Category: Alternative Investment Strategy

Strategies for Assessing ’40 Act Alternative Investment Funds

With the increase in ’40 Act alternative investment fund offerings, there is greater interest in how to use these funds to help diversify portfolio risks effectively. There are a number of classification schemes that often overlap with some traditional mutual fund categories. Hence, there is an issue of how to best classify the set of […]

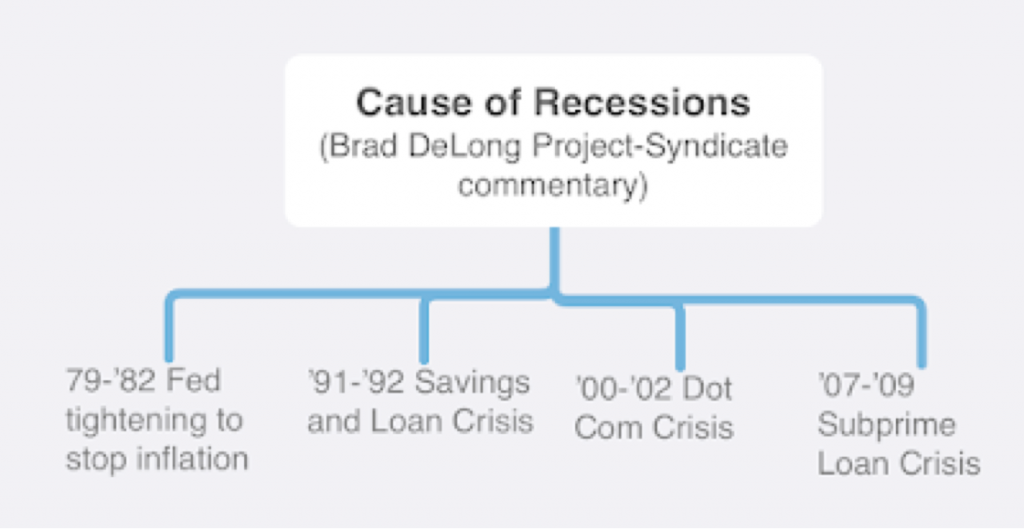

What will be the cause of the next recession?

There has been increased market talk about the next recession. Many are predicting it will occur this year albeit the dispersion of views is wide. To do a proper assessment for the cause of the next recession investors should go back to the causes of past recessions. This one will be different, but we should assume there will be common features with the past.

