Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Managed futures trend-following performance – It is not volatility but the stress that matters

“Crisis alpha” is used as a quick description of managed futures trend-following, but there has been very little work to explain what the term means. A generic definition is that a crisis is when equity markets have a significant decline, but that definition tells us nothing about what will be the conditions for a crisis or when a crisis will occur.

FX intervention – Analysis says central bank activity works

Many have held the view that central bank FX intervention is ineffective. It can be disruptive and have some temporary impact, but central banks cannot make currency markets do what they don’t want to do. Research using public data, a limited sample and mainly focused on floating exchange rate regimes, shows, at best, mixed value […]

Alternative risk premia overreaction in 2018 – Don’t fall for recency bias

What happened to alternative risk premia returns in 2018? This was a major discussion topic at a UBS risk premia conference last week. It was a difficult year. In fact, it was the worst performance year since 2008, and the decline for many strategies was a multiple standard deviation event. Yet, there is a good opportunity for investors who focus on the longer-run. Since the performance for many risk premia seemed unrelated to macro factors, there is strong potential for mean reversion to longer-term strong positive performance. To extrapolate recent performance as representative of history would be to fall into a recency bias.

Risk premia performance generally positive for January

It is a new year and the underperformance of many alternative risk premia strategies in 2018 is now an old memory. Good performance heals past return wounds. While well-constructed alternative risk premia should not be highly correlated to market beta, they will be related to the investment regime. Risk premia are time varying.

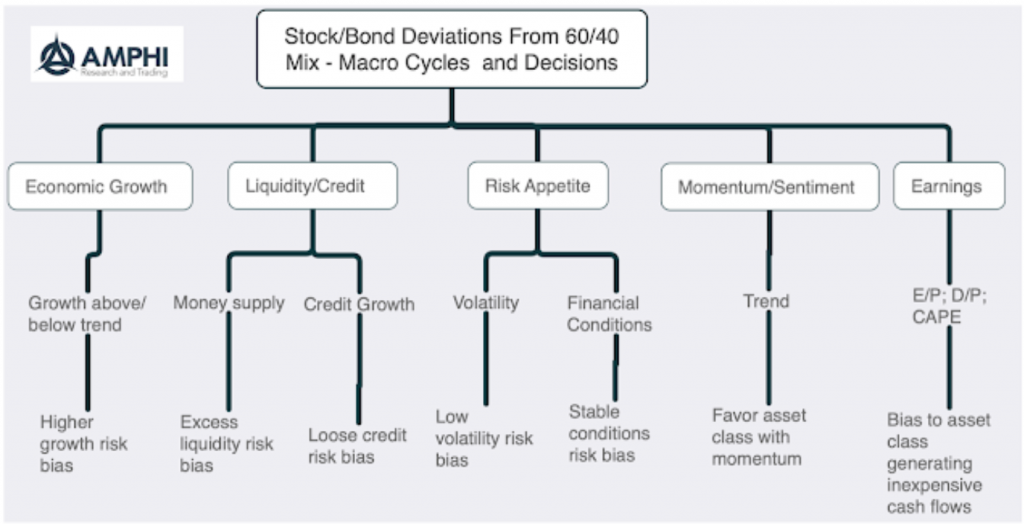

Stock Bond allocations – Using macro factors – Still be care with any equity overweight

The asset allocation decision for holding equities (risky asset) over bonds (safe asset) is inherently a macro decision. This macro decision is one of the most important asset allocation decisions given the large differential between stock and bond returns. The average annual difference is over 625 bps over the last 90 years in favor of stocks. However, bonds deliver lower volatility and reduce portfolio risk.

