Category: Managed Futures

Cayler Capital | April Performance Commentary

After finishing off one of the wildest quarters of my trading career, April managed to take the cake. For those that missed it (not sure how you possibly could have), oil settled negative $37. The effects of this were immediate: risk barometers had to be recalculated, option models switched, and most importantly was the immediate […]

Thinking about skew – Alternative skew measures

I was having a discussion about the merits of managed futures relative to other hedge fund styles. Managed futures funds will often have positive skew versus other hedge fund styles. The measurement of skew is tricky and is not present with all managers but for trend-followers who allow profits to accrue, it is more likely. The argument for positive skew is embedded in the behavior of the managers.

Managed futures trend-following performance – It is not volatility but the stress that matters

“Crisis alpha” is used as a quick description of managed futures trend-following, but there has been very little work to explain what the term means. A generic definition is that a crisis is when equity markets have a significant decline, but that definition tells us nothing about what will be the conditions for a crisis or when a crisis will occur.

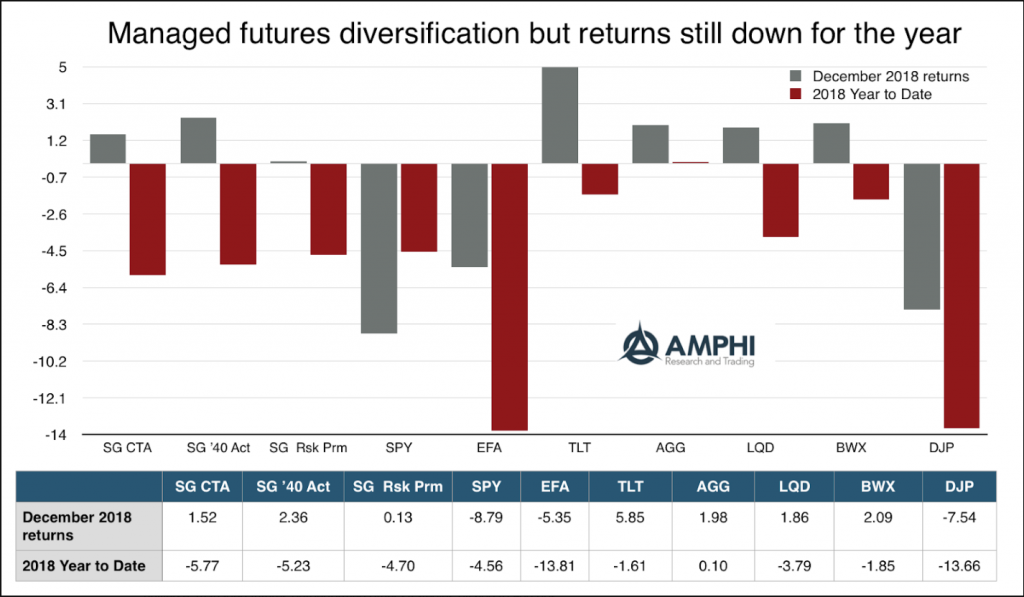

Managed futures – Provided return and diversification during difficult December

With strong trends in both bonds and equities, managed futures generated good positive returns for December. The index average does not do justice to the positive performance for some managers. For example, the CS Managed Futures Liquid Index was up around 6% for the month or four times greater than the SocGen CTA index. All of the CTA indices from BarclayHedge reported gains except for Agricultural traders. Managed futures also did well versus other hedge fund strategies and proved to be uncorrelated during the December market disruption. Versus other hedge fund strategies within the Credit Suisse liquid beta universe, managed futures outperformed other strategies by 600 to 900 bps.

Managed Futures Funds Not Able To Find Trends

This was a negative month for managed futures funds as measured by peer indices for a simple reason, range bound behavior in equities and a reversal in bonds. Equity indices have started to trend higher, but longer-term trend followers were not able to effectively exploit these moves in the second half of the month. Global bonds have trended higher for most of the month but smaller position sizes based on higher volatility limited gains. Oil prices offered strong gains, but the size of positions may not have large enough to make an overall impact on fund returns. Commodity trades are generally a small portion of the total risk exposure for large funds.

