Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

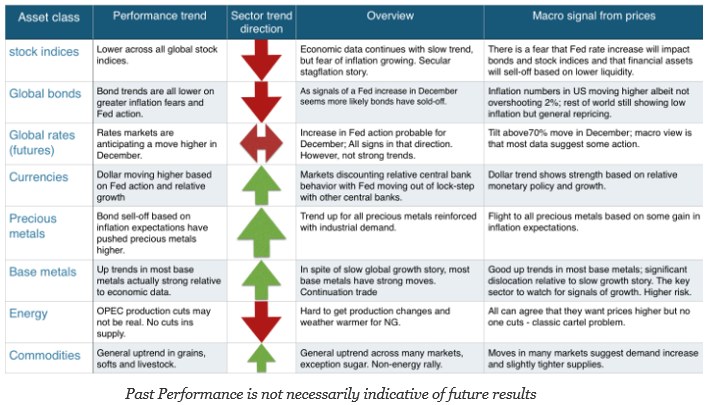

Current Trends

Each month we run a set of trend models against the major markets in each asset class sector. We then average the trend direction, either up or down, to generate a sector signal.

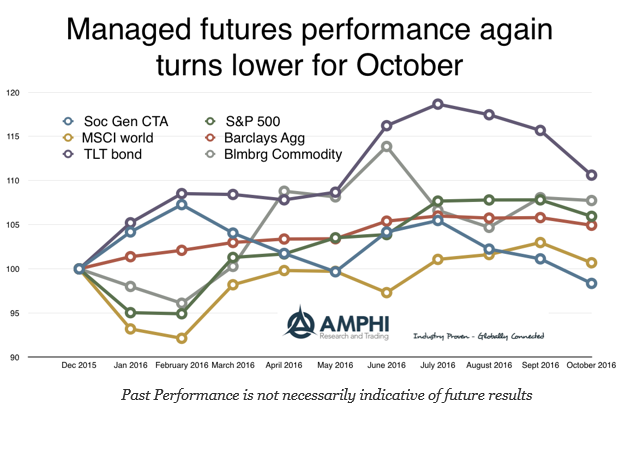

October 2016 Managed Futures Performance

Managed futures should not be synonymous with trend following but most of the major indices that track this hedge fund style have a high proportion of trend-followers.

3 Coping Strategies for Any Decision Process

The behavioral finance revolution has added immensely to our knowledge on the aberrations from efficient markets and rational expectations. Mistakes happen because we are sloppy thinkers.

Quantitative Analysis

A provocative post by Peter Lupoff the founder of Tiburon Capital called “When numbers cloud meaning – The fallacy of investment research exactitude” has me thinking about narrative versus the idea of false precision with quantitative analysis. First, something to put the issue into context; a classic joke on false precision, “I am 98.54% certain that you need both precision and narrative to be an effective trader.”

Cognitive Biases

The list of cognitive biases that can affect investors keeps growing. An explosion of studies show that observed decision-making under real and test conditions is hard. Just look at the wheel from Buster Bensen’s cognitive bias cheat sheet, the single best graphic I have seen which lists and categorizes the cognitive biases investors face, to get a flavor of the problem. Nevertheless, this work does a good job of reducing all of these biases into four problem categories:

Positive Skew

Skew can be an important component of returns. Obviously, investors would like to avoid negative skew, but if an asset with a positive skewed return distribution can be found, it can potentially generate a nice upside stretch with performance. Still, skew is sensitive to outliers and hard to measure. Skew is often generated from mixed distributions; nevertheless, if you can find positive skew investments and can associate this property with specific factors, portfolios can be structured to generate some extra upside return potential by increasing allocations to these assets.

Investment Consultants

Investment consultants are a force to the reckoned with in the pension world. They advise and drive many pension decisions around the globe.

Managed Futures Performance

Managed futures shows good long-term performance versus equities. Yes? No? If you start investing in the SocGen CTA index in 2000 and compare with any end year until 2015, you will shows positive returns as a stand-alone investment.

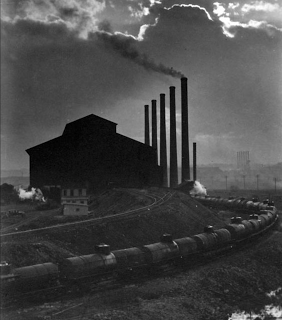

Central Banking

The modern financial world could not exist without effective central banking. The foundation of this core invention is a trust in banking; a trust that a paper claim can be used as a medium of exchange and a store of value…

History Lessons

What experience and history teaches us is that people and governments have never learned anything from history, or acted on principles deduced from it.- Georg Hegel 1832

This is a quote heard before; however, many have not given it specific operational meaning. This is especially true for financial analysts. What is learned in history can be varied, but what is critical is accepting that what people and governments will do is often mistaken. Current motivations for action will differ from should be done if there is a close reading of history. There is a strong distinction between what people and government “should” do if they internalize history and “will” do.

The End of Alchemy

I finished reading The End of Alchemy: Banking, the Global Economy and the Future of Money and came away with some useful but simple insights on the current state of finance by the author Melvyn King.

The Weatherstone Approach

Dennis Weatherstone, the former CEO and Chairman of JP Morgan had a special approach for deciding on the riskiness of new products. He would give the developers three 15 minute slots (45 minutes) to explain the product. His rule for approval would be simple. If the product could not be explained in the allotted time, […]

Hedge Fund Classification

All hedge fund strategies are not created equal. Correct hedge fund classification is important. Poor classification will generate false conclusions on the skill of the manager and may deliver return streams that are unexpected. Asset allocation becomes more difficult if classification is ineffective.