Category: Managed Futures Education

The Importance of Limiting Losses in Absolute Return Strategies

Absolute return strategies aim to generate positive returns irrespective of market direction. A more accurate and appropriate definition is that absolute return, or active investment management, always seeks to minimize losses. We mentioned this as a core attribute of an absolute return strategy in “Why an Absolute Return Strategy,” but this simple concept is worth […]

Building Wealth: The Power of Absolute Return Strategies

The first goal of investing is to increase wealth or, to put it differently, to increase purchasing power. Warren Buffet says, “Rule 1 of investing is never losing money. Rule number 2 is never forget rule number 1.” The hidden message in these seemingly obvious statements is that building wealth depends much more on preventing […]

Bonds – What Drives Investors

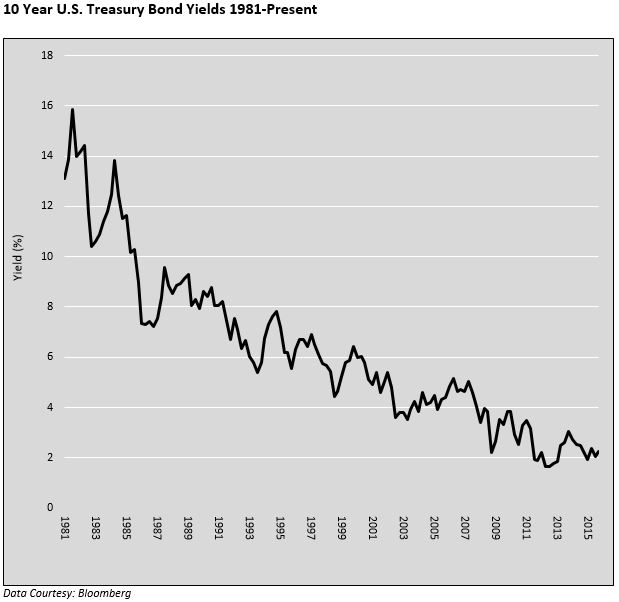

Part 2 of our series on bonds “Bonds – Is Credit Growth Hitting its Limits?” discussed the likelihood that the demand to borrow could stay weak, keeping the demand curve from shifting right and therefore playing an important role in keeping a lid on higher interest rates. In this final article of the series we focus on factors that investors should consider to help gauge demand for bonds.

Bonds – Is Credit Growth Hitting its Limits?

In “Bonds – More Than Meets the Eye”, we proposed that despite historically low interest rates there may be opportunities in Treasury Bonds to earn total returns well in excess of their current low yields. In this article, the second installment of a three part series, we analyze some important factors which help determine where interest rates might be headed in the near term. This article focuses on the demand side of the supply/demand curve to understand pricing pressures. Part 3 of this series will emphasize the supply side of the curve and key determinants of interest rates including economic growth and inflation.

Bonds – More Than Meets the Eye

When buying equities, some investors plan for a short holding period, seeking to capitalize on short-term price fluctuations – “a trade”. Others plan on a longer holding period based on economic or fundamental analysis – “a long-term strategic investment”. Regardless of which tactic is employed, few schedule a specific day, month or even year for divestiture. Contrast this with the bond investor’s strategy, whereby many bondholders seek to hold their investment to its maturity date. Those bond investors possessing this predilection are likely unaware of potential opportunities that trading bonds offers. In this era of historically low yields the opportunity for outsized returns may be significantly larger than current yields advertise if one considers selling a bond prior to its maturity.

Commodity Prices and the U.S. Dollar

The chart above plots the performance of the Commodity Research Bureau (CRB) index, a benchmark measuring the prices of 19 diverse commodities. The legend is purposefully omitted so that we may pose the following question: If the lines represent one indicator, why are there 3 lines? The answer lies not in the commodity prices underlying the index, but in the currency used to express the prices. The blue line represents the CRB index as it is commonly expressed, in U.S. dollars (USD). The green line is denominated in euros and the black line in Brazilian reals. This graph highlights that the currency in which a commodity is denominated can have a meaningful effect on prices.