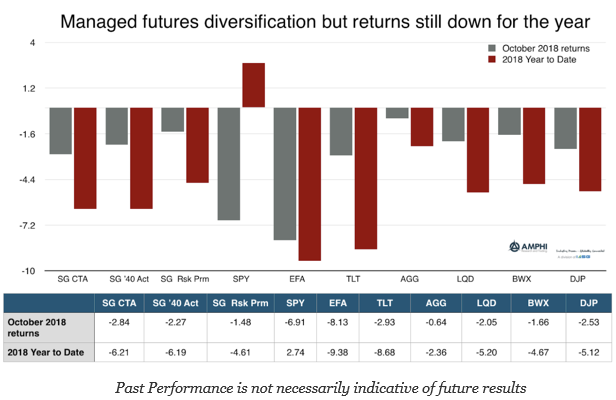

Managed Futures – No Crisis Alpha in the Short-Run

Market performance for October was sobering. Investors were complacent to volatility and the fact that markets correct. The speed of adjustment hurt the average managed futures manager who was not able to get out of markets, which repriced at the beginning of the month. Although the month ended with some improvement from return lows, there is little to celebrate.

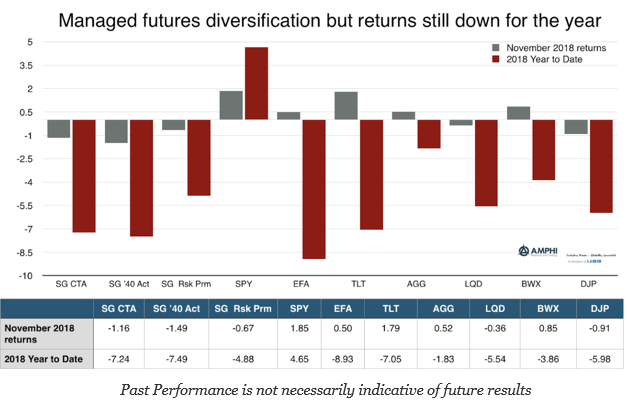

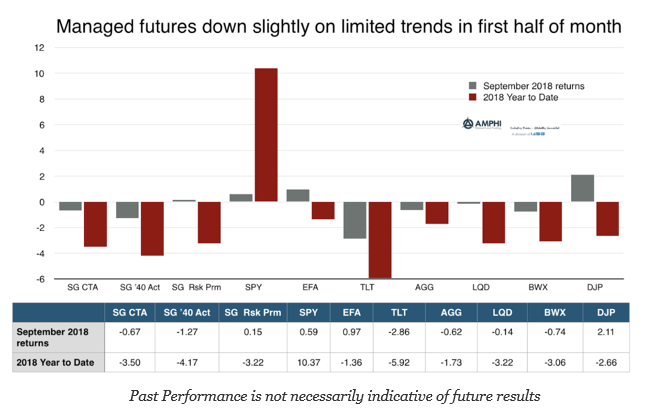

Managed Futures Down for Month but Within the Range of Performance for Other Asset Classes

Managed futures, as measured by the SocGen CTA index, showed a slight decline in return for the month, but this performance within the range of most asset classes with the exception of equities. Being long market beta is still king for the year with little absolute performance value from diversification.

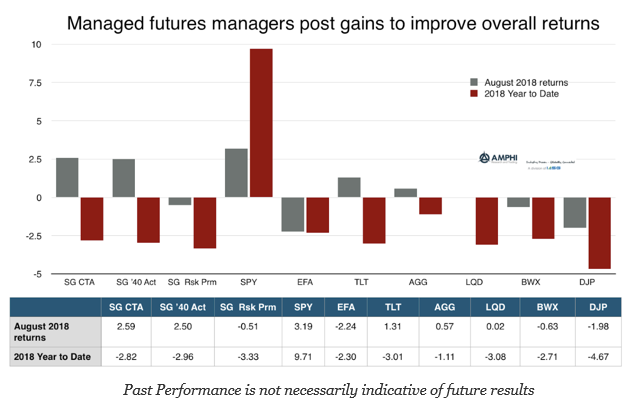

Good Month for Managed Futures – Finding Opportunities in Financial Markets

Managed futures showed good returns for August with gains in both stock indices and bonds. Given size and liquidity, as equity and global bonds goes, so goes CTA performance; however, there were also gains in selling grain markets and taking advantage of shorter-term trends in the energy sector. Other CTA indices like the BTOP50 also showed strong gains for August and similar year to date numbers at -2.66 percent. The SG alternative risk premia was down slightly for the month.

