Category: Managed Futures Education

Grain Basics 101

Many of my favorite traders focus on the grain markets. After all, we all need food, so the demand is more inelastic compared to many markets and, therefore, less sensitive to financial market conditions than most commodities. We rarely need to think much about where it comes from until recently, when we realize that our […]

Options Made Simple

For any profession, once you have done it for a while, some concepts become second nature to the point that you forget that not everyone (or very few) understands them at even a basic level. I find that options are the concept that confuses people the most and perhaps most valuable to understand. The futures […]

Evaluating Futures Traders: Going Beyond Traditional Search Methods

As one of the world’s largest futures databases, we begin talking to traders often at the earliest stages of their evolution up to billions of dollars in assets. But not all beginnings are equal, as some achieve early success and others never find it. Our challenge is determining which ones provide our investors with the […]

Understanding Minimum Investment Sizes

When launching their programs, managers in the futures space are faced with a dilemma. First, they need to choose a trade level. This is an easy process for an equity manager as they often trade 100% of the cash available and sometimes decide to use leverage. However, ALL futures contracts already have the leverage built-in, […]

In Search of Crisis Alpha: A Short Guide to Investing in Managed Futures

By Kathryn M. Kaminski, Ph.D. Senior Investment Analyst,RPM Risk & Portfolio Management DisclaimerWhile an investment in managed futures can help enhance returns and reduce risk, it can also do just the opposite and, in fact, result in further losses in a portfolio. In addition, studies conducted on managed futures as a whole may not be […]

Frequently Asked Questions About Managed Futures

Individual and institutional investors are increasingly including Managed Futures as part of a diversified investment portfolio as they search for non-traditional and alternative investment opportunit

Analyzing the performance table

Disclosure documents include performance summaries for managed futures investments. Find out how to decipher the different pieces of information these summaries provide. Upon receiving a Commodity Trading Advisor (CTA) disclosure document, the first thing investors usually do is turn to the performance table found in the Past Performance section of the document. This is where […]

The Basics of Managed Futures: Understanding the Role of Commodity Trading Advisors

Managed futures are operated by licensed Commodity Trading Advisors, or CTAs, regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. Commodity trading advisors (CTAs) are asset managers who follow systematic investment strategies. Essentially, they are the operators of managed futures accounts and are directly responsible for the actual […]

The Capital Appreciation Program: Spreads ‐ A Unique Approach to the Energy Sector

Corporate Summary Tyche Capital Advisors, LLC is a New York based registered commodity trading advisor currently offering trading programs to qualified investors. Through its trading programs, TCA will engage in speculative trading of futures and options contracts offered on the United States commodity exchanges and overseas futures exchanges. Tariq Zahir and Steve Marino are the […]

Peering Over the Fiscal Cliff

by Tyler Resch, Portfolio Manager, IASG As we go into the final few months of the year, we are more and more concerned with how we position ourselves going into 2013. A term I am hearing more often from concerned investors is the looming “fiscal cliff.” This “fiscal cliff” they are referring to is the […]

Managed Futures: Portfolio Diversification Opportunities

WHAT ARE MANAGED FUTURES? The term managed futures describes a diverse subset of active hedge fund strategies that trade liquid, transparent, centrally-cleared exchange-traded products, and deep interbank foreign exchange markets. Managers in this sector are called commodity trading advisors (CTAs) and their strategies are largely focused on financial futures markets with additional allocations to energy, […]

10 Reasons to Consider Adding Managed Futures to Your Portfolio

1. Diversify beyond the traditional asset class Managed Futures are an alternative asset class that has achieved strong performance in both up and down markets, exhibiting low correlation to traditional asset classes, such as stocks, bonds, cash, and real estate. 2. Reduce overall portfolio volatility In general, as one asset class goes up, others go […]

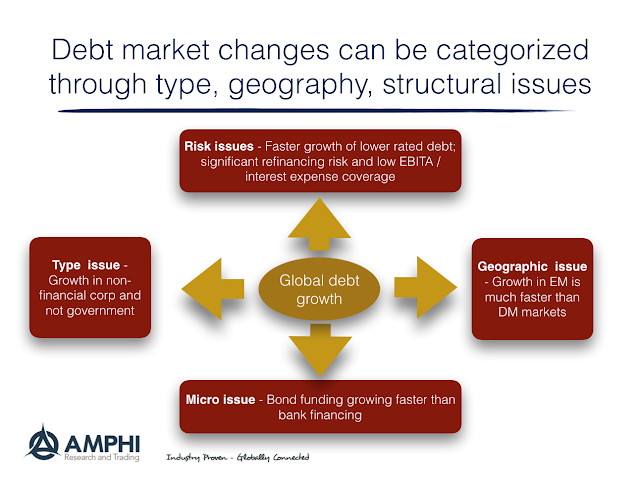

Debt – “If Something Cannot Go on Forever, It Will Stop” – The Problem Is Not If But, Figuring Out When

The McKinsey Global Institute published a new report, Rising Corporate Debt: Peril or Promise?, that is good reading for anyone focused on global debt issues. The charts and tables provide a wealth of data.