Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Endowment Models – Bogle Simplicity a Winner

Everyone likes to follow what endowments are doing because there is the assumption that they represent smart money. If universities are where the smart people are, then it stands to reason that their money managers are also smart. The return numbers suggest that endowments don’t have a lock on good performance. In fact, simple allocations have proven to be more effective at generating return. The Bogle model which is a simple variation on the classic 60/40 stock/bond mix is a perfect example. This asset allocation in made up of 40% US equities (total US stock index), 20% international equities (total international stock index) and 40% bonds (total bond index). The Bogle allocation works when compared with endowment allocation which have been tilted to alternatives and away from equities.

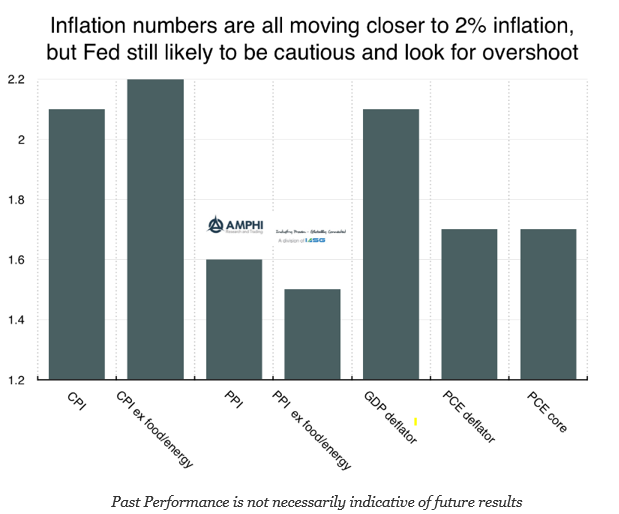

Inflation Closing in on Magic 2% or Bouncing Back

Current inflation numbers are all moving closer to 2%, but there is no special policy action from hitting or exceeding this rate. In fact, a cautious Fed is more likely with the most aggressive forecast being 2-3 rate moves. The Fed has not followed a mechanistic policy even though they have stated they are “data driven”. The most likely forecast will be to fade the earlier musings of the Fed.

Hedge Fund Performance Starts Well for January

The markets were generally calm for January even with the upheaval and uncertainty from the new Trump Administration. The surprise for many investors is the continued low volatility in the markets which seems inconsistent with the political uncertainty faced. While hedge funds generally did well for the month, there were some negative stand-outs, the macro and CTA strategies.

Commodity Exposure – Off the Lows and Worth Considering

From the high in June 2008, the Bloomberg Commodity index (formerly the DJ-UBS index) is still down from its high by 61.6%. The index is off the all-time lows since the crisis which was reached last February 2016 by about 16.5%, but the index is nowhere near old highs.

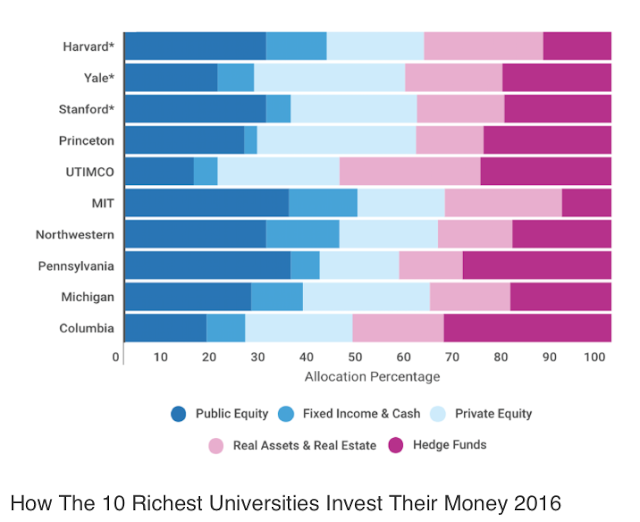

What are Endowments Doing with Their Allocations?