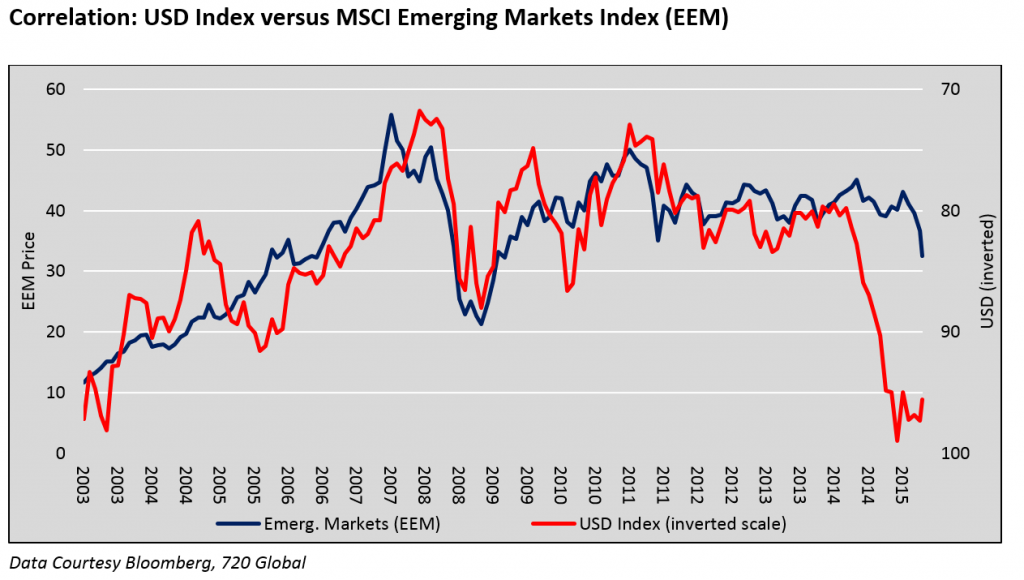

The U.S. Dollar and the Emerging Markets

Historically, periods of USD appreciation have led to outflows of investment dollars resulting in economic hardship, crisis and even regime change in emerging market nations. The 1997-1998 Asian crisis, the related default of Russia and the collapse of the hedge fund Long Term Capital Management, for instance, were precipitated by a strong USD and a rapid reversal of capital flows from Asia back to the U.S. It is estimated the crisis resulted in the repatriation of $250-$500 billion.

The USD Role as a Funding Currency

Over the past year, the real trade-weighted U.S. dollar (USD) index increased over 10%, fostering a slowing of global economic growth, increased volatility in financial markets and plummeting commodity prices. This serves as a reminder of the influence the USD has on global trade and asset markets. Periods of dollar appreciation, as highlighted in the graph below, are not well understood by the investing public as there have been only two major appreciation periods since the removal of the gold standard in 1971. The potential consequences from a third major USD appreciation can have a significant effect on expected asset class returns.

12 Questions to Ask Before Selecting a Commodity Trading Advisor

Here is a list that I’ve developed for Individual investors to know the answers to or ask before investing their risk capital with a Commodity Trading Advisor or Professional Money Manager. This checklist is ever evolving as new information comes to light or the dynamics change in the market place. Our hope in providing this […]

What are Carrying Charges and how do they influence hedging decisions?

In order to fully get the “error” in selling grain at harvest and then buying calls to replace that grain, so as to still participate in possible higher prices you need to understand how carrying charges work in the grain markets. The definition of “carrying charges” is: an expense or effective cost arising from unproductive […]

Advantages & Disadvantages of Call Options for Hedgers & Speculators

Buying (Long) a Call Option: A basic option strategy to be familiar with and learn the advantages and disadvantages of is buying a Call Option (Long Call). Buying a call option is the opposite of buying a put option in that buying a call gives you the right, but not the obligation, to buy the […]

Understanding Risk-to-Reward Ratios in Trading: A Key Factor for Success

When you trade the markets, you don’t know the exact probability of winning or losing on a given trade. You won’t know how much you will profit or lose. A CTA does extensive historical testing on their concepts and trading strategies to understand what to expect. They will also pull huge data samples of market […]

Protecting Yourself in a Locked Limit Market: Utilizing Synthetic Futures Positions

A futures or commodity market is a “locked limit” when trading is suspended due to prices moving the exchange-stipulated daily limit. This can happen for one day (it can even lock-limit and then trade-off), or if given a news event monumental, the market may stay “locked” for as many days as needed for market participants […]