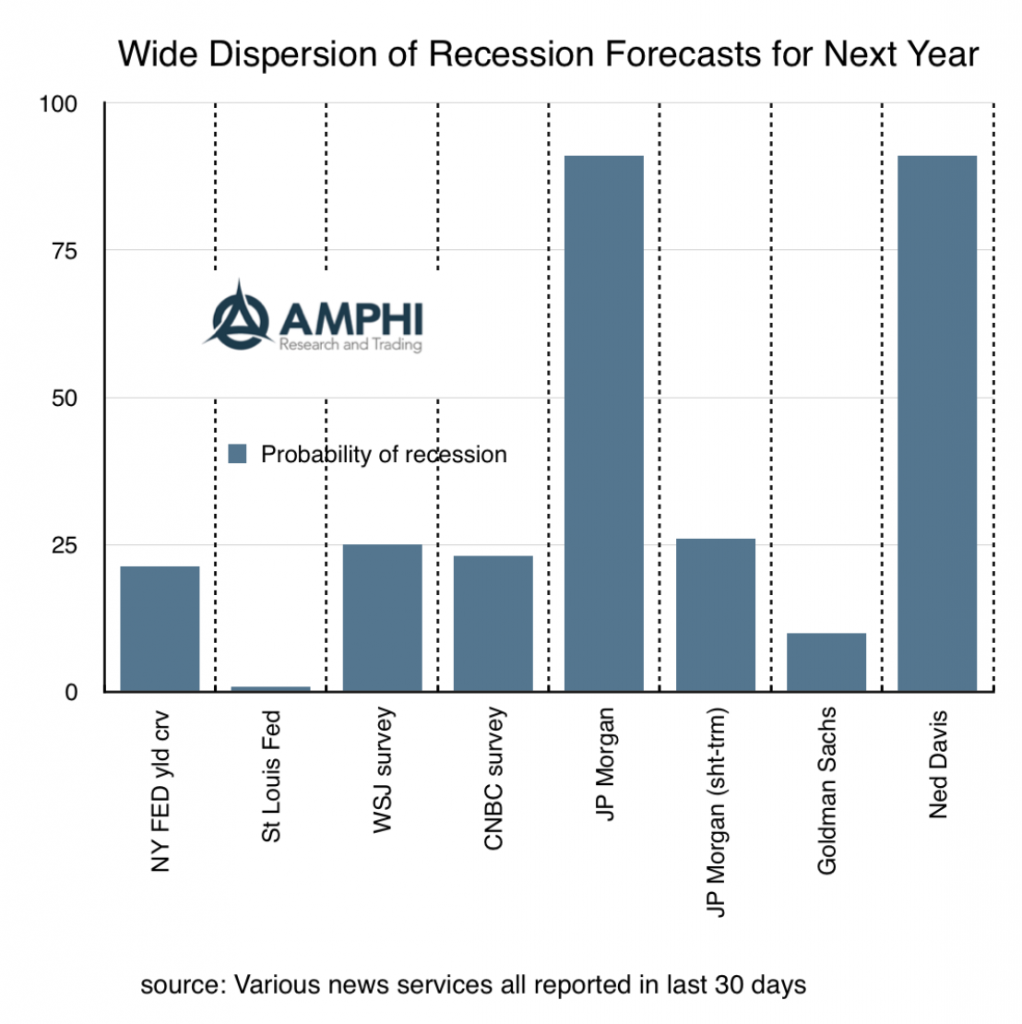

Recession probabilities – There is no consensus

What is the chance of a recession this year? Many have tried to build systematic models to give a probability number. This has been a good advancement in thinking about macro forecasting, but the variability of forecast is unusually wide. Different inputs will give different probabilities and there is no consensus on what should be the right inputs.