This above chart from thetrustedinsight.com provides an interesting tale about asset allocation for large endowments. Forgot about the traditional 60/40 stock/bond mix. Forget about the 50/30/20 stock/bond/alternatives mix. If you don’t need liquidity, as is the case for the endowment portfolio allocations, a mix between liquid and illiquid is a better base framework. Hold private equity and real estate as core allocations. This core is for long-term appreciation and cash flow greater than bonds, but is generally illiquid. Take money from fixed income and cash. Take funds from public equities and use hedge funds, which may have mixed liquidity, as an additional return enhancer. The public equity and bond/cash portion of portfolios is between 25 and 50%, while hedge funds are from 7.5 to 32.5% for these key endowments. The majority of their allocations are not with traditional equity and bond beta.

A Falling Correlation with Equities Makes for Greater Commodity Value

Commodities were supposed to be the great portfolio diversifier, a real asset that protects against inflation, offered positive roll yield, and gains from a super cycle. The reality over the last eight years has been much different. The roll yield disappeared as markets turned in many cases from backwardation to contango. Investors were penalized with negative roll. The super cycle ended with the Great Financial Crisis with a market decline over 75%. The markets have been digesting an excess supply/demand imbalance for years. The final kicker for investors was the financialization of commodities. Correlations with equities rose so investors did not get the diversification free lunch that was expected from looking at historical data. Now times are different, so throw out the old thinking.

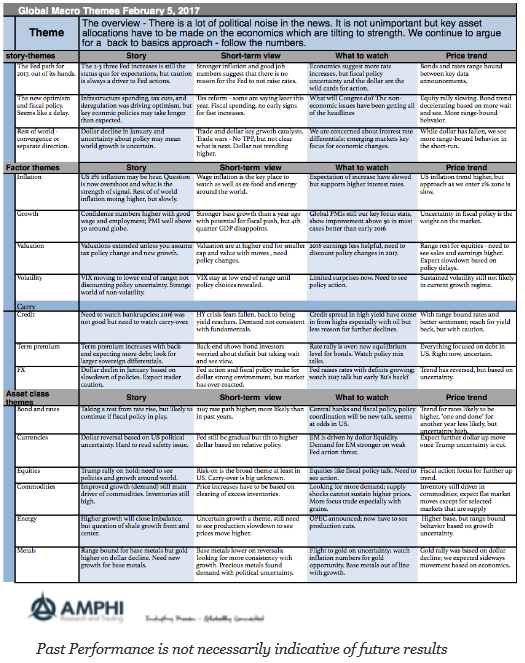

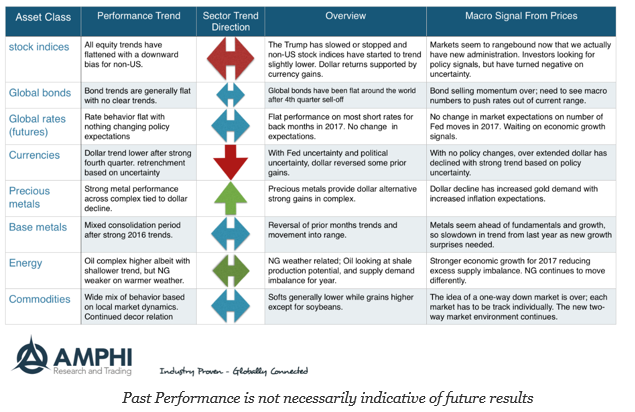

Global Macro on One Page – More of the Same

Just because there is the passage of time does not mean that market themes will change. The big issues could be unresolved with no information that will change expectations. We are at one of those times.