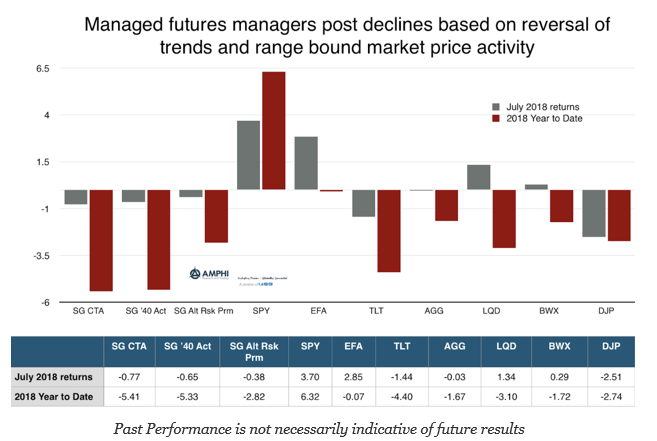

If There Are No Trends, There Will Be No Gains – Managed Futures Slightly Negative On Range Bound Market Behavior

July proved to be a classic reversal from less risk appetite to risk-on behavior. Global equities, which were weak in June, reversed on the expectations of stronger growth and earnings. This was bad news for trend-followers positioned for further market declines. The switch in risk appetite caused bonds to move lower. The strong growth, higher inflation, expected larger supplies, and expectations for continued Fed QT placed added pressure on Treasuries. Credit markets moved in-line with equities. The range bound currencies helped international assets but did not allow for trading gains. Commodities were mixed with energy prices moving lower and grains seeing some buying pressure after large declines last month. All of these reversals did not help intermediate trend traders.

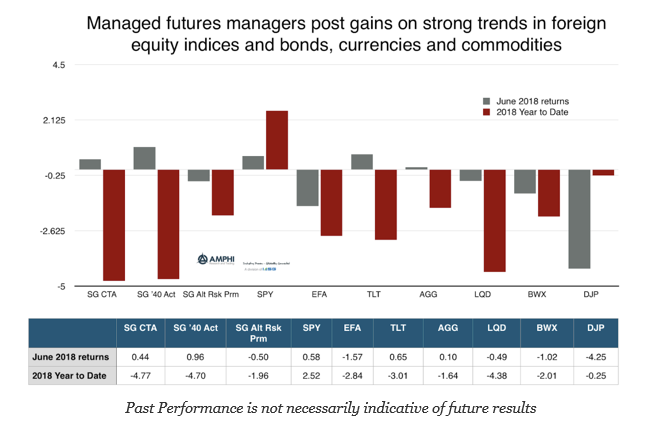

Managed Futures Show Gains versus Other Asset Classes Based on Good Trends

Based on the performance of the SocGen indices, the average managed futures fund generated positive returns for June. The performance of the Barclays BTOP also was up 59 bps and is only down three percent for the year. Managed futures outperformed all of the major asset class ETFs based on strong trends across a number of asset classes.