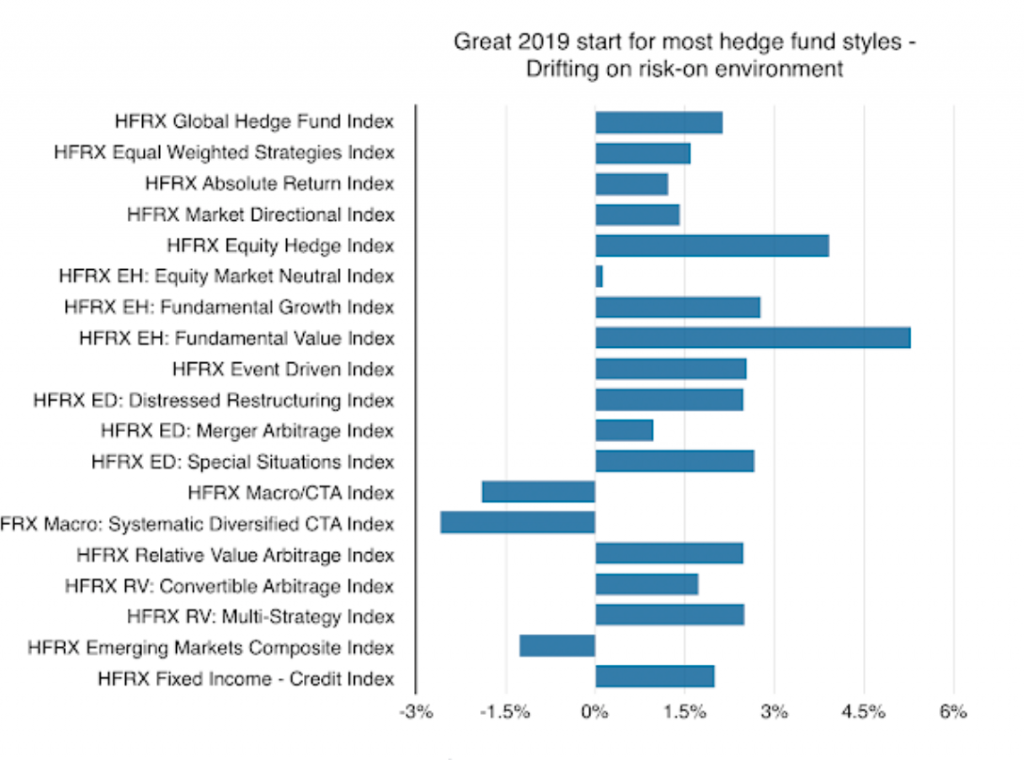

A risk-on environment and the hedge fund world is good

Hedge fund styles as measured by the HFR indices showed strong positive January performance in tandem with the gains in the stock market. When in a risk-on environment many hedge fund styles are winners.

Risk-on- What happened to fears of 2018?

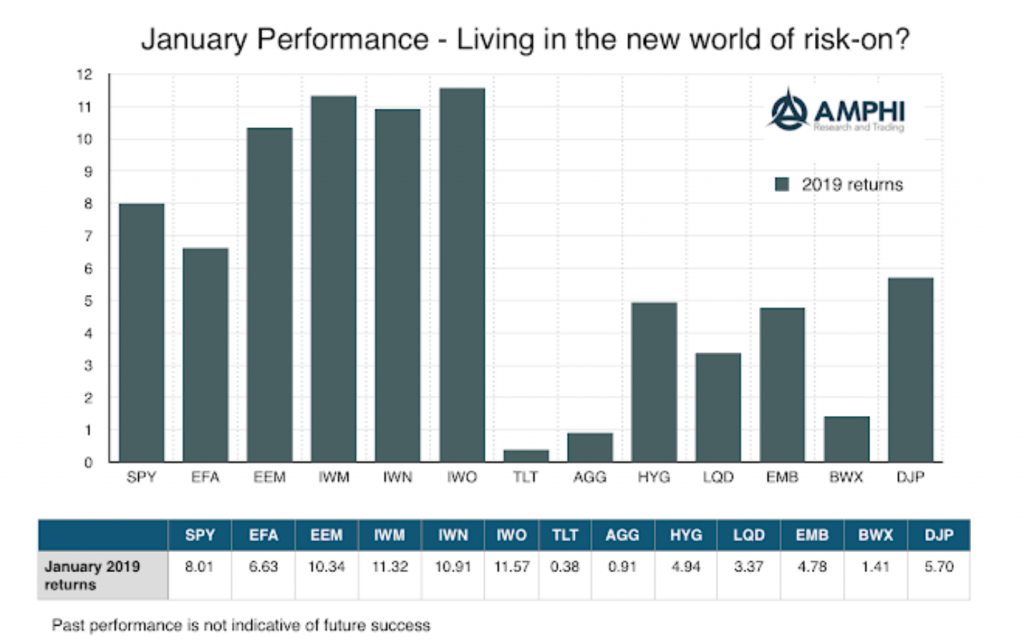

The equity reversal was tough on many trend-followers. This reversal spilled-over to US bonds during the month. Good buy trend signals now in both equities and bonds. Dollar strength reversed on Fed pause remarks. Metals and energy both moved higher during the month even with global growth threats. Commodities asset class is not a trend rich environment at this time.

