Mark Rzepczynski, Author at IASG

Prior to co-founding AMPHI, Mark was the CEO of the fund group at FourWinds Capital Mgmt. Mark was also President and CIO at John W. Henry & Co., an iconic Commodity Trading Advisor. Mark has headed fixed income research at Fidelity Management and Research, served as senior economist for the CME, and as a finance professor at the Univ. of Houston Baer School of Business.

Risk and Return

Risk and return. The drumbeat that return is received in exchange for taking on risk as measured by volatility is relentlessly driven into the minds of all investors, but what if this trade-off is not as strong as the rhetoric? New research focuses on skew as one of the key risks. In particular the downside risk of negative skew may be more important at explaining excess returns than volatility which can lead to either upside or downside.

Quant and System Developers – There is a Distinction

Thinking about the analysis of systematic global macro and managed futures managers, I asked a simple question, is there a difference between a quant and system developer. A portfolio system is a complete integrated approach for making market predictions and investment decisions including sizing, entry, exit, and risk management. Is it possible for a manager to be less well-trained as many newly minted engineering quants, but still be talented at building portfolio systems?

The Advice of Mr. Jaggers, “Follow the Evidence.”

“Take nothing on its looks; take everything on evidence. There’s no better rule.” — Mr. Jaggers, Pip’s guardian in Great Expectations by Charles Dickens.

If we had Mr. Jaggers as our guardian and mentor, we would likely be better analysts. A recurring theme this month has been about finding the truth through a focus on data, not commentary. Look to the data and not what is being said. If there is no supporting evidence, discount. If no supporting evidence is provided, then find your own. Markets may be driven by sentiment or perception but ultimately it will discount and respond the evidence.

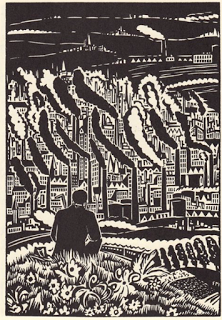

The Deeper Dimensions of Economic and Financial Globalization: A Paradigm Shift in Investing

Economic and financial globalization is not just about trade. It is about trade only to the extent that trade includes goods, services, capital, labor, information, and culture. Globalization concerns the positioning of the firm and the individual in the world, not just the positioning within the nation-state or local economy. While globalization affects everyone, the […]

Forgetfulness and Financial Analysis – Is More Memory Always Better?

Big historical events, especially tragedies, are committed to memory so we will not forget, yet is it really good to remember everything? Put differently, is forgetfulness useful? Would we be better off if some memories disappeared?

Financial Analysis and “Truthiness” – Follow Data, Not the Talk

If I were being polite, I would not argue that we are in an age of lies by politicians, businessmen, or leaders, but what The Economist has called a “post-truth world”. Stephen Colbert described the current environment as one of different levels of “truthiness”. At best, clarity by leaders and spokespeople is in short supply. Most commentary is done for spin.

The Paradox of Skill – Why Competitive Markets are Left to Luck

The paradox of skill is an important concept to understand for any investor or trader. Managers will often talk about wanting to prove their skills in a competitive environment against the best in the world. Forget that nonsense. You want to be the best in an uncompetitive or less competitive environment. You want to have a strategy that others do not follow. Being in a competitive space may seem like a good thing, but it will be harder to beat others. If there is a fixed amount of alpha, everyone will be fighting for that same alpha and it will be harder to win your share when the market is more competitive.

Tactical Investing in Global Macro and Managed Futures

There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

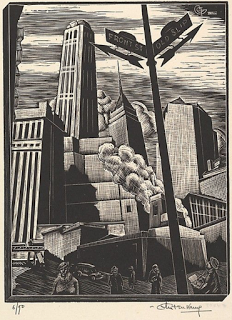

Probability of Recession Rising – A Warning

The US recession probability model based on the Treasury spread is a simple straightforward forecasting tool that can be followed in real time. If the spread term negative, watch out, economic winter is coming. Nevertheless, there are only a limited number of recessions and a limited number of signals. What is as useful is watching how the probability of a recession changes during non-recession periods. Periods of growing economic stress will see an increase in recession probability. For example, periods when the probability is more than 10% or even more than 5% will be times when equity markets will be under stress. These periods may pass without a recession, but there will be an impact on financial markets. This signal may have to be confirmed with other data since it provides early warnings, but it is valuable as a simple indicator.

Less Noise, More Insight: How Smart Investors Stay Ahead

As an analyst, reading all the news that is fit to print is not a good value proposition. It just takes up too much time and leads to the confusion of work with effort. Problem with News Consumption Too often news articles just try and fit the facts with current market behavior. If employment figures […]

Policy Coordination – The New New Thing for Central Banks?

Reading some of the recent comments by central banks there seem to be three emerging themes over the last few months.

International Monetary System Not Working on Four Dimensions

Eichengreen is one of the leading international monetary economists and historians. He has always been especially effective at describing and analyzing the global monetary framework across time. When I look at the international monetary system on these four dimensions, I find that we lacking coherence or policies that will affectively raising global growth. Consequently, the longer-term story of secular stagnation or just a lower global growth path will continue to hold. Changes in these dimensions will be necessary to change the slow growth story. Our current views are not positive:

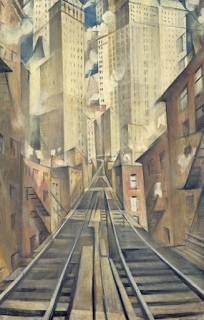

Global Macro Investing – A Simple Framework

What separates global macro investing from other hedge fund styles? This style is significantly different from others because it has a broad focus on a wide range of asset classes. It is not just equity or fixed income focused. Its search for opportunities goes beyond any single country.