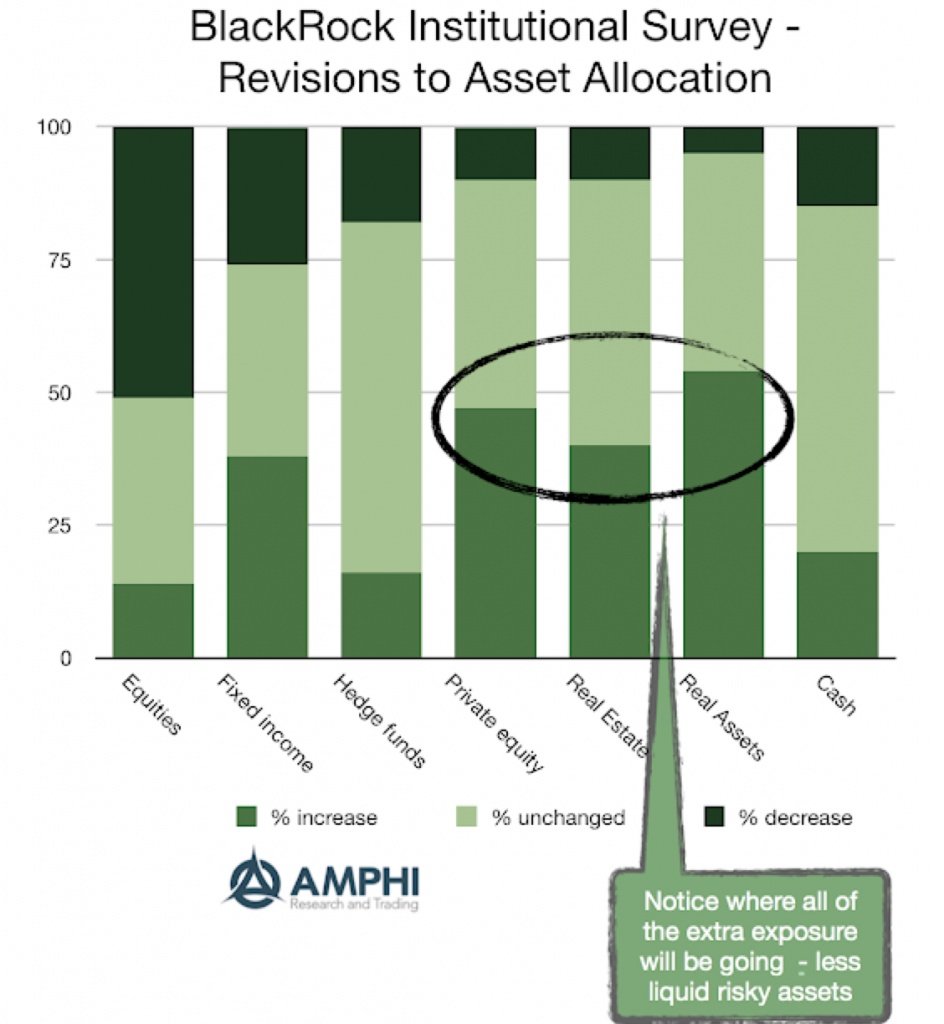

Where are institutional investors going to put their money? Not what you think

It was a tough year for money managers. All asset classes underperformed cash and most were negative for the year. Equities were a return disaster for December. Hedge funds did not do well for the year. So what will investors do?

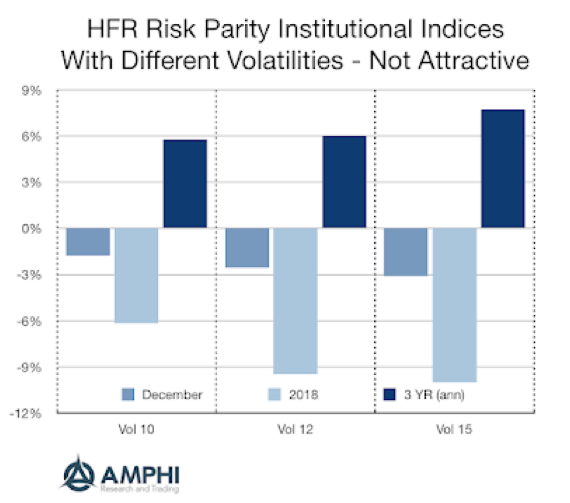

Risk Parity – A tough year for this diversification strategy

Risk parity was thought of as a portfolio strategy that would protect investors buffeted with uncertainty. Don’t think about dollar allocations, but risk allocations; it is a better way to manage a portfolio. Unfortunately, theory does not always work in practice. Using a simple benchmark of the average return for mutual funds with 50-70% equity allocation would have had slightly better returns than the 10% risk parity index and would have done much better than the higher vol indices in 2018.

What are shadow interest rates telling us?

We cannot forget that the zero bound on interest rates caused distortions in market price signals. Now in the US rates are above the zero bound so it seems like the concept of a shadow rate is not important; however, it is still relevant for many other central banks and it provides a good measure of where we have come over the last few years. Using the shadow rate as a historic measure of relative tightening, we can say that the Fed has actually been on a tightening policy since the end of quantitative easing.