Living in the new world of risk-on? Be careful

It’s all about the “pause” from the “data dependent” Fed at the beginning of the month. It was reinforced with Chairman Powell comments at the end of the month. The data looked at by the Fed is based on macro fundamentals, but the perception is that the Fed is now financial asset data dependent.

The stock-bond mix and equity premia over time – Never oversell equity exposure

Many investors don’t appreciate that 2018 was highly abnormal for asset allocation. First, the annual excess return from holding equities is generally positive with the exception during recessions. 2018 was not a recession year. Yes, there was a slowdown in the fourth quarter, and growth expectations have slowed but the numbers do not suggest a recession at this point. Second, the likelihood that both stocks and bonds will be negative in a given year is very unusual. There has only been a 4.44% chance of this occurring over the last 90 years using the SPX and 10-year Treasury returns. It is highly unlikely that we will see a similar year in 2019. There have only been seven periods when the equity premium was negative for two or more years in a row.

Global stocks – All about avoiding global slowdowns and recessions

Is it that simple? Global equity investing is all about missing the big macro risks – recessions. There are headline risks every year, but it is always about economic growth when you step-back and look at annual performance. If global growth appreciably slows, global stocks are hurt. A simple long-only asset allocation strategy is to stick with long-term trends with the ability to walk-away when a recession or slowdown occurs.

Liquid or Illiquid: Are you getting paid enough for less liquidity?

A key issue with any hedge fund investment is liquidity. How much should you be paid for illiquidity with assets? How much should you be paid for illiquidity with a fund structure? How much liquidity do you need? What are the liquidity terms that are acceptable for a fund?

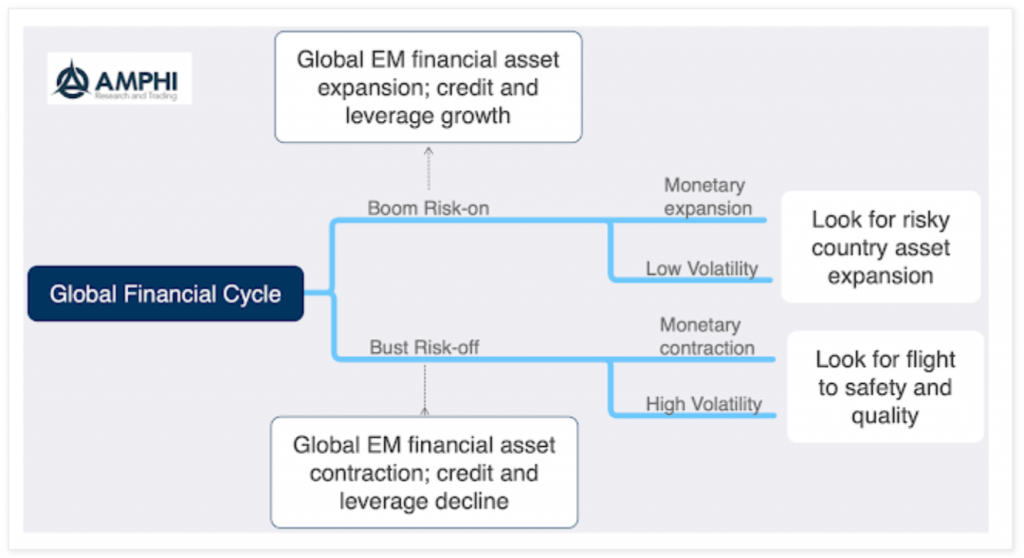

Global Financial Cycle – Look for the risk regimes

A recurring theme for our forecasting model is not predicting the future but just identifying the current regime. It is more important to first know where you are before you determine where you might be going. If you have ever been lost, the best solution is to first figure out your current location.

Concentration, inequality and the status quo – Size matters but not always for the better

A capitalist system is not always competitive environment, but competitive environment is a capitalist system. One key macro issue that is not often discussed is the increasing concentration of businesses in the US and other capitalist countries. While not monopolies, an increasing amount of market share is in the hands of fewer companies and form oligopolies.