Category: Commodities

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

Bulls Being Lured in With Dropping Rig Counts

CNBC is running out of credible, bullish analysts on the oil complex. The calls for $65+ WTI seem relatively sparse. Is anybody in their right mind still thinking crude oil is going higher? Of course. We all know Keynes’ saying, “The market can stay irrational longer than you can stay solvent.” But seriously, how much […]

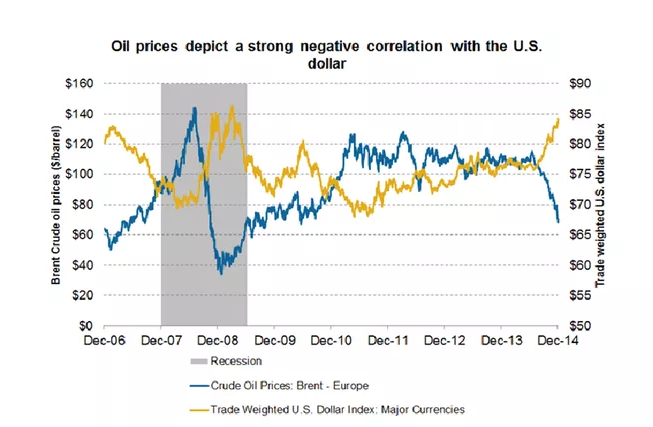

Don’t Be Fooled by Oil Bull Talk

Written by: Bryen Deutsch The 200-day moving average is a widely held long-term trend indicator. Markets trading above the 200-day moving average have a tendency to be in longer term uptrends. Markets trading below the 200-day moving average tend to be in longer term downtrends. Last July, the US Dollar Index crossed above the 200 […]

Overcoming Mental Biases in Trading and Investing

Average CTA’s, investors, and people generally have an overwhelming desire to be “right.” Who likes to be wrong? You read and hear daily from friends, and fellow traders (spouses – J), how important it is to be correct, especially when they make a market prediction or, even worse when they put real money into a […]

Crude Bulls Running Out of Steam?

Crude bulls posted a new yearly high on Friday as WTI rocketed higher in the previous two sessions after Wednesday’s more bullish-than-expected DOE inventory release. More bullish?? Or less bearish might be more like it. Since making multi-year lows on March 18, WTI crude has seen a healthy 42% rebound. Likewise, Brent crude has rallied […]

Oh, Wheat…

Wheat futures continued their downslide today with May15 sinking 15 ¼ cents in Chicago and settling at 4.70 ¼ and hitting a new life of contract low, this all despite Funds holding a record 100,000 contract short position. U.S. moisture has been beneficial with weather forecasts into next week for additional rains which is starting […]

Energies: Outlook for the Upcoming Week

Friday’s choppy action was unsurprising as the refined products exhausted themselves on Wednesday and Thursday. After a quiet start to the week, RBOB gasoline shot up 13 cents and up HO 10 cents while Brent Crude popped $4. Interestingly, June WTI closed DOWN for the week as we saw the June Brent/WTI spreads widen to over $8. Last […]

Avoiding Costly Mistakes in CTA Trading: Key to Consistent Profits

Success in trading is measured in terms of the growth of the account balance. A CTA is not expected to play God and call every twist and turn in the market correctly. Some professional and proven CTA systems are only correct 25-30% of the time and still consistently pull huge profits out of the markets. […]

Are cocoa traders making money on the Ebola scare ?

David Martin of Martin Fund Management recently posted this article on PBS Newshour:

David Martin Finds Soft Commodities a ‘Last Century’ Challenge

David Stephen Martin deals in commodities that people have a hard time doing without. Take that cup of fine Colombian coffee you just drank. Or that chocolate bar. Or that soothing glass of orange juice. Martin trades the soft commodities — coffee, cocoa, sugar, orange juice and cotton. And he has fun doing it, even though these commodities are some of the most volatile products: vulnerable to frost, drought, disease, insects, animals, guerrilla wars and occasionally unstable governments. They are grown and traded all over the world.

Managed Futures – Futures Trends

We know it is early as CTAs are still computing their monthly returns for May. With some early reports and our own proprietary tool Insight, we are seeing gains of >1% for the month of May. With continued downtrend in VIX (at or below 14) many managers trading indexes have been steady but under performing the overall broader S&P 500 index. Whereas managers trading commodities, such as coffee, cocoa, corn, soybeans, wheat, crude…just to name a few have seen a completely different story. Our interpretation is we will see a continued trend in volatility with respect to commodities and continued uptrend in equity indexes (past performance not indicative of future results). That being said, this upward trend in the indexes is going to pull back one of these days. The duration and extent are anyone’s guess. Now is the time to be more aware of “too much of a good thing”. The strength of this bull market for indexes has lasted quite some time.

New Softs CTA: Martin Fund Management LLC

Martin Fund Management (“the Fund Advisor”) is a Registered Commodity Trading Advisor (CTA) with a core focus on exchange-listed derivatives of global soft commodities (i.e. futures and futures options on coffee, cocoa, sugar, and cotton), using a Separately Managed Account (SMA) structure. The Fund Advisor seeks to generate outsized annual returns of 15%-20%, in excess of the S&P Goldman Sachs Commodity Index (S&P GSCI), employing short- to medium-term trading programs with low macro correlation and disciplined risk management. The Fund Advisor was founded by David Stephen Martin, who has over 22 years of commodity derivatives investment experience.