Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Brains and Stomach – You Need Both for Investing

Having the stomach for investing means that you are able to get over the behavioral biases that are based on emotions and fast thinking. It means being able to follow-through with an investment plan without emotions. Meir Statman, a finance professor who has focused on behavioral biases, states, “Deeply buried fears can keep us from taking risk – keeping us safe, perhaps but also robbing us of potential returns. A stronger tendency to regret past choices can keep us from repeating blunders, but also from repeating sound strategies that simply didn’t work out the first time.” from Spencer Jakab, Heads I Win, Tails I Win. Those who have regret have no stomach. Investors who can move beyond regret have the stomach for investing.

What are Asset Class Volatility Graphs Telling Us?

A close look at volatility across major asset classes over the last year shows that the BREXIT vote was a much bigger market event than the US presidential election. Looking at stock, bond, and currency volatility over 2016 suggests that the uncertainty post-election has not been as great as the BREXIT shock and already seems to be reversing.

Investment Learning Starts with Knowing the Past

I have always had problem with some of the finding behavior finance research. The research is good at pointing out flaws but less effective at offering ways to improve performance and behavior other than stop doing bad things. Nevertheless, I have found some the behavioral research work by Markus Glaser and Martin Weber very helpful with how to offset some biases. They find that there is no correlation between return estimates and realized returns, but they see difference in behavior based on experience. See their work, “Why inexperienced Investors Do Not Learn: They Do Not Know Their Past Portfolio Performance”.

Arbitrage and Ethics – Food for Thought

I don’t think many finance professionals would link arbitrage and ethics together. There is an ethical link between being a fiduciary and handling money for clients. Trade organizations and MBA schools will tie business practices, ethics, and being a fiduciary, but you would not expect discussion of ethics matched with talks on arbitrage, but Maureen O’Hara, a esteemed professor of finance at Cornell University has done just that with her new book Something for Nothing: Arbitrage and Ethics on Wall Street.

Yield Trends Started Well Before Election

Yields exploded on the upside after the election and has seen one of the largest routs in recent years, yet it would be wrong to believe that this is all associated with the election. A close look at the trend sin yields show that the market broke above moving averages at the end of September. Using simple moving averages (20, 40, and 80-day), we would have called a change in bond sentiment weeks ago.

What are the Best Investment Warnings?

So what is a warning? A warning is defined as a statement or event that may indicate a danger, problem, or an unpleasant event. With hindsight, we can always find warning signs, but the real question is whether you can see warnings before the fact. The warning has to strong enough to change current thinking. For investments, a warning could be information that contradicts a given narrative. The narrative is the story that generates a specific trade or allocation.

Commodities – Is This the Time to Allocate?

Commodities have been an out of favor asset class. With a long-term return downturn, that has only partially reversed, many have avoided commodities even though it has been one of the best performing asset classes for 2016. A return of over 5% through November 11th as measure day the DJP total return has made it a strong gainer albeit the reversal in oil has caused declines from highs earlier in the year.

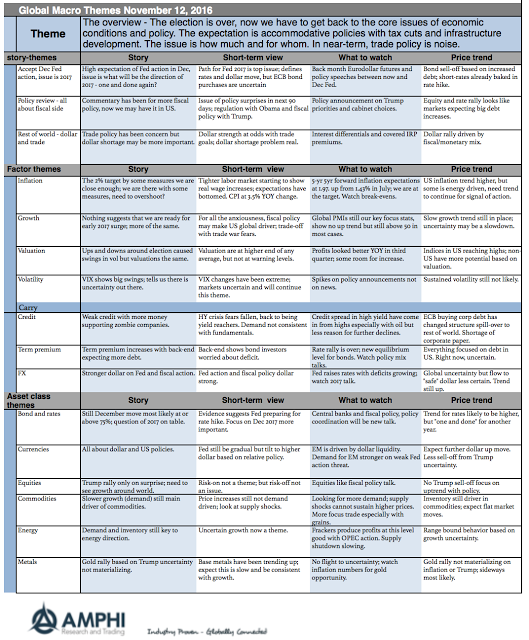

Global Themes on One Page

We have delayed our monthly global themes on one page given the US presidential election. There was too much uncertainty associated with the election to focus on the core themes of growth and valuation. Now that the election is over, we can focus on what is most important, growth, liquidity, and risk appetite. Financial markets are driven by the underlying economics of policies and not the personality of the president. Focus on policy, not the man. Personality matters to the degree that policy agendas can be moved. This is not trivial, but what moves markets are the policies. The key is determining what will get done, when, and how much. These policies have to be balanced with growth prospects around the world.

Liquidity Premium – Not Easy to Sort-Out

There is a strong demand for liquidity in all investments even hedge funds. However, there is a difference in the liquidity across hedge fund styles. The key investment question is whether you get paid to hold less liquidity. Is there an illiquidity premium?

Risk Hurdles

Risk management is more than applying quantitative tools to measure things like volatility or skew. It is an operational management problem of gathering and reporting data. The quality of risk management is related to the ability of a manager to properly aggregate data for analysis. Hence, strategies that have greater operational problems at gathering information on risk will have higher risk.

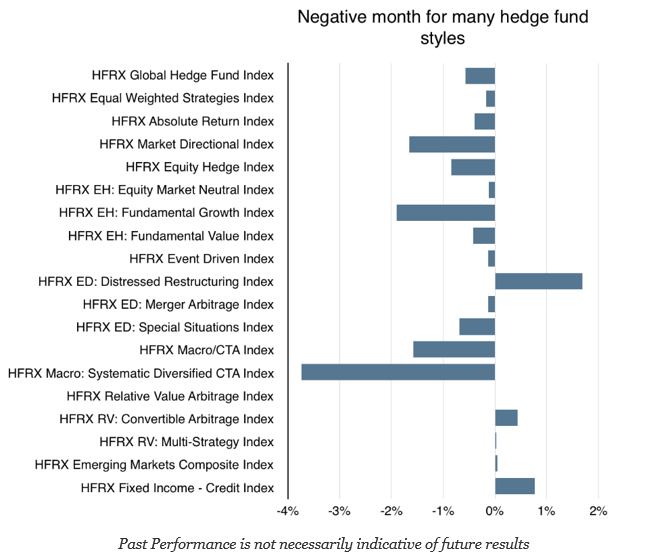

Hedge Funds

Hedge fund returns are a combination of alpha and beta risk exposure. The betas across different hedge fund styles are variable and dynamic. In general, beta will be below one, with most hedge funds showing market betas between .3 and .6. Some hedge fund styles, like managed futures, may be lower. Alpha can also be […]

Surprises Happen – Black Swan, No

Tail events will often lead to over-reaction as seen in the market action overnight. The worth of a manager is not measured by his ability to build and adjust portfolios in calm times but his ability to navigate and manage through uncertainty.

Navigating uncertainty is not always taking action but at times learning to do nothing. Discussion with managers suggests that some systematic managers did not take model signals last night. Markets moves out of proportion to the discounted futures cash flows signaled that no action was best.

Managing uncertainty starts with core portfolio construction. Extra diversification is necessary when there is extra risk. Diversification may come through differences in timeframe and styles when correlations across asset classes have the likelihood of moving to one. Managers are paid to build portfolios, manage risk, and take action on changes in economic fundamentals, this cannot generally be done with passive investing.

Sector Exposures

October was a painful month for investors with no place to hide in many sectors, styles, countries, or bonds. Major equity styles declined significantly especially in small caps.