Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

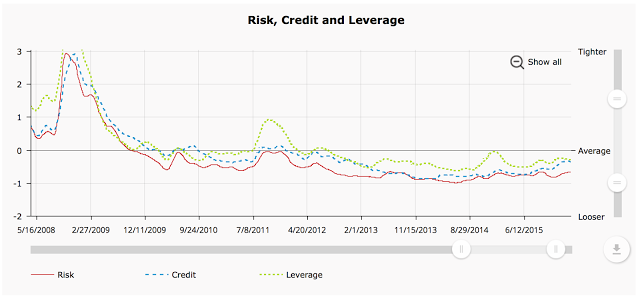

Always Check the Financial Conditions – Still Loose

There are many narratives for why equities or bonds will move higher, but a recurring theme is the financial conditions faced by investors. Financial conditions provide the tailwinds or headwinds to push asset class returns. These conditions tell us something about whether we will be transitioning between a risk-on and risk-off environment or whether we will be a crisis mode.

The Real Bias – Stock Optimists versus Bond Pessimists

During a simple discussion on investing, the topic turned to biases. We have learned to talk about many biases from behavioral economics. We now have a catalog of preferences which makes them easier to mitigate. Still, there seems to be one bias that is very hard to address, and that is the overarching theme of […]

Determine What Goes Wrong with Your Investment Model

How do you know whether a model is broken? Or, how do you conduct a model review? There are many specific steps for any review but there are four major questions that have to be addressed that are separate from risk management. The key question of model efficacy should focus on forecasting skill and action. Does the model forecast correctly and is the model employed properly to make good decisions.

Preparing for Market Risk – Stay Diversified Across Asset Classes, Factors, and Strategies

You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready – you won’t do well in the markets. If you go to Minnesota in January, you should know that it’s gonna be cold. You don’t panic when the thermometer falls below zero.

-Peter Lynch

Follow the World Business Cycle – Economies are Integrated

Globalization is a critical part of macro investing. There can be talk of separation politics, but for investors, you have to focus on the global economic cycle because the world is highly integrated. What is very interesting is that globalization has been fairly stable between the current environment and the Bretton Woods period as discussed by the recent work of Eric Monnet and Damien Puy who studied long horizon data available from the IMF. They find that there were two common shock periods which caused a highly synchronous global behavior. The first was oil shock period of the 70’s and the second was the Great Financial Crisis. You could say that these were the two periods when “correlations went to one” across asset classes. There was no international diversification benefit.

“Winner‐Take‐All” Dynamics and Hedge Fund Investing

A growing stream of thinking in microeconomics is the concept of “winner-take-all” dynamics. The idea seems simple. A combination of networking economics and classic economies of scale creates situations where there are just a few dominant firms or economic agents who are able to capture significant market share in a given industry. With the advances in technology over the last decade, many industries are seeing the impact of winner-take-all dynamics leading to the result of greater concentration.

Populism and the Market: Assessing Risks for Investors

There has been tremendous talk concerning populism and politics, but for investors, the focus still must be on these movements’ economic and market impact. So discount the news headline and rhetoric and focus on the potential market impact, but a good definition of populism is necessary for building a framework to determine risks. Defining Populism […]

The Role of Factors in Finance: A Focus on Global Macro Investing

What has been at the vanguard of thinking in finance is the breakdown of returns into their constituent parts or risk factors. Finance has moved well beyond market beta. The first breakdown for a portfolio is not returns by asset class but returns by risk factors. Some have criticized the current situation as a factor […]

Why a Buy-and-Hold Strategy in Commodity Index Investing May Not Work

An article in the Wall Street Journal, “Why Commodity-Index Investing May be Futile,” has attracted much interest from investors. However, there was no new information in the story. The reasons for avoiding commodity indices should be taken seriously; nevertheless, the broader issue of differences between commodity and equity investing is straightforward. Commodity investing in an […]