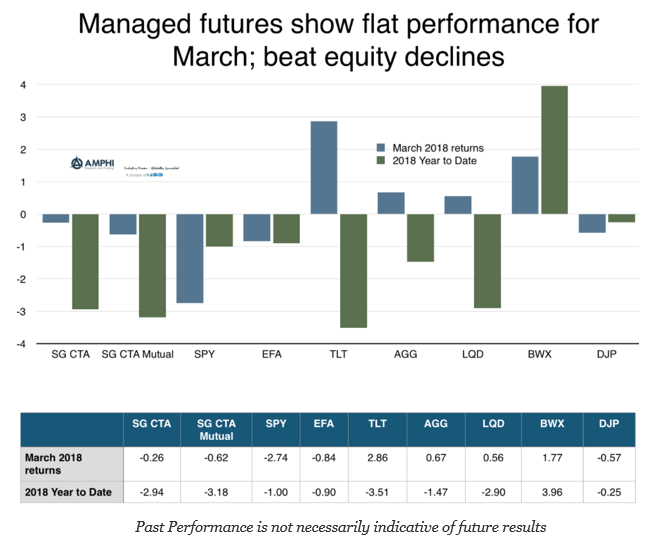

Managed Futures Slightly Down for Month – Better than Equites

Managed futures index returns were slightly negative for the month with the SocGen CTA index down 26 bps and the SocGen CTA mutual fund index down 62 bps. The BTOP 50 index gained 26 bps for the month. This compared favorably against many equity indices, but was less than the fixed income indices. Trend-following managers were not able to catch the early rotations from equities to bonds during the second half of the month.

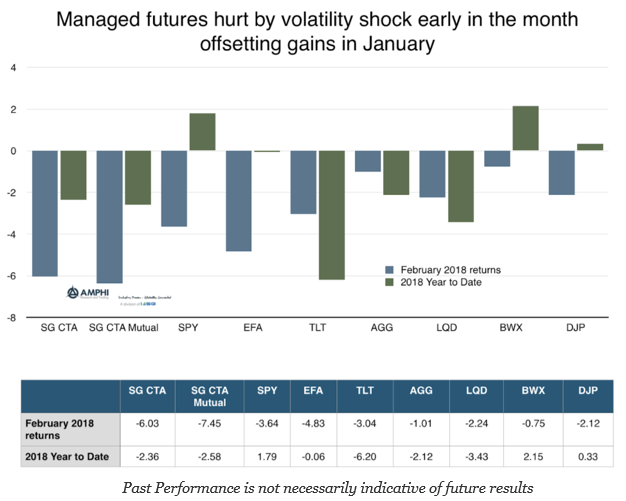

Managed Futures Managers Hurt By Volatility Shock

The managed futures hedge fund category generated poor performance in February as measured by the SocGen CTA index and the SocGen CTA mutual fund index. This behavior was also seen in the BTOP 50 index which declined 5.29 percent for the month. The SocGen short-term traders index was down 4.31 for the month but still up for the year by just over 1%. Nevertheless, the year to date return numbers for managed futures are better than long duration bond performance and the credit sector as measured by the TLT and LQD ETFs.

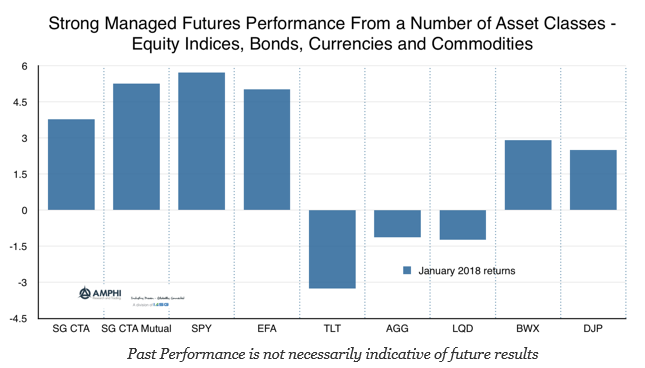

Strong Managed Futures Returns from Multiple Asset Classes – Consistent with Fundamentals

Managed futures showed strong performance in January from a variety of asset classes. Many managers were able to continue to take advantage of the trend in US equities, albeit with a giveback of some profits at the end of the month. Global bonds generated gains from short positions as a significant sell-off accelerated through the month. The dollar decline made trading currencies also profitable. The trend in oil and refined products also continued although a surprise inventory increase at the end of month added volatility. Selective trading in precious and base metals also added to performance. There were also commodity opportunities from newly formed trends.