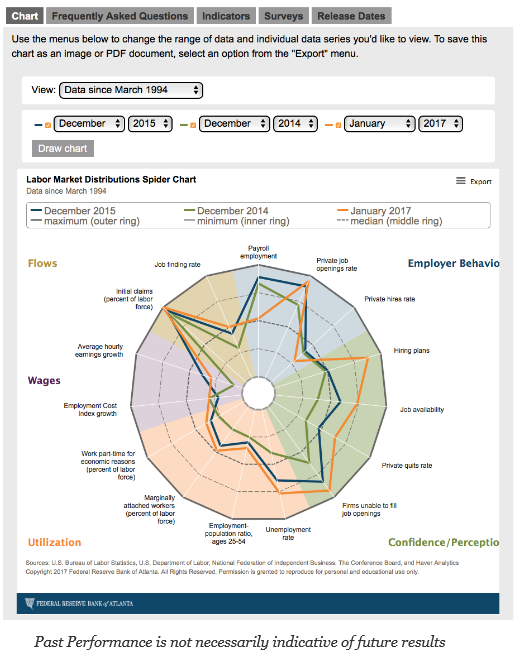

Labor Spider Shows the Key Issues – Utilization

There are a lot of labor statistics to analyze to measure what may happen with fed policy and interest rates. One of the key problems is trying to place all of this information on a single page or in a visual format that can do proper comparison with the past and provide analysis of the present. The Atlanta Fed has achieved that goal with their new labor spider graph.

Trendless Markets as We Move into February

Our sector indicators have all pointed to more trendless behavior for the major asset classes. The only major trend was a decline in the dollar for January and stronger moves higher for precious metals. With higher inflation expectations, and policy uncertainty, there are fundamental reasons for these moves.

Emerging Markets – Bonds Beat Equities Which Beat Commodities – Will this Continue?

Emerging markets have been a tough place to invest especially in equities during the post Financial Crisis period. We include a stock index (EEM), and bond index (EMB) and a commodity index (DJP) for some simple comparisons of three ways to play emerging markets. After a strong rebound in 2009, emerging market equities have generated no returns for investors. Slower growth, poor commodity markets, and a stronger dollar have left equity holders with nothing to show for seven years. Emerging market bonds have told a different story with strong consistent gains since the Financial Crisis even with the strong dollar move over the last few years.

Sector Behavior Shows Stability After Large Moves at End of the Year

It was a positive month for risky assets, albeit more one of consolidation and than return break-out like what was seen last quester. Global markets outside of the US, especially emerging markets, showed large gains after a weak fourth quarter. The dollar gains post-election were partially reversed which added a tailwind to non-dollar investments of about 2%. After accounting for currency changes, developed non-dollar returns are back in-line with the US.

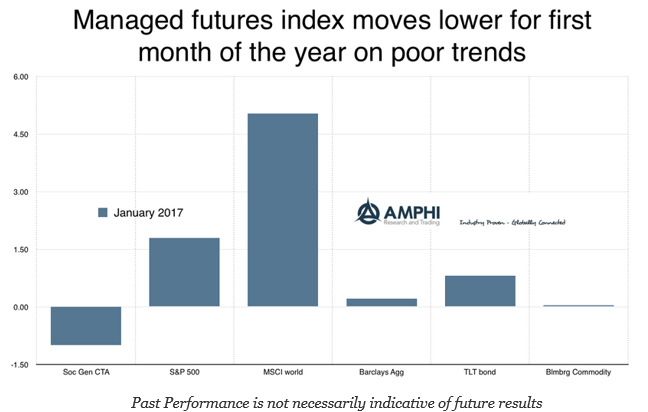

Managed Futures – No Trends to Exploit

The managed futures hedge fund style, as measured by the SocGen CTA index, declined by just under one percent for the month. There was limited movement in commodities and bonds and the largest gains for the month were in non-US equities where there is usually less exposure by futures managers. Going back over our sector trend measures, we were predicting a lackluster month since there were few strong directional trends going into January. The SocGen trend indicator index was down over 6 percent and the short-term trader index declined about 4 percent.

Banking and Speculation – All a Matter of Opinion?

“When as a young and unknown man I started to be successful I was referred to as a gambler. My operations increased in scope. Then I was a speculator. The sphere of my activities continued to expand and presently I was known as a banker. Actually I had been doing the same thing all the time.”

– attributed to Ernest Cassel by Bernard Baruch