more likely. The argument for positive skew is embedded in the behavior of the managers.