Category: Managed Futures

Quant and System Developers – There is a Distinction

Thinking about the analysis of systematic global macro and managed futures managers, I asked a simple question, is there a difference between a quant and system developer. A portfolio system is a complete integrated approach for making market predictions and investment decisions including sizing, entry, exit, and risk management. Is it possible for a manager to be less well-trained as many newly minted engineering quants, but still be talented at building portfolio systems?

Tactical Investing in Global Macro and Managed Futures

There are good times to invest in global macro and managed futures on a tactical level and there are other periods when the investment decision should be made on a strategic level. There are conditions when divergent strategies which are highly uncorrelated to core risky assets such as equities will do better. Unfortunately, there is not a lot of data for those periods of very strong managed futures performance. For example, crises like recessions are good periods. We also believe that periods of large deviations from fair value for an assets class will be global macro and managed futures friendly.

Managed Futures and Volatility – The Type of Vol Matters

Managed futures strategies can be described in a number of different ways. Many researchers and market practitioners have referred to it as a long volatility strategy. This language has captured many as a good shorthand description. In the same vein but much more clearly developed, it has been called being long a straddle. A straddle is volatility sensitivity with its gains occurring only after prices move outside the strikes plus premium. Empirical research has shown that the long straddle is a good representation.

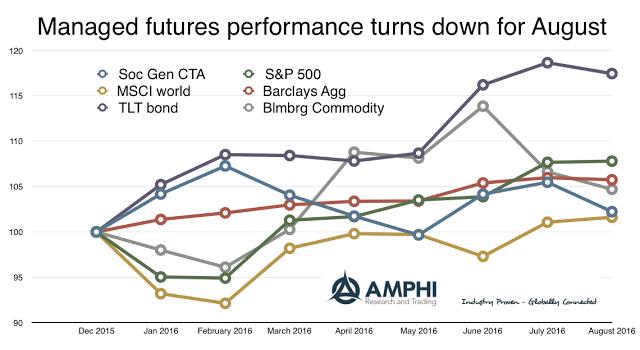

The Summer Ups and Downs of Managed Futures

The summer was a positive performance period for managed futures, yet it was still filled with return up and downs. We have identified periods of more than 2% gains and losses on the AMPHI Liquid Alt Index, an equal weighted index of the largest liquid alternative programs available. This return pattern is representative of many periods in managed futures performance with equal gains and loses punctuated by larger gains when there is a market divergence or dislocation. In this case, the main driver was the post-BREXIT market reaction that lasted for approximately two weeks.

Managed Futures August Performance – Negative Chop

A rule of thumb for managed futures performance is that if there is little movement in the underlying asset classes, there will be negative performance for the average managed futures manager. While it does not apply to all managers, certainly trend-followers need trends, and a measure of trend is the longer-term volatility or spread in prices.

Investing in a Continuum of Change: Trading Futures Markets Amidst Rapid Transformations

Market Commentary from Kottke Commodities – Commodity Capital CTA – Kenneth Stein Most of our expectations are just knee-jerk reactions to day-to-day details, but today’s headlines rarely reflect tomorrow’s reality meaningfully. For example, how many tectonic changes in different areas of our lives have and continue to occur, only dimly perceived even by those attentive to […]

Alternatives to Long Only Passive Strategies

As we discussed in “Why an Absolute Return Strategy”, most investors, knowingly or not, rely on long-only passive strategies. These investors may shift between stocks, bonds and cash at various intervals, but generally their portfolio returns mimic those of well-known stock and bond indices. Alternatively, active or absolute return investors rely on many different strategies that are not dependent upon a positive market direction to generate positive returns. To continually build wealth through good and bad markets, absolute return investors require a diverse, alternative set of strategic tools. This article describes a number of strategies used by absolute return investors to help them achieve their goals.

July Results showing good month for Managed Futures

The IASG CTA Index has approximately 75% of managers updated through July performance with almost all sectors posting positive returns for the month. The one exception is the agricultural index where many managers struggled with grain pricing continuing downward pricing and many with expectations that there would be a bounce back in grains.

Energies: Outlook for the Upcoming Week

Friday’s choppy action was unsurprising as the refined products exhausted themselves on Wednesday and Thursday. After a quiet start to the week, RBOB gasoline shot up 13 cents and up HO 10 cents while Brent Crude popped $4. Interestingly, June WTI closed DOWN for the week as we saw the June Brent/WTI spreads widen to over $8. Last […]

Still Neutral Sugar

Sugar #11- May15 Futures – In yesterday’s trading session Sugar future values were strongly influenced by the exchange rate movement in Brazil. This is the first time since March of 2004 that the dollar quote fell below $3, closing at R$2.967 (-1.3%).

Crude Oil: Potential Target in Focus

Crude oil bulls had a brilliant day on Thursday, with the oil complex posting strong gains. Brent crude finished at $64.83while WTI closed at $57.66. With the market sailing above the 100-day MA last week, a review of the continuation chart gives a perspective on what the bulls might be targeting in the longer term. […]

Red Rock Capital – An Honest Update on the Trend Following Landscape

Trend following is the most prevalent strategy utilized throughout the managed futures industry. What is the best way to objectively analyze, measure, and compare the performance of a particular group of trend following CTAs? Last fall we attempted to answer this question by publishing a research paper that introduced our own metric that measures and compares the “goodness” of similar managers’ returns. This article updates that original piece, and the measurements and ranking methodology that we initially introduced remain the same.

Kottke Associates – It’s The Weather, Stupid

August trading results improved markedly as one of the metrics with which we track ourselves, the ratio of winning trades to losers, rose dramatically. Summer crop development was uncharacteristically dull, with unchanging, uncannily positive growing conditions. Since we refrain from exposing investor capital to weather forecasts anyway, we trained our attention on the wheat crops already harvested and the old-crop soybean market still working out its supply tightness.