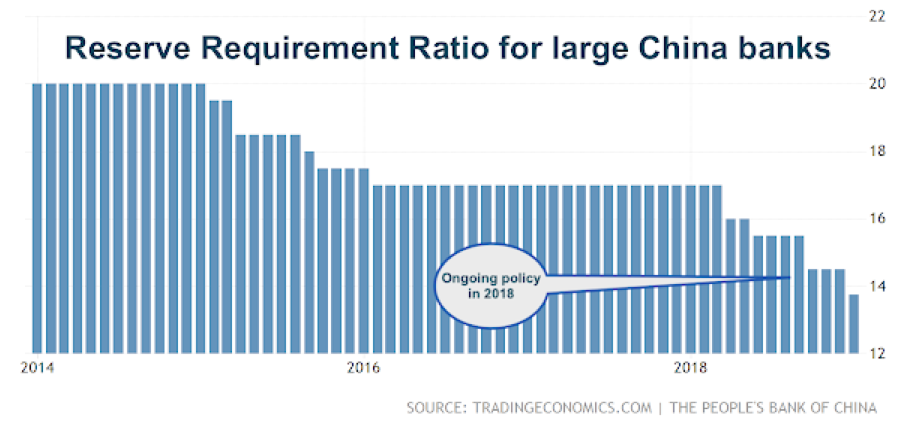

Just as important as Powell Put – China monetary action; PBOC on the move

One of our major themes for 2019 is that investors should more closely track monetary policy developments in China. The reasons are simple: the economy is big, its trade impact is global, and the PBOC at times has followed a monetary policy at odds with the Fed and ECB.

Facts and Stats – Some facts are interesting but not useful

The end of the year is usually filled with reviews and facts about what happened and speculation on what may happen in the future, yet investors can be cluttered with too many facts. Some facts can be very interesting and great for conversations, but that does not mean they are useful for plotting a course for 2019.

Powell Put in place after AEA comments

Every Fed Chairman has their own variation on the market put strategy; Greenspan, Bernanke, Yellen and now Powell. We can call this new one the “everything on the table” put strategy where the guidance of yesterday tells us nothing of what might happen tomorrow. This may be a reluctant put. Powell may have tried to stay the course for tightening, but a bear market can change the mind of many a well-intentioned central banker.

Alternative Risk Premium versus Multi-Strategy Hedged Funds – A Process of Creative Destruction

There is growing competition with how investors access returns for different investment strategies. For example, hedge funds have developed multi-strategy approaches to investing. The multi-strategy approach has replaced fund of funds as a good means for accessing diversified hedge fund return exposures. On the other hand, there are the bundled offerings of alternative risk premia through banks who are now effectively competing in the multi-strategy hedge fund space.

Time Varying Alternative Risk Premia – Do You Want To Be Active Or Passive?

A big issue with building an alternative risk premia portfolio is whether you believe that it should be actively managed or whether it should just be a passive diversified portfolio. This is a variation of the old issue of whether there is investment skill with predicting returns. Investment skill is not just isolated to security selection but also can be applied to style rotation just like asset allocation decisions.

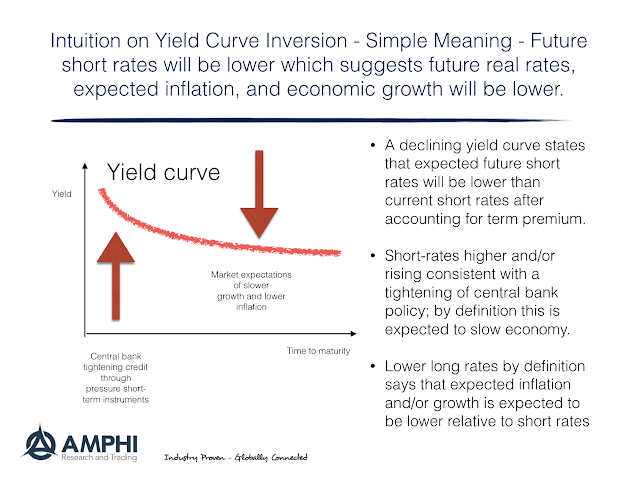

Yield Curve Inversion Hysteria – Give It a Rest

Everything you have heard about yield curve inversion is true; nevertheless, everything that is true may not harm your investments. Yield curve inversion is a good predictor of recession, and there is a link between this inversion, recession prediction, and equity declines. However, being the first to react to flattening or inversion may not win you portfolio success.

Bear Markets – Not Unusual, But Hard to Predict, so Stay Diversified

Everyone talks about bear markets; however, it is surprising that this downturn definition is so arbitrary. Commentators are somewhat cavalier with their discussion of bear markets. It is a down move of 20% from a high price point. A correction is a down move of 10%. A bear definition could be applied to a individual asset, a sector, or an asset class.