Using Economic Growth as a Predictor for Managed Futures Returns

Another simple test to determine whether managed futures returns will do better than average is by looking at economic growth. We know that bonds and other defensive assets like managed futures will do better in “bad times,” such as a recession, but there are not many recessions. The cost of being defensive can be very […]

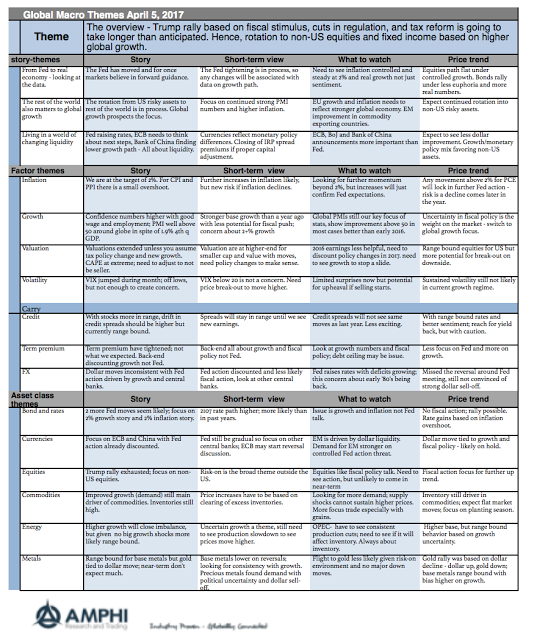

Global Macro in One Page – Rotation to Non-Dollar Assets Continuing

March was a tough month for making any economic judgments. The Trump rally in equities was expected to continue, but reality has been a switch to non-US risky assets. A bond sell-off was expected given Fed action combined with more fiscal policy revelations. It did not happen. The dollar was expected to continue its rally based on further confirmation of the Fed being out of step with other central banks. It did not happen.

March Showed a Rotation in Return Performance

March saw a significant rotation in return performance from US equities to global and emerging markets and from value to growth. Our indicators show prices are starting to break to the downside albeit trends are currently flat. March was a transition month from euphoria to reality concerning US government policies. Future price direction will be determined by the real economy and not policy expectations.

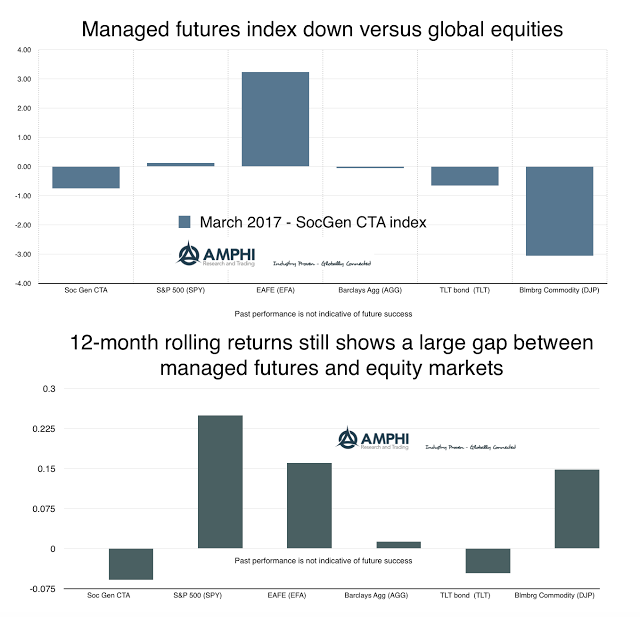

Managed Futures Cannot Find Returns on Market Reversals

Managed futures declined on market reveals from the Fed FOMC announcement of a 25 bps rate hike. While the move seemed to have been baked into market thinking before the announcement, key asset classes revised trend direction after the 15th. The SPX, which was already flattening in trend, turned lower. Bond returns, (long duration), actually turned higher on a perceived more aggressive Fed. The dollar strength reversed and commodities moved higher after declining for the last month. You get the picture on the change. Trend-followers saw a reversal in performance which added to a lower overall return.